Speer: Discernment Is Paramount

Selloff: I’ve had several emails about the cattle market in recent days. Most people looking for some semblance of reason surrounding the selloff. It’s best explained by Cattle-Fax (see below). Perhaps more important than understanding the price action is one’s response. And this past week provided a stark contrast between emotion versus factfulness.

Emotion: Let’s start with the emotional response – it’s all about blame:

1. “CME should take some ownership of this failure of the board here this week…”

2. “NCBA, they’re going to continue to support the CME because all the changes that the CME has made over the last several years for the short side which has ran all of our longs off…

3. “I think your LRPs are are partly responsible.”

4. “Who would benefit from this? Well, obviously your packers…if you think, and I want somebody to prove me wrong here, if you think that the packers - and the funds that they're associated with - are not involved in selling off this board in a big way...I’ll kiss your @#*.

Unsubstantiated: Most of that is just noise. But given it’s out there in public, let’s tackle the inconsistencies anyway.

- CME: Do the givin’ and gettin’ points balance out? Are kudos due to CME for the market establishing new all-time highs? I don’t remember any complaints on the way up.

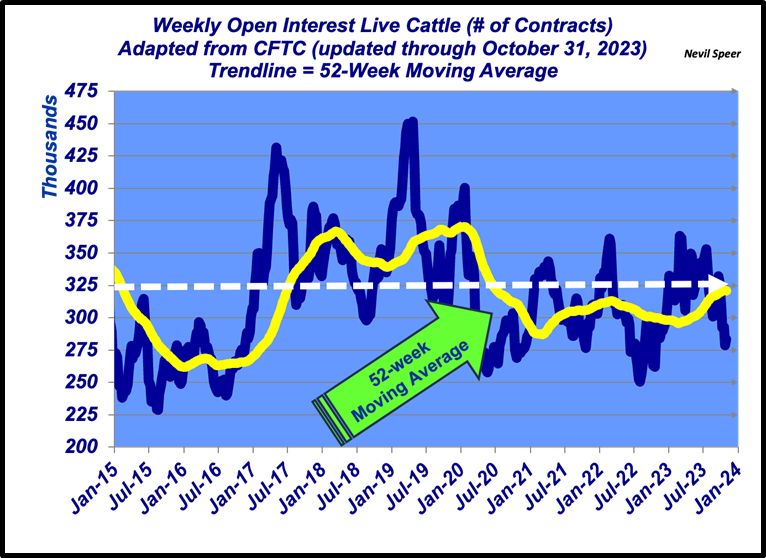

- Longs: For every seller (short), there must be a buyer (long), and vice-versa. If there’s a deficit of longs, it’d be reflected in a decline in open interest. However, it’s remained remarkably stable over time (see first graph below). Moreover, if open interest (i.e. liquidity) is a concern, the blame could also be turned right back around: where are the sellers to entice the buyers?

- LRPs: Now I’m confused. All this is also because of short positions, too? That is, there are too many shorts? In other words, producers have taken on too much price protection (via LRPs) to their own demise.

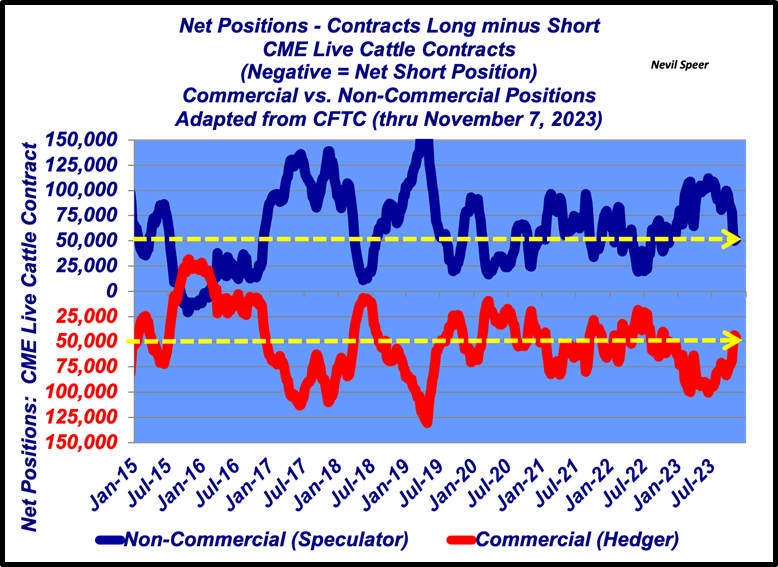

- Funds: Any claim the packers and funds are working together is especially far-fetched. The funds are categorized by the CFTC as non-commercial entities (i.e. speculators). They largely assume the long side of the market; as such, they only make money if the market goes up – not down. Why would they want to sabotage their own net long positions? (see second graph) (We’ll forgo the @#* kissing).

Factfulness: On the other side, the more informed, reasoned and trusted approach was provided by Patrick Linnell with Cattle-Fax this past week. He explained it this way:

… the snowballing effect from several factors has led to the present market flush. For one, the market appears to see an adequate supply of fed cattle for the next several months as placements have been larger than anticipated…cattle on feed totals are above year ago by 2.5% to begin November. With the backdrop of increasing on-feed supplies, the market was spooked by outside noise. The U.S. budget deadline, House Speaker ejection, and the attack on Israel came in short succession. Now a month later, these issues remain largely unresolved as Congress has a new Speaker but a new budget deadline looms and the Israel-Hamas war continues…Multiple headwinds have snowballed into the break in cattle markets, factors that may remain constraining in the months ahead, even as the fundamentals of cyclically tighter supplies and resilient demand remain at play.

Coffee Shop Talk: Oaktree’s Howard Marks, in one of his renowned notes (What Does The Market Know?), wisely observes: “In short, people make each other crazy. And when times are bad…they depress each other.”

That maxim ultimately leads to several important questions:

- Who are you listening to?

- What do they really know?

- Are they talking their own market position? (Financial stress (i.e. margin calls) often makes people cranky and irrational.)

Stated another way, Howard Marks would likely encourage us to avoid the coffee shop and social media – especially when the market gets turbulent. Discernment is paramount!

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.