Speer: Less Matrix, More Moneyball

In a previous column, I addressed a recent YouTube video and specifically highlighted its misrepresentations around international trade. Meanwhile, the video also twisted a timely column by Greg Henderson including the following rant:

“The editor of this magazine, Greg Henderson, he writes in Packing Plants Fool’s Gold: “cattle producers work themselves into a frenzy over U.S. packer capacity since the Tyson [sic] temporarily shuttered a giant plant three years ago.” ….and to put it that way just seemed so condescending and arrogant, and has no empathy to the people who lost so much money over that span of months after that fire in 2019 and it was for absolutely no reason. It was simply because the packers manipulated the market because they have a stranglehold on the industry. Four packers control 85% of the industry. And they manipulate that market and cattle producers went broke, went out of business….

So, let’s look at some of those assertions.

First, “…the packers manipulated the market.” That’s a very serious allegation – and one that shouldn’t be made lightly. However, as much as the YouTube storyteller portrays it to be true, he provides no foundation substantiating such. Alternatively, Dr. Jayson Lusk, Purdue University, explained the market like this: “…the effects we’re seeing right now in the beef and cattle markets are exactly what we’d expect from a textbook treatment of a reduction in wholesale supply in a vertically linked market.”

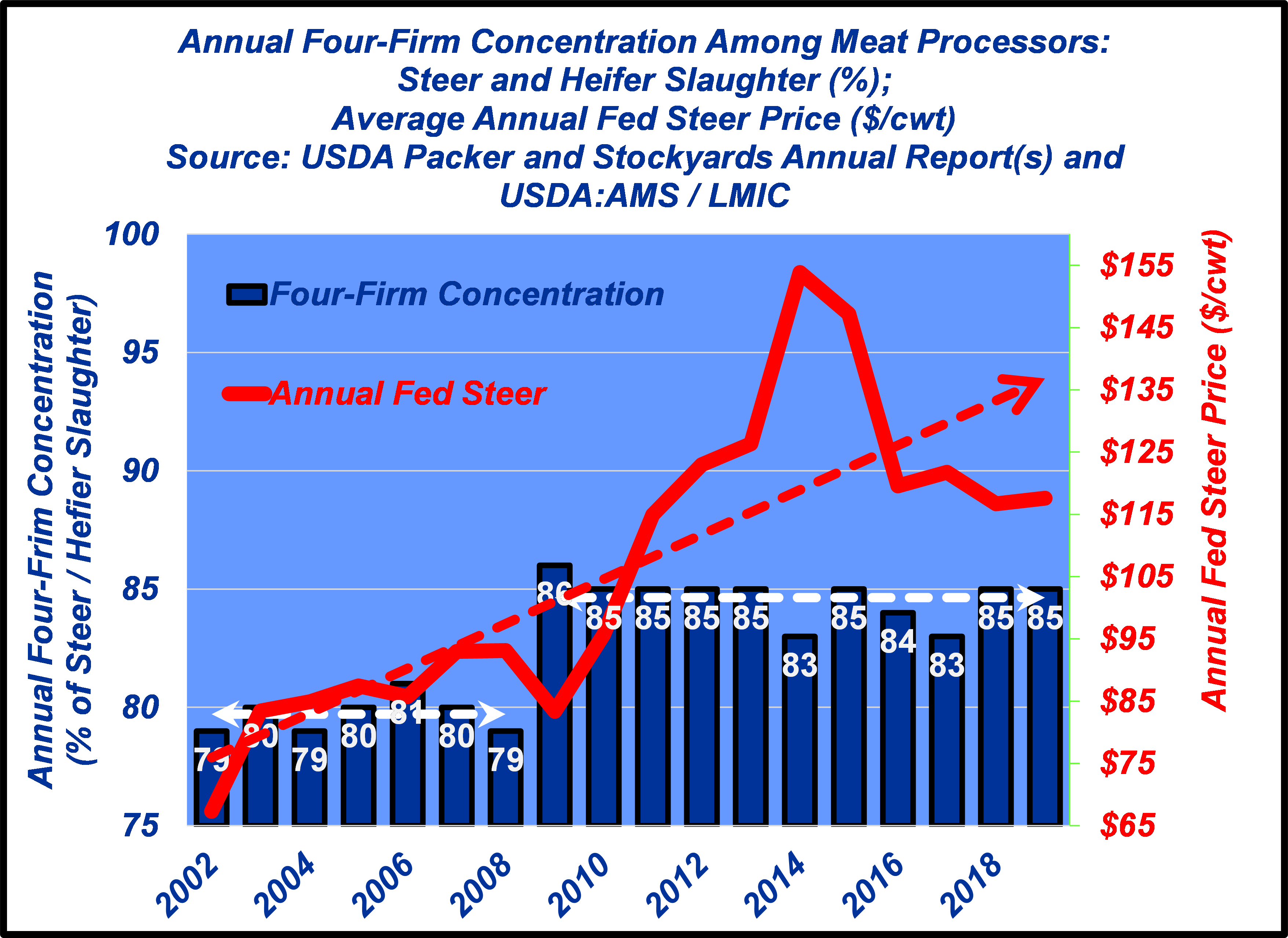

Second, “Four packers control 85% of the industry.” The talking point -word for word. And as noted in a previous column, “Packer concentration is unchanged over the last ten years (and only 6% higher versus the previous seven years)…” And yet fed cattle prices have surged 75% during that time. (see graph)

Third, the packer has a “stranglehold on the industry.” The contention reveals a narrow view of the business. Most notably, it misses the industry’s complexity. For more on this see: Not Just The Packers.

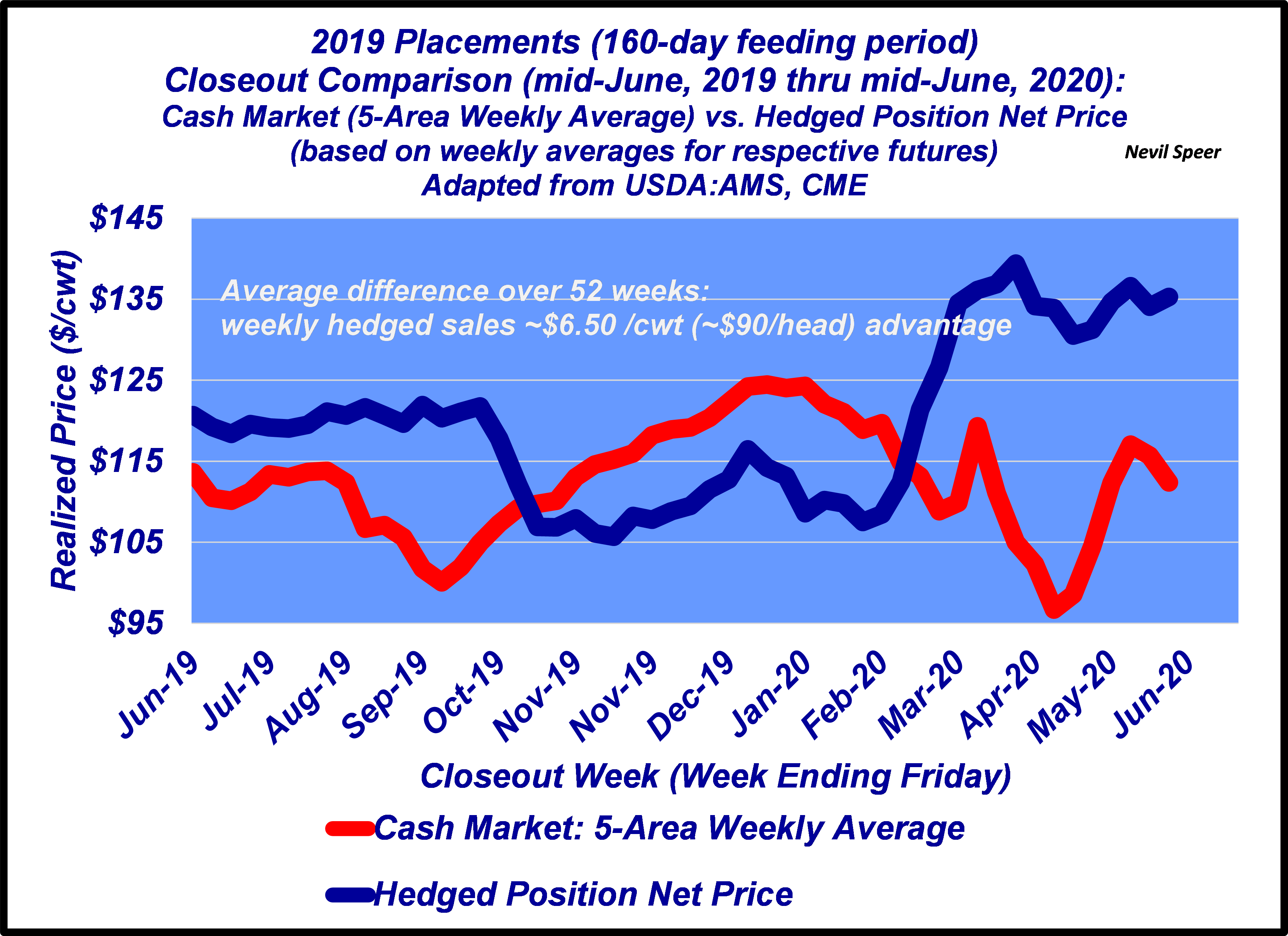

Fourth, “…people who lost so much money over that span of months after that fire in 2019…” On two separate occasions (late-2019 and mid-2020), I provided some analysis relative to risk management. The second graph below highlights the difference between cash sellers and hedgers for feeder cattle placed in 2019. The subsequent twelve months of closeouts reveal disciplined hedgers maintained an advantage of nearly $90/head versus the cash market. In other words, those producers avoided losing “so much money” – the very essence of risk management.

Fifth, “…cattle producers went broke, went out of business…” Again, the video provides no evidence Tyson’s Holcomb fire proved to be the knockout punch for any producer. Not to mention, such thinking avoids the reality of the huge variance in profitability over time.

On a more personal note, at the time of Tyson’s fire, I was working with a progressive, business-minded producer. On Sunday, August 11, he sent a load of pre-conditioned calves to be sold the next day in Oklahoma City. At loadout time, the August 9, Friday-night news of the fire hadn’t made its way through the news channels. Of course, Monday’s sale was disappointing. I talked with him several days later. His resolve was unshaken: “We learned our lesson and won’t ever do that again.” And he’s since expanded his cowherd.

Less vs more: financial historian Perter Bernstein notes, “The most important lesson an investor can learn is to be dispassionate when confronted by unexpected and unfavorable outcomes.” That same principle applies to business because it asks, “how do we get better?” (Just like the producer mentioned above.) To that end, Greg Henderson’s column was right on target.

Conversely, YouTube videos ranting about Drovers or the packer or NCBA don’t advance producer success. That happens with less social media and more spreadsheets; less pandering and more professionalism; less Matrix and more Moneyball.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.