Speer: LRP, Markets, Good Business

Premise: LRP insurance is an immensely valuable program. It’s straightforward, versatile, and makes risk management readily accessible to producers. And that’s more important than ever; record prices translate to heightened equity risk for farmers and ranchers.

Market: As quick review, the fed market established a new record ($189) in early June. And for the next five months, it remained remarkably resilient – averaging $184 through October. However, that resiliency was increasingly bumping up against growing supply coupled with ongoing concerns about the economy and consumer demand.

The pressure ramped up in October: federal budget deadline, House speaker debacle, Israel-Hamas conflict, spiking bond yields (topping out on Oct 18 at 5%) and plunging equity markets (the S&P 500 marked a new-term low on Oct 26). But October’s cattle-on-feed report threw gas on the fire leading to an inevitable price break.

Blame LRP: All that got ignored by some industry observers who wanted to establish blame: CME, NCBA, packers (of course) and investment funds (always bash the speculators). But specific to this discussion the list also included LRPs: “I think your LRPs are partly responsible….” It’s a little like saying, “Hey neighbor, your LRP policy broke the market.”

Options Action: All that aside, my recent column covered some additional granularity. Many readers emailed their concerns about the options market. The thinking being LRPs are influencing volume and volatility (especially on the put side).

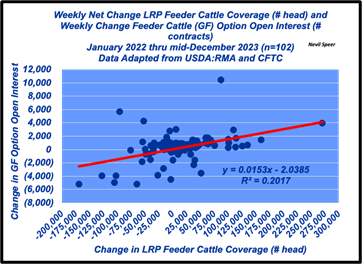

Zeroing In: The first graph details changes in option volume versus changes in LRP volume. As expected, LRP coverage and option open interest largely trend together, but there remains lots of noise in the data (weekly differences in LRP coverage account for only 20% of the weekly variation in CME feeder cattle option open interest).

Nevertheless, much of the concern includes the single-week addition of ~10,000 option contracts. It’s an outsized move in a relatively small (and illiquid) market – clearly way off trend. That creates challenges in terms of bid/ask spread for those attempting to use options as a risk management tool. And there’s been some further big moves in the weeks since.

But is LRP the driver? Hard to know. Meanwhile, during the past 8 weeks, LRP coverage has declined by ~487,000 head; option open interest has gone the other way, tacking on another 2,554 contracts.

Back To Blame: Responding to my recent LinkedIn post one individual proclaimed LRP volume resulted in “increasing downward market pressure with substantial volume.” Then, he summarized with this: “If the goal was downside price protection and market stability, the LRP feeder program achieved the exact opposite on both counts…”. That assessment is counterfactual:

- It ignores fundamentals described above (e.g. economy, cattle-on-feed) and avoids complexities of markets.

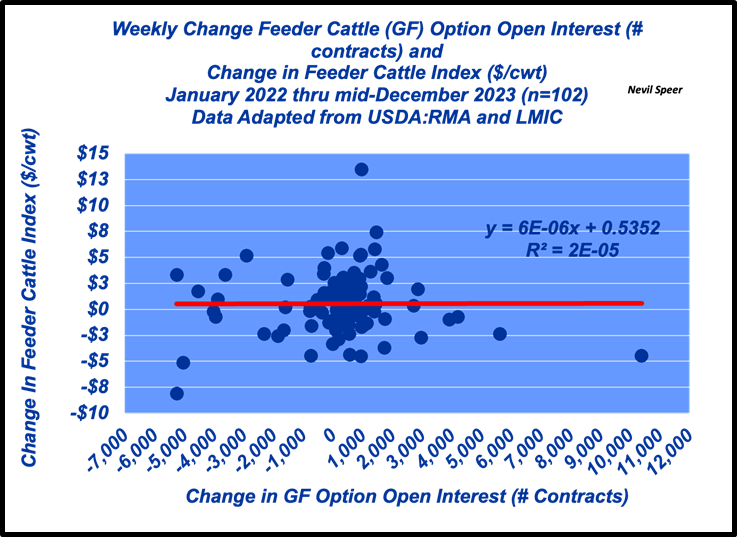

- Options are a derivative of futures, and futures a derivative of cash. It’s directional – else the three markets would be caught in a meaningless, circular loop. Changes in option volume doesn’t influence the physical market (see second graph - the correlation is .007, the regression .000006).

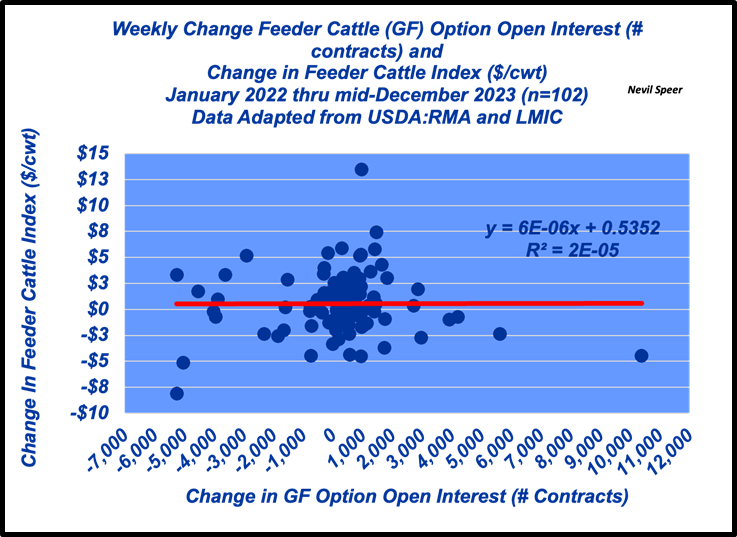

- Neither has LRP volume influenced the cash market (see final graph below).

- It disregards favorable LRP stories from the country.

Good Business: During the past month, I’ve heard every combination and permutation regarding LRP and options and futures and cash – many of them not quite sure how it all fits together. And while it might’ve seemed like LRPs are responsible for the sell-off, the data indicates need for careful discernment before the business decides what’s what.

Darin Newsom at Barchart provides some great perspective of late on both feeder cattle (and markets in general). With that in mind, as stated in my previous column, let’s be careful not to throw the baby out with the bathwater.

Most important, it’s easy for producers to be consumed by LRP talk and subsequently overlook the importance of taking action to manage price risk. That’d be a mistake: things that never happen, happen all the time.

To that end, one email I recently received cut straight to the matter – risk management is essential to the bottom-line: “There are seasoned risk managers…Those people know that they don’t know [what the market will be] and act accordingly day in and day out. It’s pretty boring…and consistently profitable.”

That’s good business.