Speer: LRP Options Action

Feedback: I received more feedback on last week’s LRP column than anything else I’ve ever written - all of it constructive and meaningful. As review, the column was intended to dispel any notion LRPs are driving the cash market lower.

However, most readers zeroed in on their frustration with the options market – not cash market – in recent weeks. They underscored the importance of the implications of what may (or may not) be occurring: “I do think producers need to understand what is happening.” So, let’s explore some of that.

Subsidy Harvest: Herein lies the crux of the issue. One reader details it this way: “…someone buys an LRP in feeders…the put the insurance company buys [costs] $10, the government subsidizes about 35%, so he pays roughly $7. He turns around and sells the same put in his commodity account for $10. He collects $3 with no risk.”

Speculator: That is, seemingly “no risk”. In other words, what was perceived as a no-risk trade to collect the premium places him/her at even greater risk. One reader correctly observed, “When a producer sells a put to offset the LRP cost they become a speculator.” Attempts to arbitrage the spread in value undermines the very purpose of purchasing LRP insurance. (See: 1. previous column’s risk disclaimer, and 2. Don’t Try This At Home.)

That’s because even a 20-delta put can quickly transition to being in the money (i.e. gamma). And when that occurs, the put seller is subject to margin calls along the way. Once that gets too painful the position needs unwinding. IF the washout happens in large numbers the market becomes disorderly. (Bear markets are NEVER orderly; selling begets selling. One person remarked, that’s when “the market will take you to school”.)

That all gets compounded in a relatively small market (i.e. feeder cattle); pricing gets clunky with ever-widening bid/ask spreads.

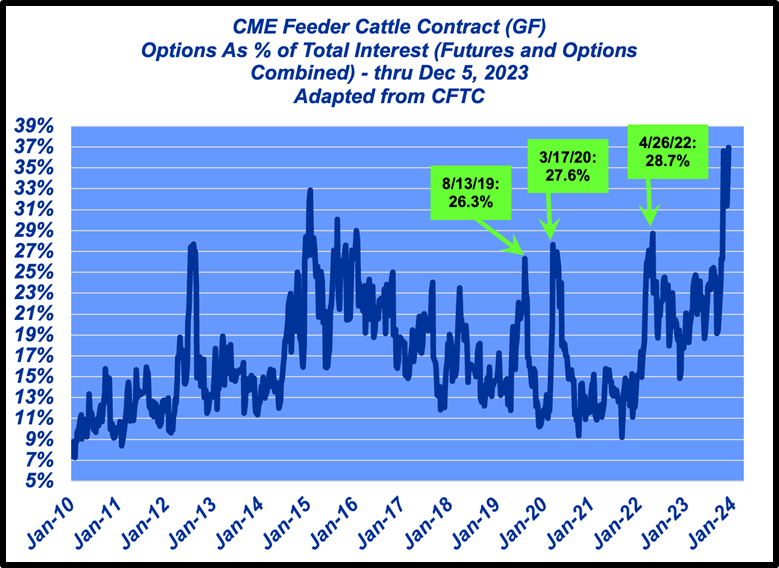

Data: For some historical perspective, the first graph below details the long-run contribution of feeder cattle option contracts to total open interest (futures and options combined).

Let’s focus on the three recent peaks:

- August, 2019 (following the fire at Tyson’s Holcomb plant).

- March, 2020 – the early throes of Covid.

(Both occurring prior to the most recent subsidy increase)

- A third peak then occurs in April, 2022 – corn futures jump past $8 against the background of the Ukrainian war and a slow start to planting.

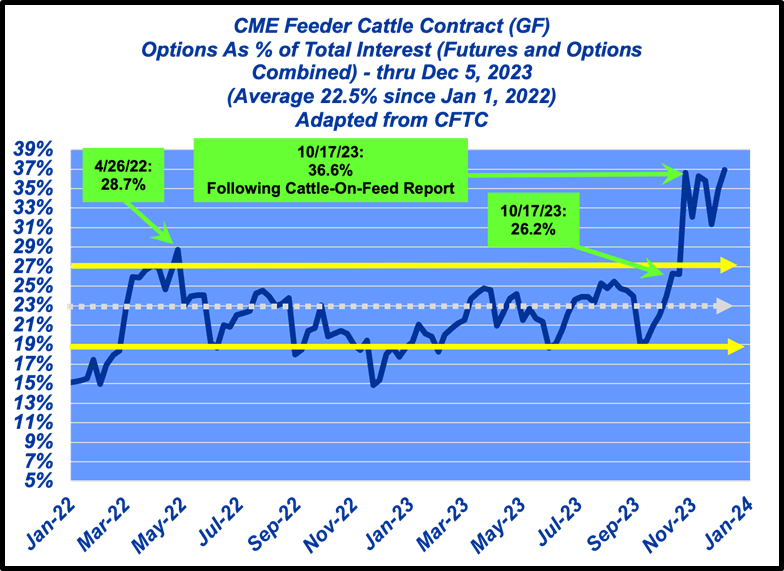

Now, let’s turn to the second graph; same data for just the past three years. For the most part, option volume following the April ’22 spike was routine and stayed inside the guardrails. But then the market (already wound tight without much correction along the way) had to absorb both outside worries (federal budget deadline, House speaker debacle, Israel-Hamas conflict) and a bearish cattle-on-feed report – all in the span of about three weeks.

Granted, the recent peak is a new record, but option volume spikes aren’t unprecedented – they predictably follow negative news.

Blame / Conspiracy: Guest analyst Elaine Kub was asked about LRPs on last week’s Market-To-Market. She emphasized the cash market has been more resilient than futures. And also pointed out those producers who “made the protections [are] sitting pretty…” (see Things that never happen, happen all the time).

However, her response noted several other important points:

- Per the data above: “… things just get really streaky when there's nobody to step in there and catch that falling knife. So whether or not it was the LRP program itself involved in that, I don't know.”

- Per last week’s column: “And obviously you would never be able to find that level of data in the CFTC reports.”

- Last, she pointed out, “…we always seem to have some type of a conspiracy story in these livestock markets.”

Similarly, one reader echoed the conspiracy sentiment: “…in these pain/blame situations, it seems to be a strategy (not sure it is a good one) to blame something that few really understand – i.e. LRPs”.

Closing Thoughts: One email summarized the concerns this way: “We may have created something systemic here.” To that end, another remarked that, “Clearly everyone is loving this debate, at the end of the day only a regulator will be able to contact the CME to see who the ultimate owner of the options are (i.e. insurance companies or not?).”

LRPs and options are essential risk management tools. Accordingly, the discussion going forward needs to remain measured and objective to ensure we don’t throw the baby out with the bathwater.

In the meantime, discernment is more important than ever. That is, it’s probably best to avoid coffee shop talk and social media crisis peddlers. “When masses of people succumb to an idea, they often run off at a tangent because of their emotions” (Humphrey Neill, Art of Contrary Thinking).