Speer: Bashing The Speculator

Same But Different: There was a period following the financial crisis in which futures markets were heavily scrutinized by politicians and the media. At that time, the criticism was largely directed towards index funds (i.e. speculators). They were being blamed for fueling commodity prices and unduly penalizing consumers.

I was reminded of that flurry during the past month as live cattle futures sold off from their recent highs. While it’s the opposite scenario (prices going down), the complaint is the same (speculators). That is, the funds have fled the market and sabotaged cattle prices on their way out.

Balance: As a quick reminder, futures markets are perfectly balanced. That is, for every buyer there must be a seller – and vice-versa – otherwise, a contract doesn’t get written. Thus, when we start complaining about speculators we need to ask ourselves a couple of questions:

- Can one side (buyer vs. seller) really dictate the market?

- Are speculators drivers, or simply chasers of the market?

The point being, any question about speculator activity, whatever their respective market position, needs to also be posed to parties on the other side of the equation. After all, futures markets are a zero-sum enterprise comprised of matched pairs.

Markets: However, there’s a pervasive belief that speculators – either too many or not quite enough (it’s always nuanced) – are solely responsible for driving the market in one direction or another. That thinking often portrays speculator activity as driving open interest; more speculators means more contracts (and vice versa) – and price subsequently goes hand-in-hand with trading activity.

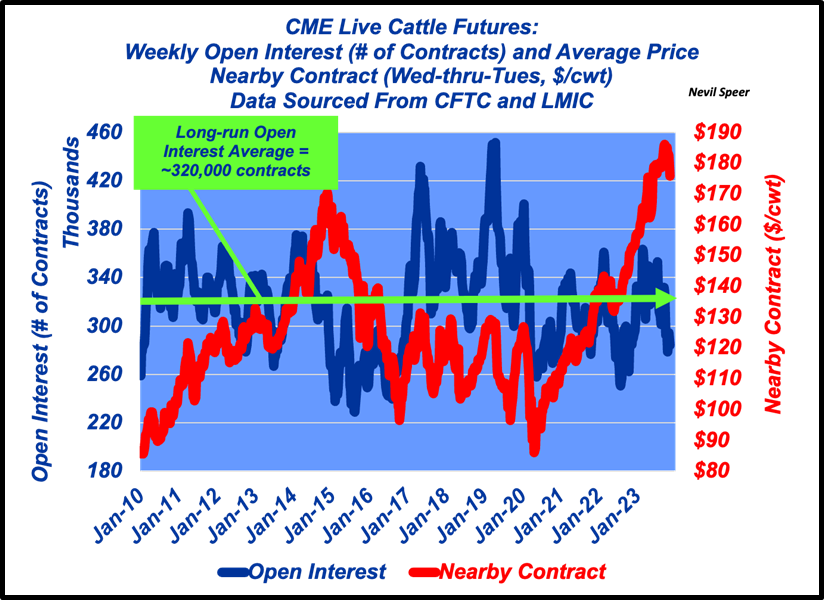

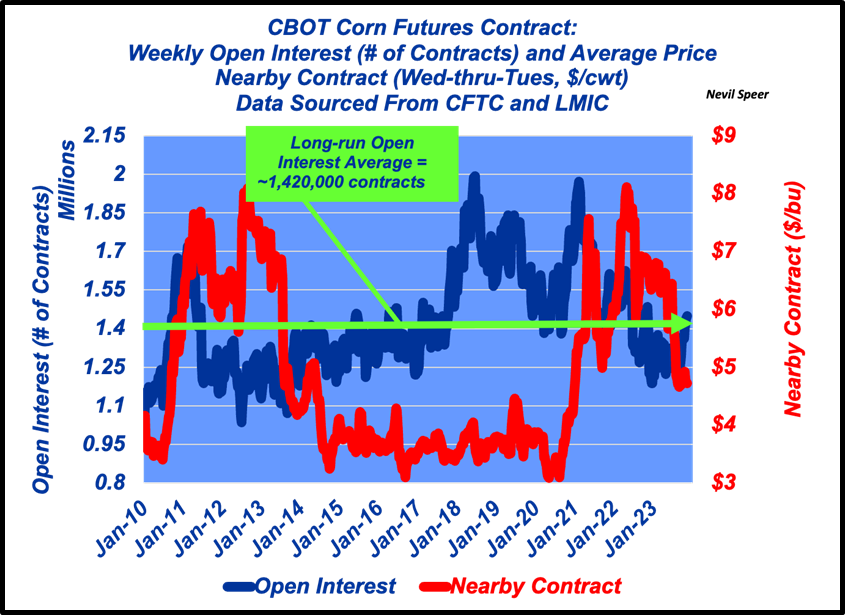

With that in mind, let’s turn to the data. The graphs below that reflect a sequential view of open interest and the nearby contract’s weekly average closing price for live cattle and corn, respectively.

(Average price reflecting Wednesday-through-Tuesday closing prices - corresponding to CFTC’s commitment-of-traders report reflecting positions at close-of-business on Tuesday.)

It's difficult to discern any sort of meaningful pattern. That’s because in both cases the relationship is very weak (and in the opposite direction of what’s typically portrayed by market skeptics): the correlation equals -.07 and -.20 for live cattle and corn, respectively. That is, there’s not much case to be made here that speculators alone are able to drive the market in one direction or another.

(We’ll look at the relationship of changes in open interest and price in a subsequent column).

Hedging Position: Amidst all the handwringing about the recent live cattle selloff at the CME, it’s also important to assess what’s happening on the hedging side. The hedger, once locked in, is indifferent. And better yet, amidst the sell-off of late, the short hedger has watched his/her margin account grow along the way.

Hedgers rarely complain about speculators – they represent necessary liquidity by which a hedger can lay off their respective risk (see last week’s column). Without speculators, there’d be no insurance opportunity.

Bashing Speculators: One last observation to all this is especailly timely and pertinent. Dr. Craig Pirrong, University of Houston recently provided the following commentary about oil prices on his blog (streetwiseprofessor). He provides some meaningful context amidst this discussion:

Bashing speculators is what people who don’t like the price do. And since there’s always someone who doesn’t like the price (consumers when it’s high, producers when it’s low) bashing speculators has been and will continue to be the longest running show in finance and markets.

Price – it’s either too high – or too low - never just right. And there must be someone to blame! The speculators – they’re either too busy – not busy enough – never just right.