Speer: 55 - 0

Last week’s market topped $150! Even numbers don’t really matter, but it’s a significant milestone, nonetheless. More importantly, it’s a timely opportunity to review the need for regulatory intervention into the cash market (i.e. the Cattle Price Discovery and Transparency Act of 2022).

Per that issue, one group took issue with my work earlier this year: “…Nevil Speer who unabashedly tells policy makers to ‘leave well enough alone.’ Speer argues there is no confirmational data supporting legislation like the Grassley/Tester bill (S.949) that requires packers to purchase at least 50% of their cattle in the negotiated cash market. Instead, Speer claims an inverse relationship between increased cash volume purchases and cattle prices.”

The criticism was based on a previous column detailing USDA data regarding weekly negotiated trade and the fed market. The column wasn’t a narrative essay – it neither “argues” nor “claims”. To the contrary, it presented hard data (facts are stubborn things) outlining the relationship (or lack thereof) between cash volume and cattle prices.

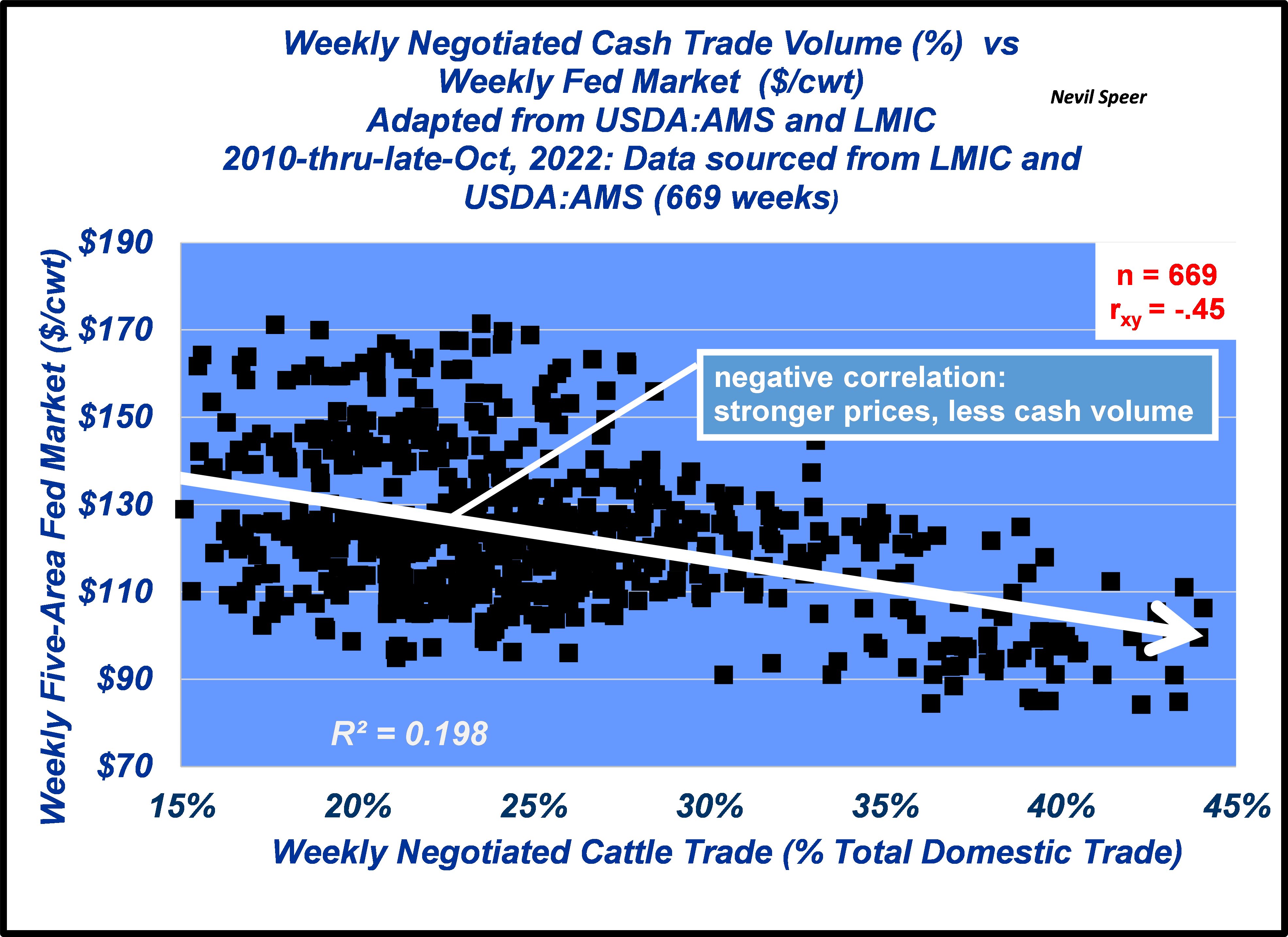

How about a second look at the data? The first graph below details an updated version of what was presented earlier in the year. Nearly thirteen years of weekly data; the correlation between cash volume and the fed market is NEGATIVE .45!

Correlation doesn’t equate to causation. But the trend is strongly tilted in the opposite direction of what mandate proponents are proclaiming (“more trade, better prices”). That is, over time, prices have gotten stronger while negotiated trade has faded.

All that invites several obvious questions:

1. Would a mandate really make cash prices stronger?,

2. If so, at what cost? (see: Business First, Market Second),

3. If not, what sort of unintended consequences will be introduced by a mandate?

Momentum for government intervention gained steam in 2020 amidst Covid’s market disruptions. The fed market dipped below $95 and packers were garnering unprecedented margins – even exceeding $2,000/head for several weeks in late-spring. The argument went something like this: “Proof positive: the packer is manipulating the market! Something must be done! Make ‘em get in there and bid for those cattle. More cash trade will make prices stronger!”

Now, let’s circle back to last week’s $150. I’d wager if we went back in time, all those people wringing their hands about the cash market would tell you that sort of price achievement would have been impossible – unless, of course, we had more active bidding in the cash market.

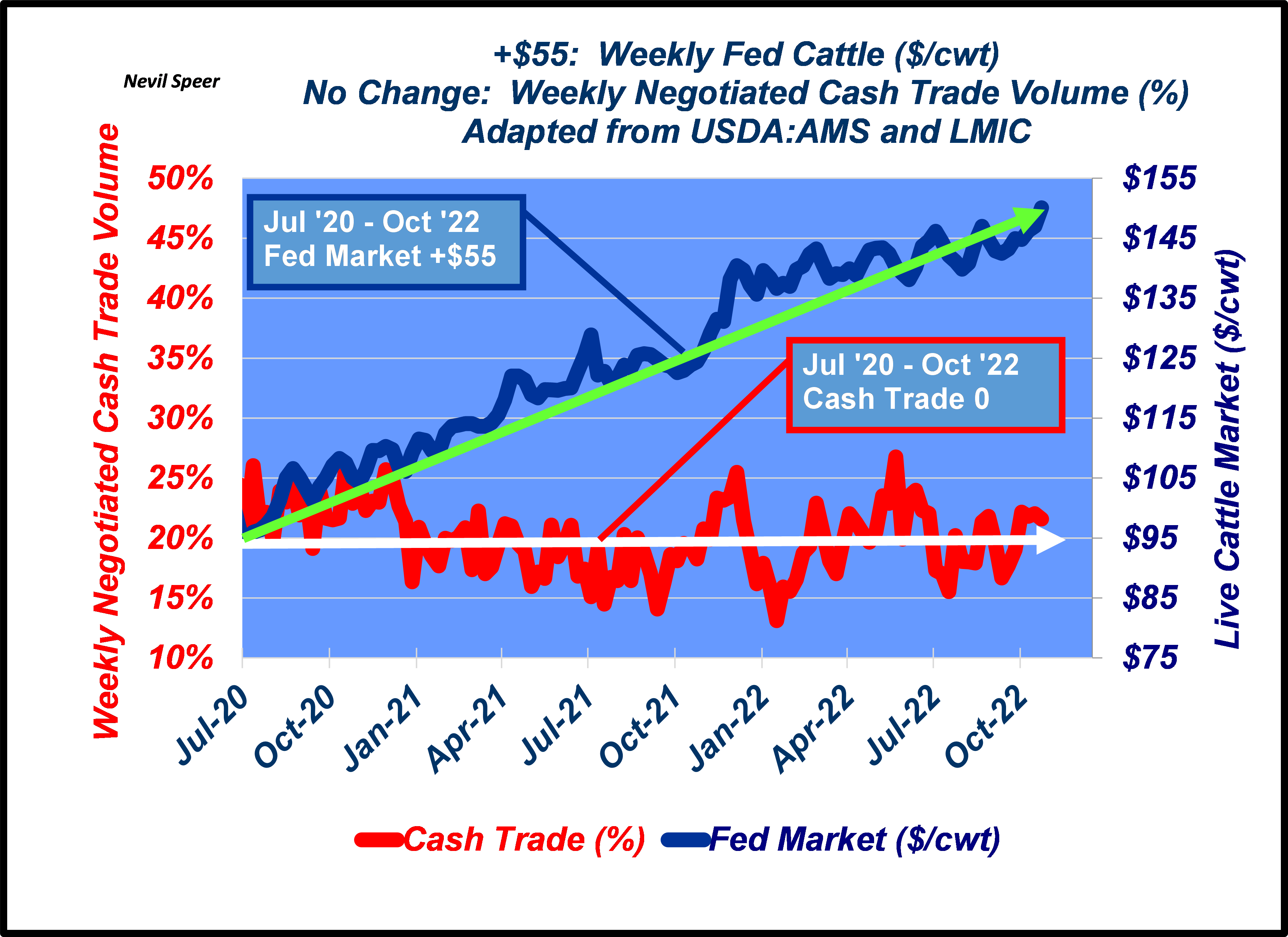

The second graph details percentage of weekly negotiated trade and the fed market since July ’20. The date marks the near-term bottom of $95 with cash volume representing just 21% of all transactions. Since that time the market has added $55/cwt while average negotiated volume remains stuck at ~20%. In other words, score the market +$55, cash volume zero. (Back to the three questions above.)

And along the way, packer margins have steadily eroded. Given last week’s $150 trade, gross margins (live-to-cutout spread) are hovering around $300/head. It’s impossible to know precise processing costs across the industry – but with added fuel, labor and interest costs in recent years, many analysts would likely tell you that $300 number is at-or-below breakeven levels in most plants.

One of my favorite quotes about markets comes from Oaktree’s Howard Marks (What Does The Market Know?): “In short, people make each other crazy. And when times are bad…they depress each other.” It aptly illustrates some of the angst amidst the market’s uncertainty following the Holcomb fire and through the initial stages of Covid. But now, given the benefit of time, cooler heads should prevail: that is, What If We Did Nothing? After all, nothing has happened, and the scoreboard reads 55-0.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.