Speer: The LRP Horse Is Definitely NOT Dead

Cash: The previous column was intended to be a starting point geared towards making some sense of LRP and the market. My concern was it would be perceived as redundant - beating a dead horse – after all I’ve written four previous columns on the topic. (See one and two and three and four) Based on the feedback I received, the horse is definitely NOT dead.

Given space limitations, it’s impossible to cover every nuance in one shot. Last week’s column dealt with the cash market. However, one reader emailed: “I do think you misinterpreted the conversations regarding their [LRP] market effect. My interpretation of the commentary was not about cash market effects but the possibility that LRP had a negative effect on the futures market.”

But that’s not quite right. As mentioned in my very first column on the topic, the LRP detractors tell us insurance companies have “too many” LRP policies to cover, resulting in “undo selling” in the futures market to offset their risk. And because the feeder cattle contract is cash settled (i.e. feeder cattle index), that’s spilled over to weaken the cash market. So, it’s not just one (cash) or the other (futures) – it’s both.

(As a side note, when the market doesn’t go our way, there’s always an explanation. And generally, it’s either “too much” or “too little” of either buying or selling depending on what side of the trade you’re on. See Bashing The Speculator)

That aside, cash is the anchor. First, we have to make sense of the physical market before we move on to the derivative market(s). Last week’s column was cash, now let’s turn to the derivative markets (i.e. futures and options).

Futures: The first derivative of the physical market are futures contracts. One of the complaints highlighted in the previous column went like this: “LRP volume roughly matches that of the entire feeder cattle futures market.” That’s a correct assessment; but that leaves more questions than answers.

Let’s turn that back around:

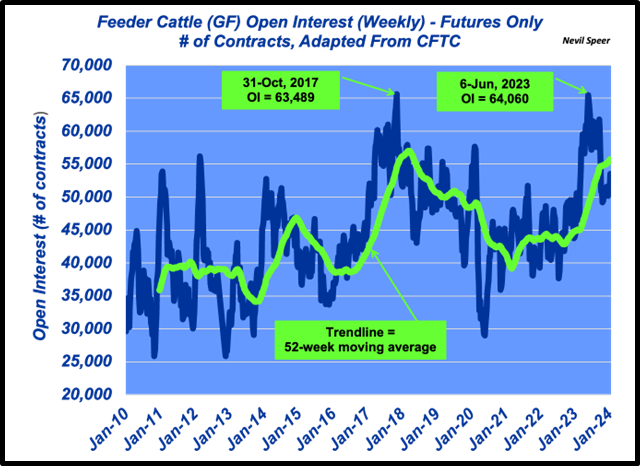

- IF LRP is driving futures action, why hasn’t open interest surpassed the previous peak in 2017?

The first graph below highlights feeder cattle open interest over time (futures only). Notice the peak in 2023 matches the peak in 2017 (note also open interest surpassed 55,000 contracts back in March, 2012).

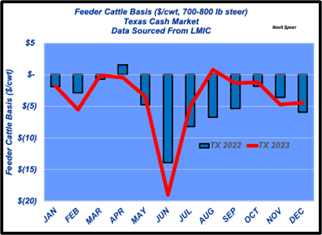

Then comes consideration around basis. Per the previous column, we established LRP isn’t influencing cash. Therefore,

- IF something wonky is happening in the futures market, wouldn’t that manifest via basis?

Cash is the anchor, but futures would be unchained. However, 2023 feeder cattle basis moved in lock step with 2022. (see graph below)

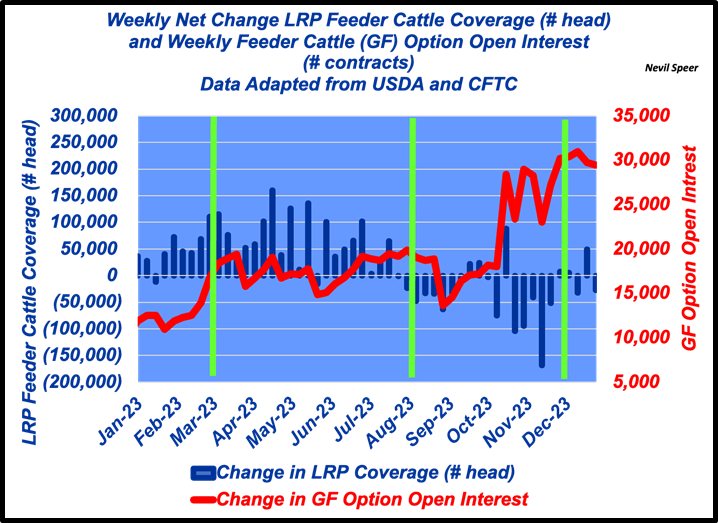

Options: 1. Physical, 2. Futures, 3. Options – it’s directional. If it weren’t, markets would be nothing more than a circular reference. The options market is a derivative of the futures market (hence, a second order derivative of the cash). That is, options are priced off futures (delta, gamma, theta, vega) – not the other way around.

Nevertheless, the ’23 surge in option volume often points to LRP as the culprit. The third graph below details LRP coverage and option open interest, respectively. Volume remained relatively stable in the front-half of the year while LRP coverage was growing.

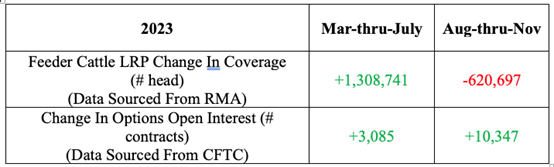

Meanwhile, the jump in options volume came late in the year, during a period of declining coverage. The data looks like this (see table below):

Narrative fallacy: Nassim Taleb coined the phrase, “narrative fallacy”, in his book, The Black Swan, to describe the phenomenon in which we build a narrative to tie a series of facts or events to one another; it seems to make sense - but in actuality may be completely disconnected.

With that in mind, the industry needs to ensure that’s not happening around LRP. As noted last week, a haphazard and/or arbitrary approach to “fix” LRP could result in unintended consequences for the program – i.e. producers. Any adjustments need to be based on knowledge (data, facts and logic), not emotion.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.