Speer: Let's Beat the LRP Horse Again

LRP: At the risk of beating a dead horse, yet another column on Livestock Risk Protection (LRP). Why? One, it’s a very important risk management tool for producers. Two, it’s been misconstrued by some voices in the industry in recent months. Three, the topic keeps going round and round in my head (like a marble in one of those gravity funnels). Last, there continues to be discussion about making changes to the program; it’s important to have a broad understanding around all the nuances and claims to ensure that discussion stays on track.

Objections: Let’s start with some examples of how we ended up here. Several comments have stuck with me over the past several months:

- LRP drove the market lower. One commentator noted, “I think your LRPs are partly responsible.” And later doubled down: “I can’t prove this, but I know it’s true…and I’m pretty damn sure that there’s several outfits that are abusing the system…”.

- One of my LinkedIn posts asked the question, “Are LRPs driving the cash market lower?” One person responded, “How could they not, especially in the feeder market where the LRP volume roughly matches that of the entire feeder cattle futures market?”

- Finally, one reader even suggested that, “We may have created something systemic here.”

I’ve yet to see any corroborating evidence demonstrating the suggested link between LRP and the recent market correction. That is, the comments are mostly conjecture. As a side note, the market discussion is separate from subsidy harvesting (a topic unto itself to be addressed later.). With that, let’s dive into the market connection.

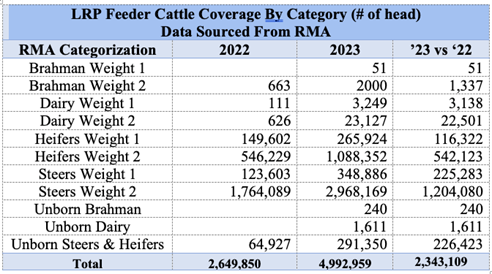

Quantitative Perspective: There wasn’t any murmuring about the influence of LRP on the market in 2022 – nor even the front half of 2023 for that matter. The complaints emerged in lock step with last fall’s correction. Given that premise, the table below details feeder cattle LRP head count by category in ’22 and ’23, respectively.

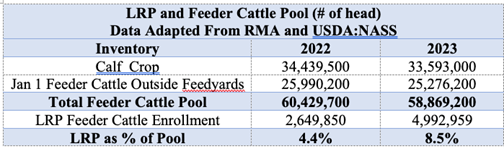

Now consider the relative inventory numbers. The second table details LRP as proportion of the feeder cattle pool for 2022 and 2023.

Seemingly, the 2022 proportion was acceptable, but now in 2023 LRP enrollment is “too much”. As noted here, when the market doesn’t go our way, it’s always either “too many or note quite enough” – it’s never just right. Are we sure the marginal increase (2.3M head) in 2023 really made a difference on the market? And if so, then what’s the precise threshold where it becomes “too much”? Talking about all this in generalities (“too much” or “not enough”) really doesn’t get to a meaningful answer and/or solution. And suggested limits don’t possess any real analysis or precision – thus far it’s just guesswork.

Qualitative Perspective: That consideration inherently invites the next question. IF LRP impacted the market in 2023, what was the specific mechanism? To that end, several key questions arise:

- Does LRP change the differentiating attributes and/or underlying value of the cattle?

- Is buyer / seller behavior influenced by the presence of LRP?

The answer to both questions is, “No.” Accordingly, I haven’t heard any explanation of how or why LRP might affect transactional decision-making or behavior in the cash market.

But if the answer to either was, “yes”, the Cowabunga Regional Stockyards would be applying distinguishing backtags and selling them separately from the other cattle. That’s not happening. Better yet, Cowabunga might even hold special sales featuring LRP cattle. That, too, hasn’t happened.

The parallel here would be something like Stub Hub. Do Taylor Swift tickets get priced and/or traded differentially when sellers own ticket insurance? I “think” (don’t know) the answer is, “no”. That’s because the insurance is separate from the value of the ticket. It’s the same with LRP.

Thinking Out Loud: These are important questions before the industry (and/or RMA) considers any change to the program. Despite some conventional thinking to the contrary, it’s hard to understand how LRP could have influenced the market last fall. Given that premise, any sort of knee-jerk reaction to last fall’s market correction, and subsequent proposals to “fix” LRP, could result in unintended consequences for the program – i.e. negatively impact producers. Any, and all measures, need to be based on knowledge (data, facts and logic), not emotion.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.