Speer: Policy Makers Should Just Leave Well Enough Alone

More trade means better prices: “…if you have a lot of negotiated, pure cash sales then your market’s normally gonna be higher. If you don’t have very many it’s gonna be lower.” The critics of current fed market dynamics are very vocal in that line of thinking.

That’s now spilled over to Capitol Hill. The so-called 50/14 “compromise” bill has received the most attention. Senator Grassley justifies the legislation by proclaiming, “cattle producers…struggle to get a fair price...” The premise being packers increasingly exercise their respective market leverage and limit the volume of negotiated trade; that practice inherently leads to softer prices for cattle producers.

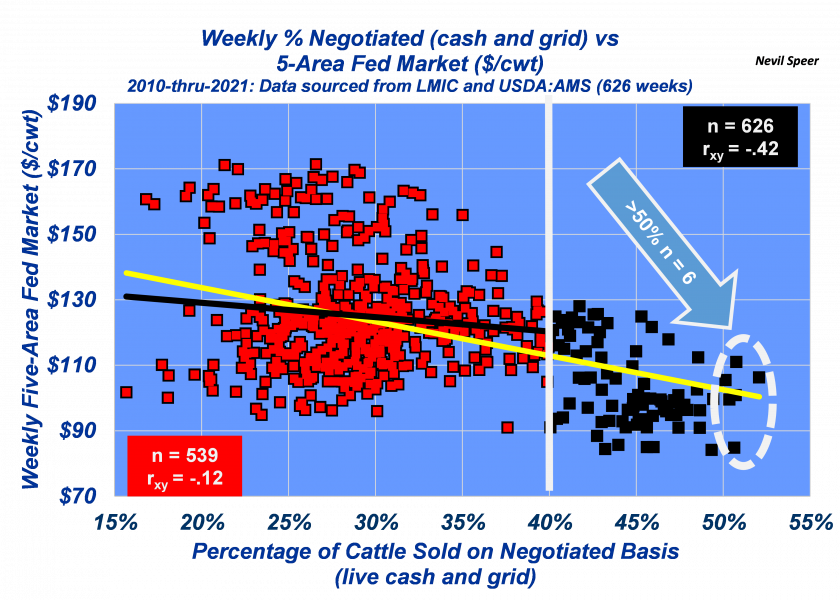

It’s an increasingly popular assertion – and given the traction of late must mean there’s objective data to back it up. To that end, the associated graph details weekly fed market vs level of negotiation since 2010 (12 years, 626 weekly observations). There are several key take-aways from the analytical perspective:

- Over the course of twelve years, cash trade and the fed prices are inversely related (counter to the mandate mantra); the correlation equals negative .42.

- Per #1, let’s throw out the relative outliers (87 weeks with negotiated trade surpassing 40% of total volume) to discern trends amidst the bulk of weekly trade. The correlation remains negative, albeit weaker (-.12).

- Last, the analysis raises questions about the 50% threshold within proposed mandates. It’s a random cutoff that’s been achieved only 6 weeks of the previous 626.

Correlation doesn’t imply causation. But if there was even a hint of meaningful, positive trend, the trade/price argument would at least be understandable. But it’s not there (and in fact, trends the other way). All this leads to some broader considerations.

Beginning with Senator Grassley’s comments, what is a fair price? And how is that determined – and by whom? Then there’s co-sponsor Senator Ernst’s claim that some cattle producers are, “…unfairly shouldering the burden of price discovery…” But is that weekly negotiation being driven by some altruistic motive for, or coercion by, their fellow producers? Instead, aren’t they really negotiating out of self-interest to obtain a better price?

Now think about implementing new legislation. The devil is in the details. For instance, what process will assure sellers meet the 50% limit, plant-by-plant, every week? And what happens WHEN that threshold isn’t met? In very short order, daily business could get pretty wonky: commerce flow becomes interrupted and creates bottlenecks up-and-down the supply chain. That all spells uncertainty – the very thing markets hate the most.

In the end, it’s the principles that really matter. The private sector evolves because that’s what makes sense for the business. And regardless how good intentions may be, government generally fails at making things better. New regulation always brings a plethora of unintended consequences.

More trade / better prices; it sounds good, it feels good, but it’s simply not true. And just saying it, over and over, doesn’t make it so. Given the absence of confirmational data, plus the potential to introduce weird incentives and business uncertainty, policy makers should just leave well enough alone. Over the long run, that’s the only path that’ll make beef producers better off.

Nevil Speer is based in Bowling Green, KY and serves as Director of Industry Relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at nspeer@wherefoodcomesfrom.com.