Speer: Stalking the LRP Smoke Monster

Disclaimer: “Trading in futures products entails significant risk of loss which must be understood prior to trading and may not be appropriate for all investors.” The lead-in disclaimer to Joe Vaclavik’s daily podcast is a cogent reminder that futures markets are inherently volatile (BOTH ways).

LRPs: That brings us to the recent sell-off at the CME. Along the way, some have suggested LRPs (Livestock Revenue Protection policies) are to blame. But much of that is wholly unsubstantiated; I have yet to see any detail regarding:

- The volume of LRP policies that have been sold.

- Level of coverage of those LRP policies.

- Aggregate convergence of insurance company trading activity.

- And subsequent influence on price.

Meanwhile, I’ve never heard anyone suggest dairy margin coverage or crop revenue protection programs have unduly influenced the market.

We’ve Seen This Movie Before: Let’s come back to my previous column. Following the financial crisis futures markets were heavily scrutinized by politicians and media. The controversy surrounded the influence of long-only index funds; that is, some believed they were driving prices higher. The controversy ultimately led to establishment of CFTC’s disaggregated report thus adding more granularity to the agency’s legacy reports.

Claiming LRPs are responsible for the selloff provides the polar opposite argument. I once wrote a column addressing index funds that included a piercing explanation from Dr. Scott Irwin, University of Illinois dispelling the controversy: “It makes as much logical sense to call the long positions of index funds new demand as it does to call the positions on the short side of the same contracts new supply.”

All these years later, that same explanation discredits this current LRP smoke monster.

Feeder Cattle Index: Much of this converges around feeder cattle. The LRP detractors tell us insurance companies have “too many” LRP policies to cover resulting in “undo selling” in the futures market to offset their risk. And because the feeder cattle contract is cash settled (i.e. feeder cattle index), that’s spilled over to weaken the cash market. Let’s look at some data.

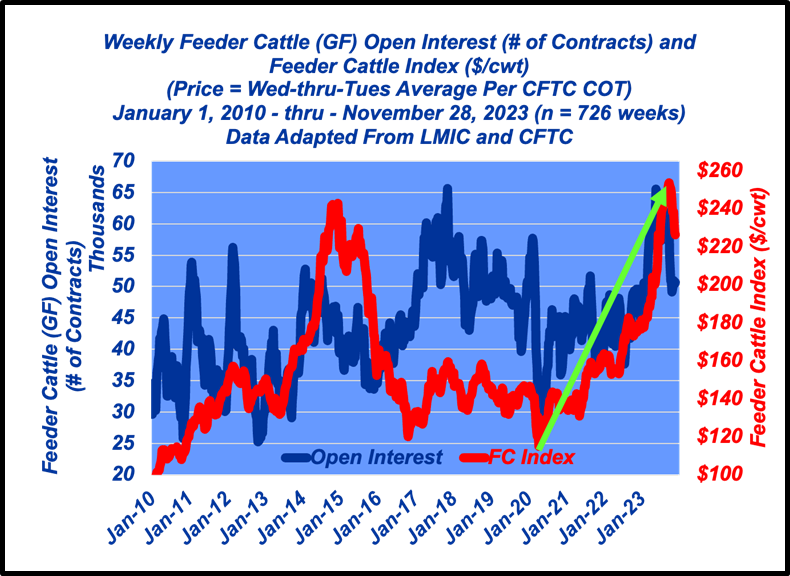

Per the first graph: 1) no one mentioned LRPs on the way up; 2) amidst the recent selloff, feeder cattle open interest hasn’t increased but rather declined (~10,000 contracts) – so much for the claim of “too much” LRP volume.

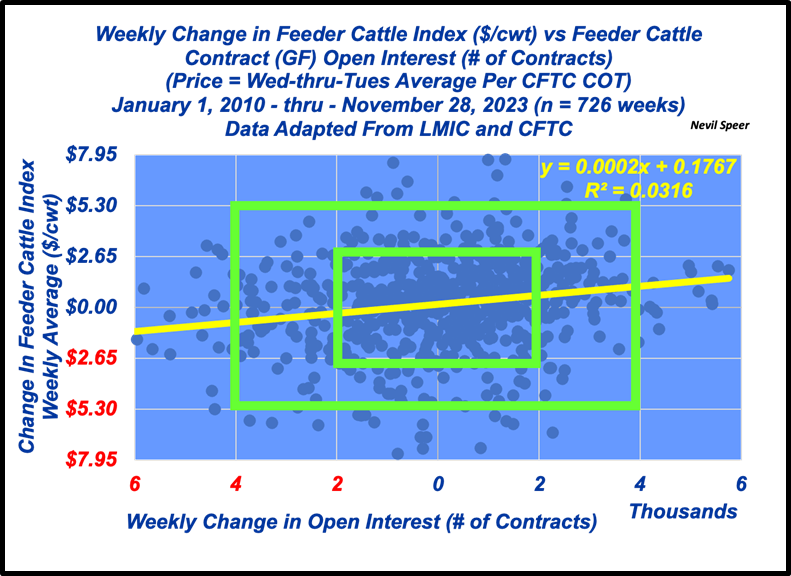

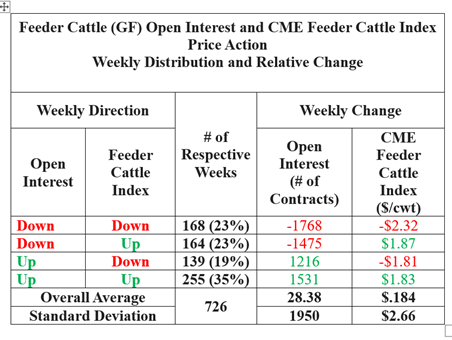

What about the argument none of this is orderly? That is, LRP coverage is lumpy from week-to-week. The second chart details weekly change in open interest and the feeder cattle index (see also data summary at the end of the column). A couple of things are important:

- The direction – it’s positive - more volume equals higher prices (opposite of the LRP argument). More important, variation in open interest week-to-week explains only 3% of the variation in the feeder cattle index.

- The regression - it requires a weekly change of 10,000 contracts (5 standard deviations = probability of 1-in-3.5 million) to move the index just $2.

LRP blame really is a smoke monster.

Hedgers Seldom Complain: Back to the top. “Markets can remain irrational longer than you can remain solvent” (John Maynard Keynes). But you won’t hear hedgers or LRP policy holders complaining. They’re proactive about protecting their equity (after all, things that never happen, happen all the time). It’s a no-regret, no-drama strategy. Warren Buffet says it best: “what the wise do in the beginning, fools do in the end.”

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.