Speer: Altruistic Seller?

There’s a faction in the business that spends a lot of time and energy focusing on the packer. There’s even some who seemingly don’t care about winning, they just want the packer to lose. Much of that sentiment is self-defeating. The better approach is directed towards growing beef demand – that’s where opportunity happens. With that thought, let’s delve into making some sense of the business.

Competitive strategy: First, some general background. Michael Porter in his landmark book, Competitive Strategy, highlights key considerations regarding potential / threat of new entrants venturing into an industry:

1) overall profitability potential of the industry,

2) economies of scale required to succeed,

3) closely related to #2, amount of capital investment required,

4) importance of learning / experience curve to success, and

4) level of over-arching government regulation.

Prospects for new entrants are generally low IF profitability requires economies of scale, large capital investment, and/or high levels of government regulation. Moreover, the experience curve further hinders new entrants if it’s important to success. That meat processing business checks all the boxes.

Profitability: Pertinent to this discussion, it’s also important to review overall profitability of beef processing. As outlined in a prior column, Tyson’s total return performance during the past five years lagged both its peers and the broader market.

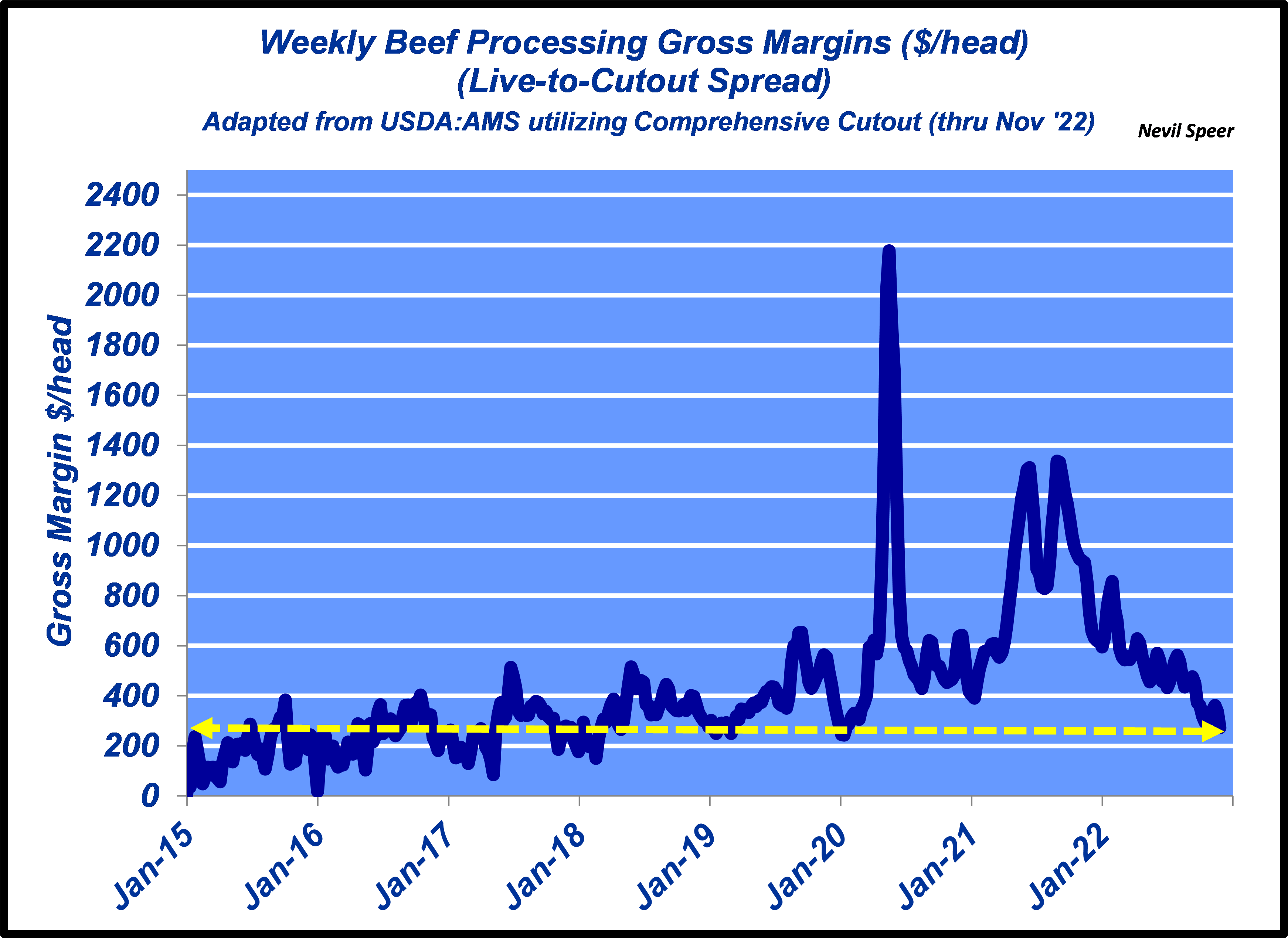

Meanwhile, despite all the hullabaloo during the past several years, weekly gross profit has systematically plunged since the Covid peak. (see first graph)

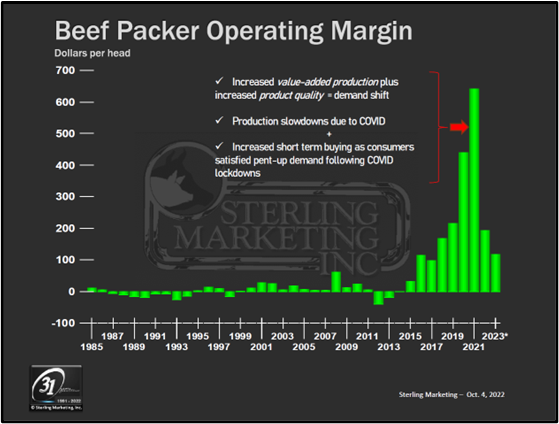

The measure ended November sub-$300; many analysts would suggest current breakeven being around $300-to-$350 /head. Moreover, John Nalivka’s analysis indicates even further erosion in ’23. (see second illustration)

“Reduced margin”: With all that in mind, a previous column highlighted an email from a reader with the following observation: “…one thing that I don’t see in your articles…addressing what seems to me to be the lack of competition in the processing side of the industry.” I subsequently asked, “Would you rather have two companies that are profitable, or ten companies that aren’t profitable, buying your cattle?”

Ultimately, that question circles back to Porter’s framework and the general picture of profitability outlined above. The reader responded with the following observation: “It seems logical that one extra plant [or company] would create competition, and erode margin, but I wonder why would it default to be unprofitable? I would welcome one more packer buying cattle, even if it meant all of them have reduced yet positive margin.” (emphasis mine)

More questions than answers: Welcoming one more packer with reduced margin makes sense if you don’t have any skin in the game – after all, it’s not your capital at risk. Therein enters several key questions:

- “Reduced” margin – given what’s outlined above, how much lower should it go? That is, what profit / margin threshold should be deemed acceptable?

- Does that match what’s required – over the long run – to attract new entrants?

- Do you have an investment strategy to attract new entrants into the business (while also maintaining sufficient margin)?

- You’re focusing only on the buy side of the business; any consideration for the sell side? (see: Not Just The Packers)

- Would it be preferable for packers to operate as utilities – whereby both the purchase price of cattle and the selling price of beef was determined by some sort of oversight board? (Yikes!)

Altruistic seller: In the end, the “reduced yet positive” margin concept introduces the most important question of all. Are you willing to sell your cattle to the lowest bidder / weakest company to ensure they remain “competitive”? Likely not, because when it comes to doing business, we all act in our own self-interest. That’s how markets work; no one is ever an altruistic seller.