Speer: Less Drama, More Factfulness

Absolutely Ridiculous: At the end of April, fed cattle were trading at ~$178.50. Meanwhile, on the futures side, June live cattle contract stood at only $164. One of social media’s daily market commentators sounded the alarm:

…June is going to be our spot month and it is 14 ½ dollars behind where our fat cattle market is established. It’s absolutely ridiculous guys. Why has nobody got into the June live cattle?...Why have there been no investors, no fund managers getting into that?

Fallout: Several things are important about the statement:

- The implication being cattle prices are victim to “investors and fund managers” and their alleged unwillingness to enter the market.

- The complaint is usually followed by another – there’s too much outside noise at the CME. For example, my column last spring cited another analyst’s complaints about speculators:

What once was a viable and sensible risk management tool has been turned into something barely recognizable. Many who trade cattle futures know nothing of their fundamentals…

So, where does that leave us? On either side, the angst about speculators represent:

- misunderstanding about how futures markets work, and/or

- misrepresentation to stir up the listeners / readers.

Trading Volume: The fundamental complaint being investors / fund managers have gone AWOL; thus, trading volume and subsequent contract price is depressed. That brings us to open interest: the total number of outstanding futures contracts for a given commodity.

For every buyer there must be a seller (and vice versa) – else there’s no creation of a contract. And second, there’s no limit to the number of contracts that can be traded on futures exchanges (versus equity markets where there’s a finite number of shares for a given company).

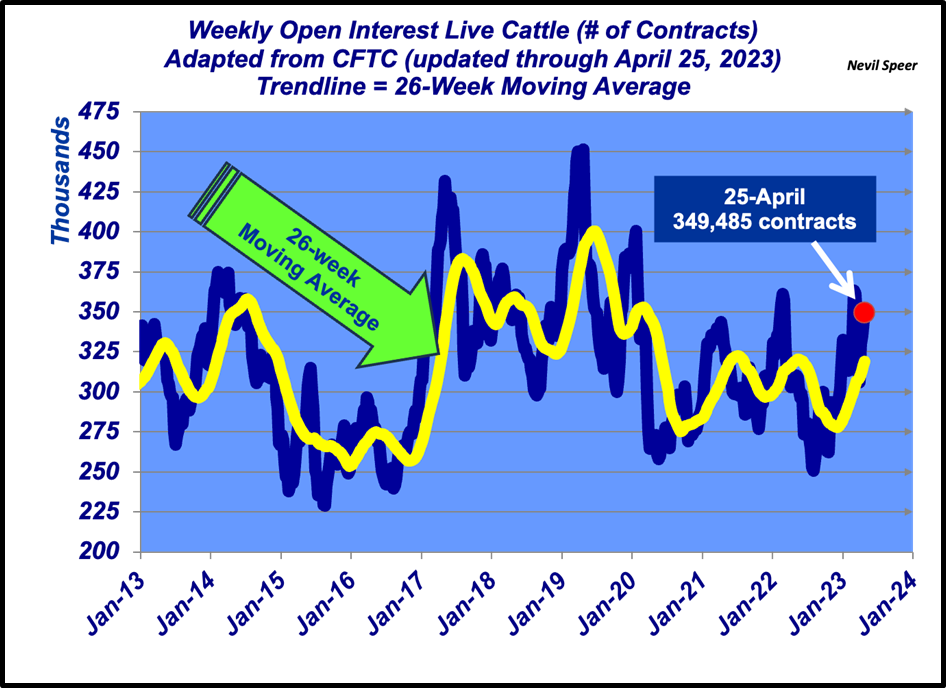

On April 25 (the last Commitment of Traders report prior to April expiration) open interest for live cattle stood at 349,485 contracts. Now let’s put that into context. The 26-week moving average at the end of April equaled ~319,000 contracts. Bottomline: trading volume exceeded the longer-run trend; the commentator has it wrong. (see first graph below)

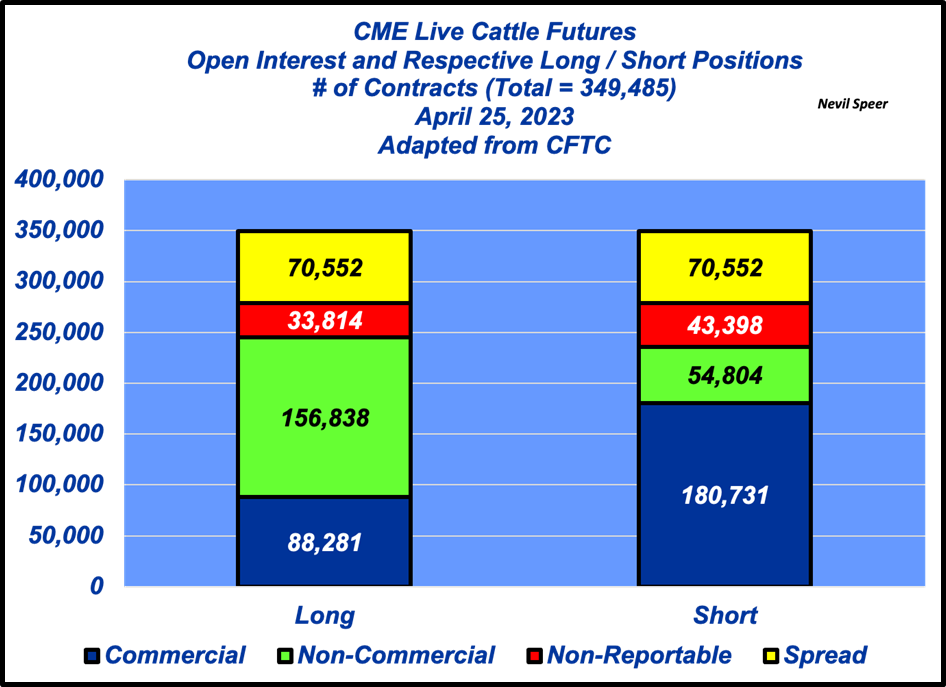

Respective Positions: As noted, the total number of long positions must exactly match the number of short positions. And on April 25 commercial traders (hedgers) were long 129,564 contracts versus being short 188,522 contracts. Meanwhile, non-commercial traders (including investors and fund managers) were long 113,250 contracts, but short just 44,311 contracts. (As a side note, the spread positions will always match.)

With that principle in mind, we could turn the commentator’s question right back around: where are the sellers to entice buyers into the market? The point being, it’s not just up to the buyers; here again, the commentator has it wrong. (see second graph below)

Factfulness: Aside from understanding futures markets better, the discussion points to something broader: There’s seemingly an enduring desire to stoke fear and drama around markets and/or the business. That happens too often in social media (and the coffee shop).

All this calls to mind the principles surrounding “I think” versus “I know”. Likewise, the authors of Factfulness (c. 2018) encourage us to make assertions based on supporting evidence:

Factfulness…Start to practice it…replace your overdramatic worldview with a worldview based on facts…You will make better decisions, stay alert to real dangers and possibilities, and avoid being constantly stressed about the wrong things.

And so, sticking with an ongoing theme of less-versus-more:

Let’s add one more to the list: Less drama, more Factfulness.