Speer: ...Not Just The Packers

My recent column addressed packer concentration, specifically discussing a recent editorial in the Kansas City Star declaring legislators should: “…break up the enormous meatpackers for the betterment of both the consumer and the producer.”

I subsequently received the following email from a respected, experienced industry veteran:

The retail industry is very concentrated with Walmart, Kroger and Safeway/Albertsons controlling a significant percentage of retail beef sales. Who do you want negotiating price with these retailers? …20 to 30 small packers who don’t have enough leverage or resources to walk away or turn down a price in a negotiation? …Or packers that have enough leverage to say no and walk away in the negotiating process? …Any discussion about concentration in the beef supply chain needs to include the entire system, not just the packers. (emphasis mine)

Those comments are a reminder about the importance of a broader understanding and more comprehensive view of the business. That’s especially true considering many packer critics seemingly believe the sector is THE price maker on both sides of the ledger – dictating prices buying cattle AND selling beef. Nothing could be further from the truth.

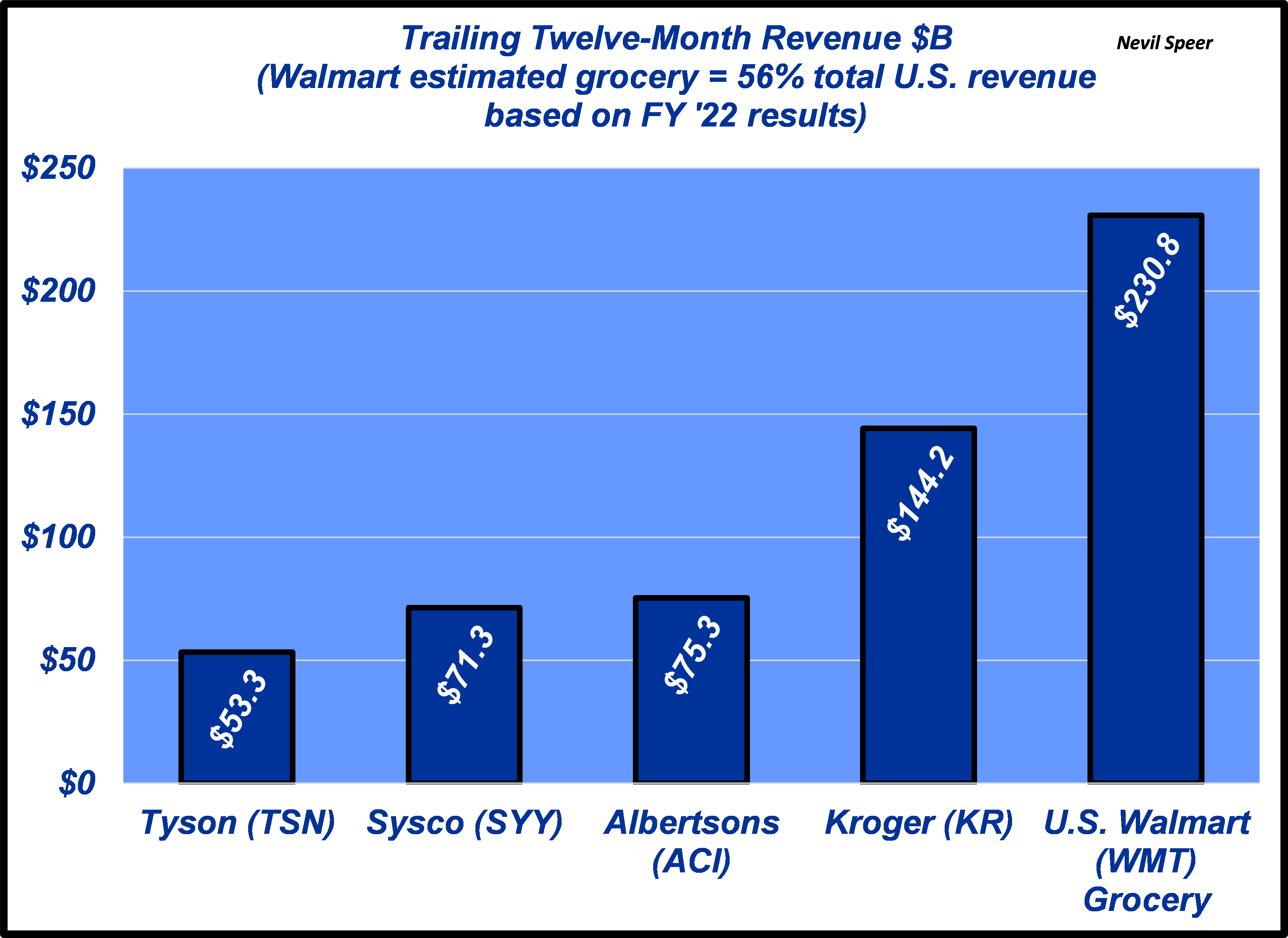

Revenue comparison: with specific reference to the email, the graph below compares trailing twelve-month (TTM) revenue values between packer-benchmark Tyson versus Sysco, Albertsons, Kroger, and Walmart (U.S. grocery sales). Given the comparative size of the companies on the buy side versus the packer, they’re anything but price takers. With that, let’s turn our attention to a couple of key points in recent earnings reports.

Walmart: the company had an incredible quarter (announced 15-Nov). U.S. comp sales were up 8.2% versus the previous year – and much of that due to strength in grocery. Most important, the company is gaining market share with higher-income households – because of their respective commitment to grocery. Walmart CFO, John Rainey, highlighting the company, “…continued to gain grocery market share from households across income demographics, with nearly three-quarters of the share gain coming from those exceeding $100,000 in annual income.”

Tyson: on the other side of the business, the company’s FY ‘22 beef segment operating income was down nearly 25% versus FY ’21 (announced 14-Nov). Tyson’s press release noted operating income, “…decreased as margins compressed from historically high levels, paired with continued increased operating costs as a result of the inflationary market environment.”

That’s an enduring issue going forward. For example, Adam Samuelson (Goldman Sach’s analyst) asked the following tough question on the earnings call:

…thinking about the outlook for fiscal 2023 in beef, and you're kind of staying at or below the low end of the normalized range. Clearly, there's been some herd liquidation that's been happening in the U.S. industry. Cattle prices have risen. I guess I'm trying to understand if we're already at or below the low end of that normalized range, the cattle herd…is going to keep shrinking. Can you help us think about how we would ever get back to that normalized range in the next few years with the smaller herd?

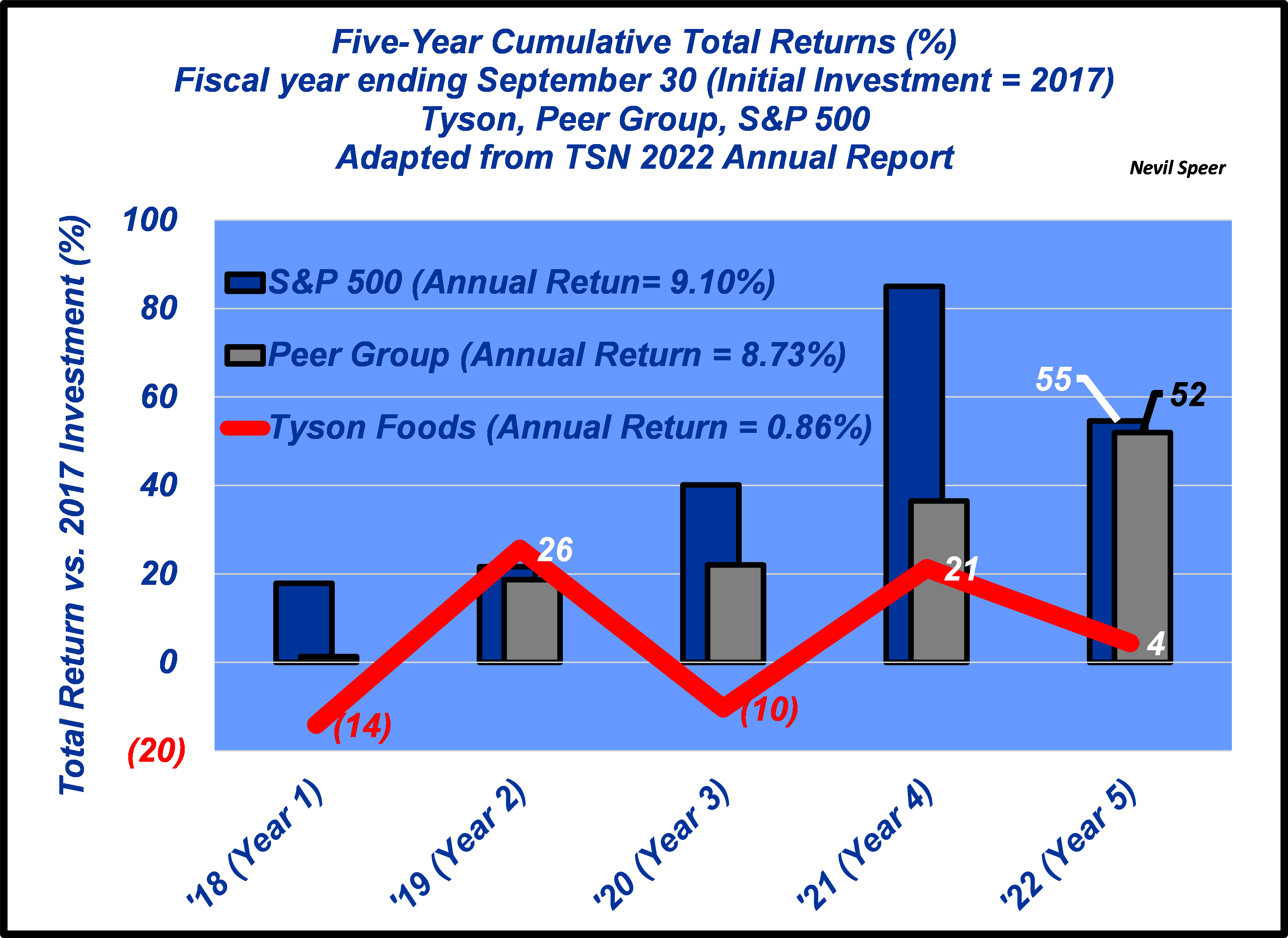

Meanwhile, the company outlines total cumulative return on investment in their annual report. Tyson also provides comparative returns in both the broader market (S&P 500) and its peer group (which includes companies 14 companies involved in the food business). During the past five years, investment in Tyson has woefully lagged both its peer group and the broader market. (see graph) Clearly, the portrayal offered in the Kansas City Star doesn’t match the what’s occurring in the capital markets.

Not just the packers: the pervasive “enormous meatpackers” narrative – and all the subsequent connotations – ignores the realities of the broader business. The beef industry is big, complex and represents the culmination of multiple dynamics at work every single day – “…not just the packers.”