Speer: Business First, Market Second

Nevil Speer is based in Bowling Green, KY and serves as Director of Industry Relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at nspeer@wherefoodcomesfrom.com.

Last month’s column focused on the claim, “more trade means better prices.” As review, there’s no evidence to back that assertion (in fact, the data trends the other way). That’s straightforward with respect to cash trade and the market. But there’s an even more important aspect – as it relates to business - that often gets overlooked in this discussion.

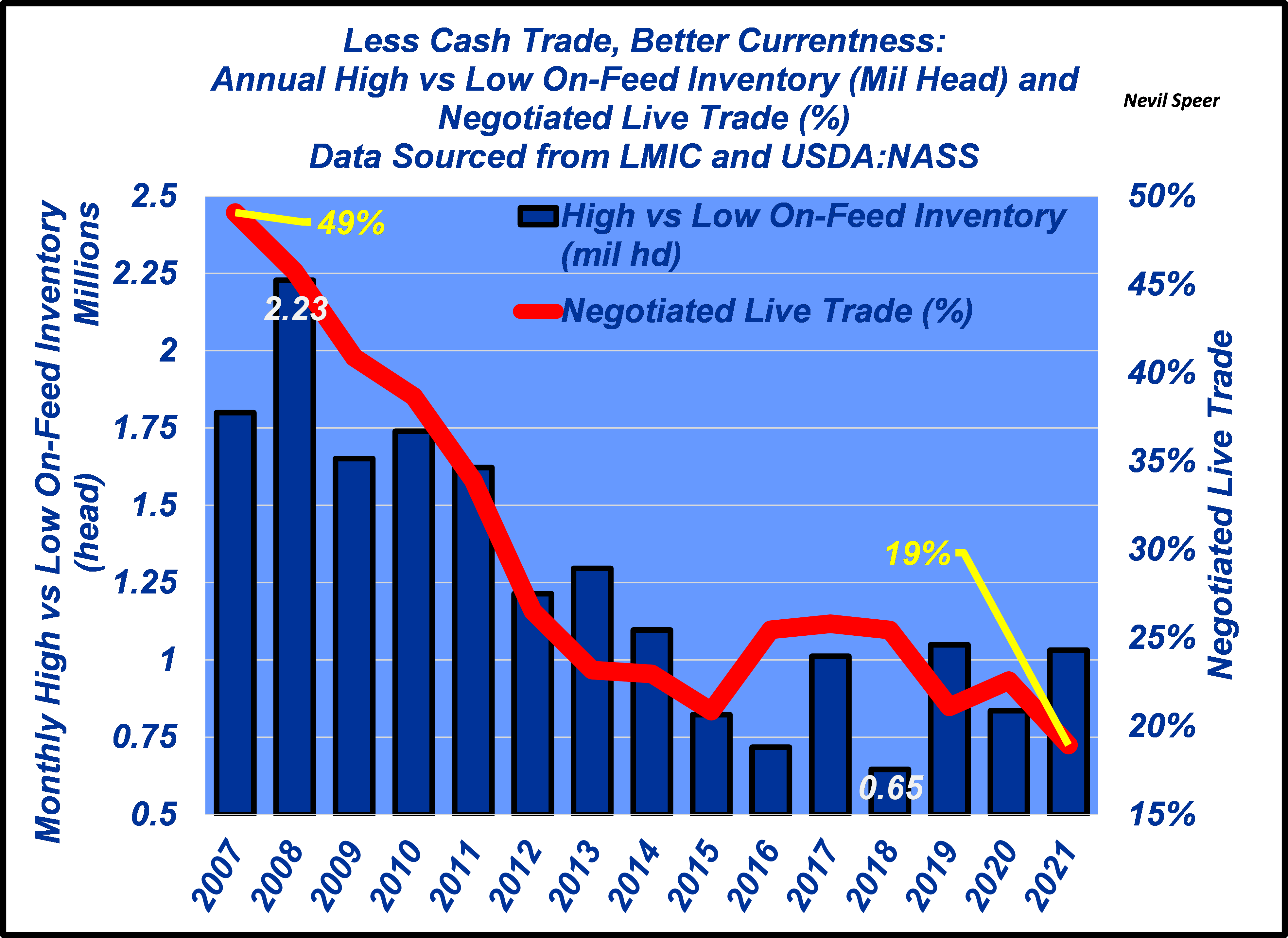

The attached illustration represents two separate measures. One, annual high-vs-low feedyard inventory range. Two, annual live cash trade percentages.

Several items worthy of emphasizing:

- Feedyard inventory: the difference between high-vs-low monthly inventory peaked in 2008 at 2.23 million head and subsequently bottomed at 650,000 head in 2018 (nearly an 80% decline).

- Cash trade: active negotiation has dropped from 49% in ’07 to 19% in ’21. Seemingly, the often-proposed 50% benchmark is arbitrary (and likely unachievable) given the 15-year pattern.

- Despite grappling with the Tyson Holcomb fire and Covid, the industry has established some equilibrium for both measures (inventory difference and cash trade) in recent years.

Let’s look at how these metrics fit together.

First, and most important, there’s the direct business consideration. During the past twenty years, cattle feeders have increasingly implemented operational innovation. That emphasis is congruent with most industries. For example, in 2002, business strategist Michael Hammer referenced those efforts as, “forward to basics,” and highlighted companies like Wal-Mart, Dell, Progressive Insurance, Southwest Airlines, Toyota and Harley-Davidson.

Accordingly, the feeding sector has increasingly committed to disciplined inventory management. Feedyard managers are more fully utilizing bunk capacity throughout the year and thus reducing monthly swings in inventory. Those efforts provide multiple advantages:

-

- Dilution of fixed costs;

- Improved feedyard efficiency;

- Better administrative productivity;

- Reduced exposure to choppy, uneven buying and selling;

- Enhanced ability to profit from disciplined hedging strategies;

- Increased opportunity to deliver into specified value-added programs.

Many of those advantages start with timely marketings – largely facilitated through reduced reliance on cash sales. There’s less effort and energy spent on guessing the market - and more work dedicated to consistent throughput. In other words, there’s a reason cattle feeders have spurred the downward trend in cash trade; it’s part of doing business better.

Second, comes the market itself. One item often gets neglected amidst the cash trade debate: currentness (or lack thereof). Once cattle feeders fall behind the front-end, closeouts become perpetual losers, and they become increasingly reluctant to sell. Subsequently, the wall of market-ready cattle grows even further and the market spirals downward.

Cleaning that up can be a long grind. But the feeding sector has stuck with the game plan LESS cash trade and MORE marketing discipline is favorable, ensuring feedyards stay current. During the past ten years (except 2015), the industry has mostly avoided the long, ugly stretches where nothing matters but the front-end.

Starting with “what’s the market?” reflects a commodity, one-size-fits-all, doing-what-we’ve-always-done approach. Conversely, leading with “what’s the business doing?” suggests intentionality and transformation and innovation. For any industry, and its participants, to remain competitive and create opportunity, it’s the latter question that matters. Business comes before the market, not the other way around.