Speer: Less Crisis, More Opportunity

The end of the year always leads to lots of predictions about what’s to come. However, the best read on where things are headed generally comes from assessing where things have been. Given that focus, let’s start with the nearby perspective (i.e. market), then zoom out to the larger view (i.e. business), and ultimately wrap-up with some broader assessment (i.e. implication).

2022: When it comes to the market, the past year was favorable for producers. Despite the market’s surge, the permabears are always dismissive. They’re assigning 2022’s market strength as simply a function of weather: “…the widespread drought that began last winter is again beginning to increase fed cattle prices.”

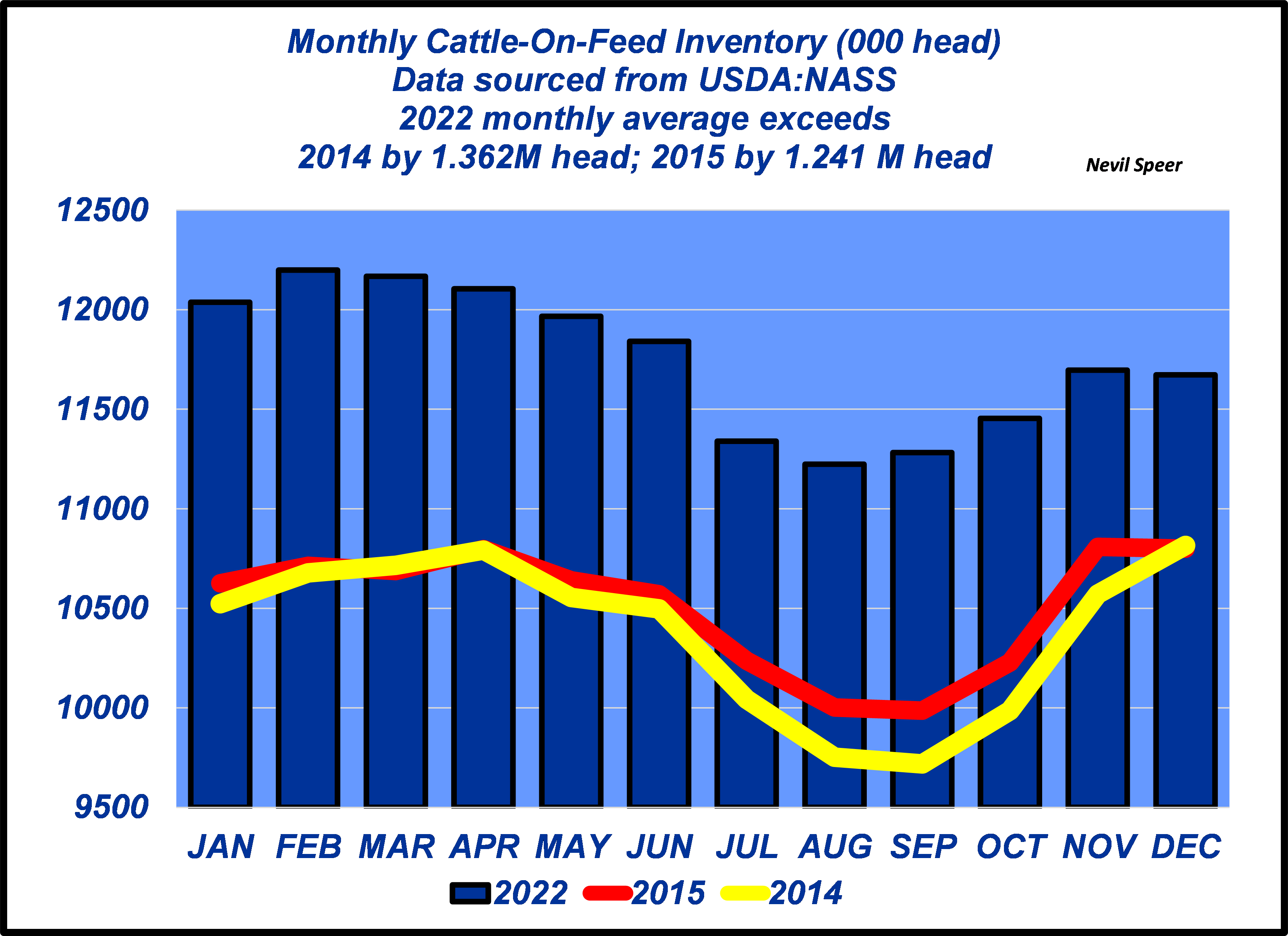

But it’s too early to make that call. The impact of drought hasn’t really been absorbed into the market yet. In fact, 2022 monthly feedyard numbers have consistently run ahead of last year’s inventories. And way ahead of the favorite market benchmark of 2014 and 2015. (see first graph)

Drought-induced supply drawdowns won’t truly begin until 2023 and will be manifested in stages that overlap. First comes the immediate influence of smaller feeder cattle supplies in the country (as calves have been pulled ahead into the feedyard). Second, the calf crop over the next several years will be markedly reduced following the sharp selloff of the cowherd. And last, the supply gets especially crunched when producers begin holding back heifers as replacements.

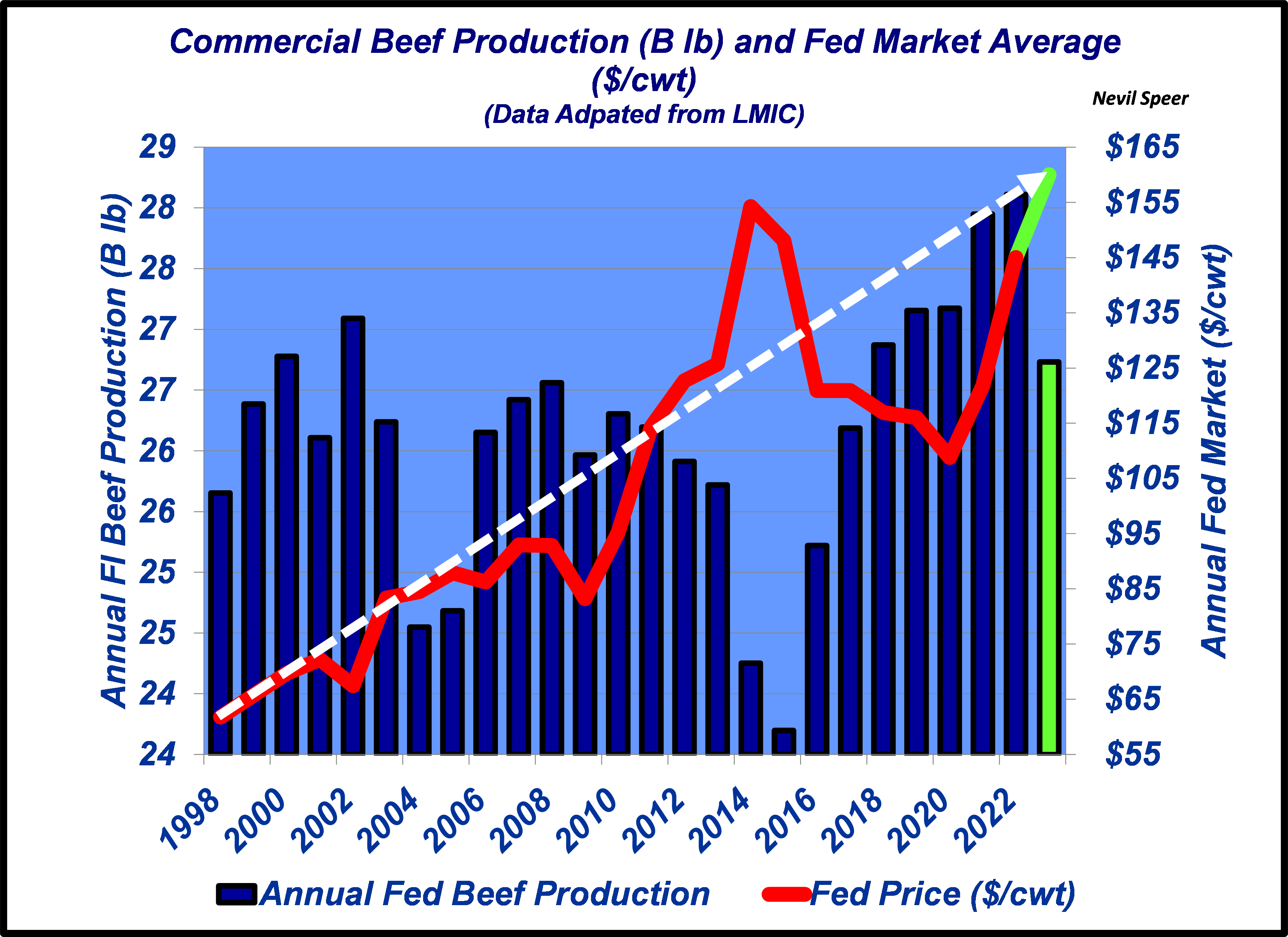

Longer run: Now let’s look at the business (emphasis!) over a longer time horizon. The second graph details annual beef production and the fed market (dating back to 1998). It demonstrates just how favorable prices have been in 2022. A couple of items are of particular interest as it relates to the importance of beef demand and consumers:

- 2022 commercial beef production eclipsed 28B lb – a new annual record. As noted previously, clearly drought-induced supply cuts haven’t yet been a factor – and yet, fed prices tacked on ~$20/cwt from January through December.

- The last time fed prices averaged ~$145 was 2015; however, beef production back then was only 23.7B lb (~15% less vs. 2022).

- Looking ahead to 2023, commercial beef production is projected to be ~26.7B lb; futures markets have the fed market averaging $160/cwt through the year. That price would beat the 2014 record by $6/cwt on production that’s ~2.5B lb bigger.

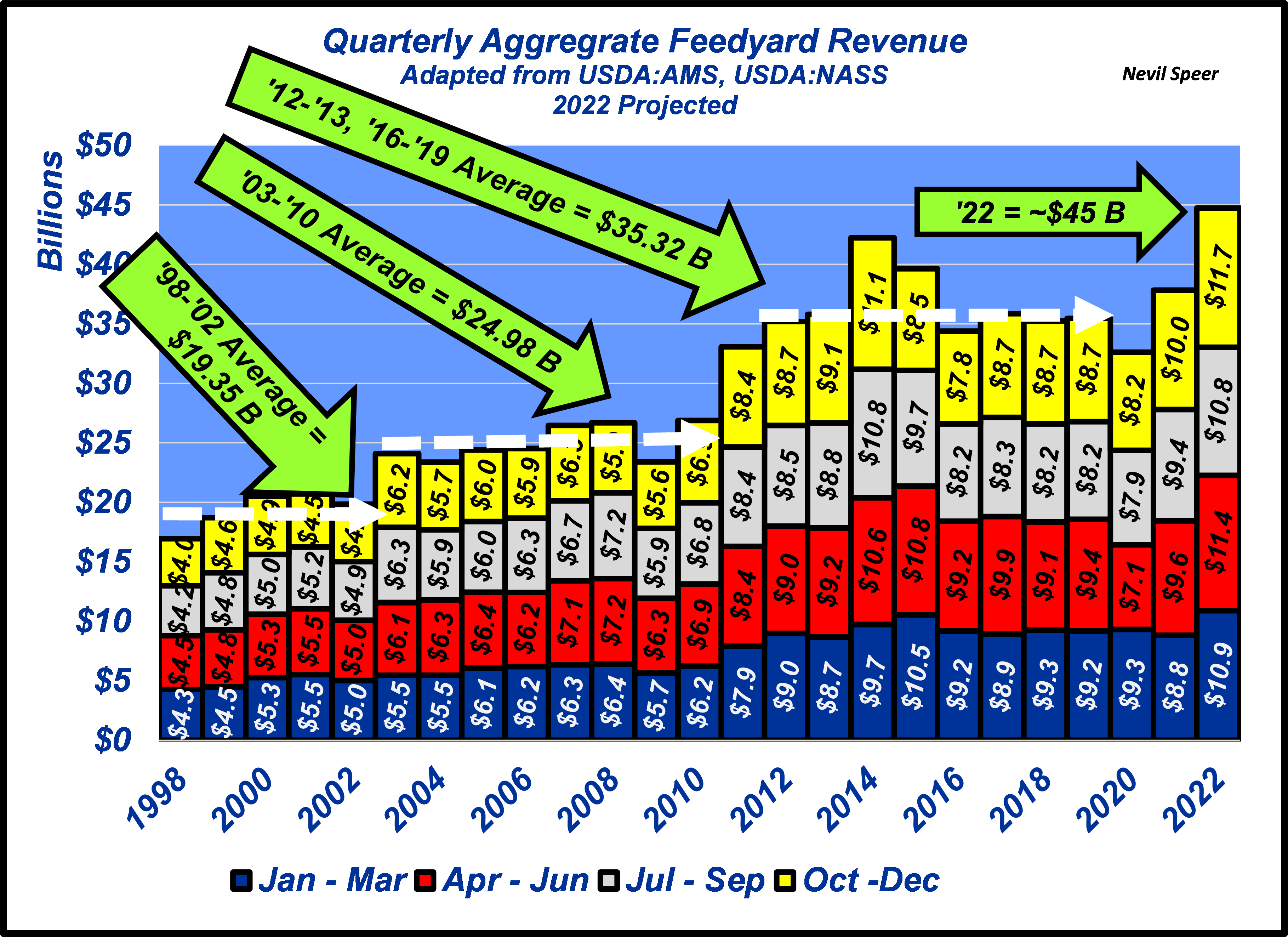

Revenue: All of this culminates in an important story: more dollars coming into the production sector (a function of marketings, weight, and the fed market). Note the beef industry established a new record in 2022 ($45 B). (see third graph)

The business is getting better – the direct result of making cattle better, which in turn has resulted in higher-quality, more consistent beef products. And it all gets amplified when it occurs in tandem with consistent and effective promotion (i.e. Beef Checkoff).

Regarding the Checkoff, a reader recently emailed me an insightful observation that’s especially pertinent amidst this discussion:

“Every day at the national and state level there is a very committed group of national and state staff and volunteer leadership working to increase beef demand and consumer acceptance of beef in the U.S. and in export markets. It’s hard and focused work. They don’t yell and shout about what they are doing, sit around demagoguing issues or creating false hopes for beef producers. They don’t ask for it, but they deserve a lot of credit…”

Implication: What about next year? Tom Lee, Head of Research at FSInsight recently held his year-end financial market overview. He distilled the outlook into one simple phrase. Given all the commotion of the past 12-to-24 months juxtaposed against beef’s remarkable resilience, it’s especially fitting here going into 2023: less crisis, more opportunity.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.