Speer: Not Even Close

Intro: This year’s market has blown past all expectations. As discussed in last week’s column, that’s the direct result of building a solid foundation: product quality, consistency, and effective promotion.

Let’s weave that precept in with several prior columns. And we’ll add some additional data to further emphasize the importance of a consumer focus.

OFF Boondoggle: First, a previous column discussed a hollowing talk point from OFF Act supporters. It’s meant to undermine the industry’s accomplishments and subsequently disparage the Checkoff:

…beef was consumed at an average of 84.4 pounds per person per year in 1970, and in 2023, that number is expected to be 56.7 pounds …chicken consumption is up from 40.1 pounds in 1970 to an estimated 101.9 pounds projected for 2023 — all without the help of USDA commodity checkoff programs…

The talking point is misleading. Consumption data, in the absence of price data, provides zero information about the competitiveness of the industry.

Dr. Wayne Purcell’s label for such confusion? “The Per Capita Consumption Boondoggle, or What Demand Is Not”. He notes that, “…per-capita consumption is seen as synonymous with demand. Nothing could be further from the truth. Making this mistake can lead you down all the wrong roads.” (see A Primer on Beef Demand)

Similarly, Dr. Glynn Tonsor, Kansas State University, explains: “…demand is NOT [emphasis mine] per capita consumption. Per capita consumption (PCC) is simply availability (net volume of domestic production, cold storage adjustments, and international trade) divided by resident population. This measure, independent of prices, provides no meaningful information about demand.

(See here for full delineation on availability.)

Correlatable: Following my column, RCALF subsequently doubled-down

on the consumption talking point: “…despite Speer’s baffling argument, there is, after all, a correlatable relationship between consumption data and demand data.”

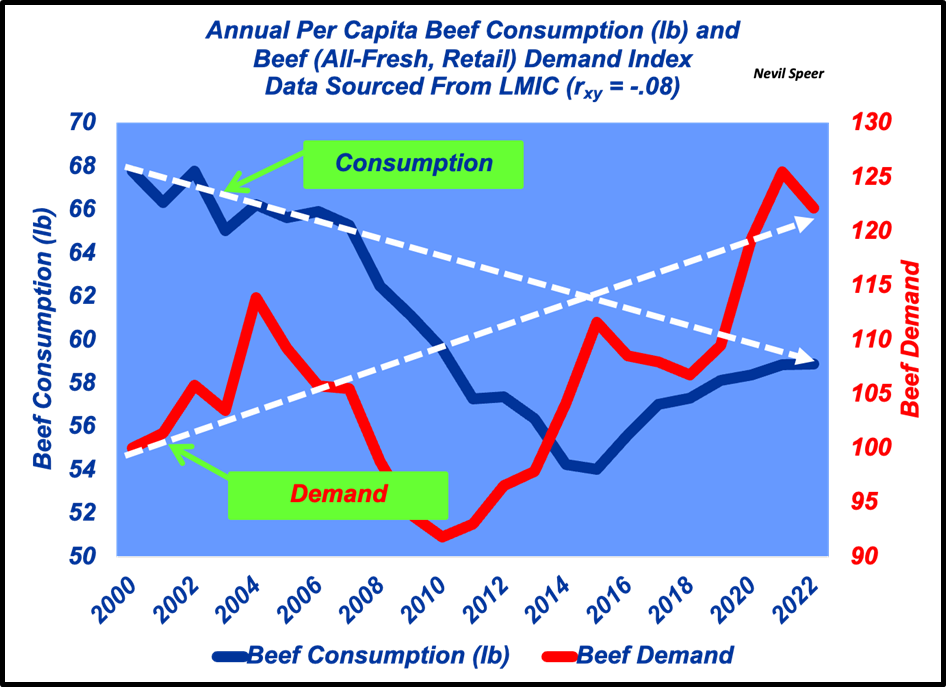

I’m not sure that means what they think it means. The first graph delineates the difference between consumption and demand (presented on a “historical time continuum” to guard against any claim data is presented in an “overly complicated and purposefully fragmented and confusing way”). During the past two decades domestic demand has improved while domestic consumption has declined. The correlation equals negative .08. (Not to be confused with causation.)

RCALF’s column also highlights work completed by Dr. Harry Kaiser, Cornell University. It mentions “consumption” and CBB activities. But the column sidestepped Kaiser’s overarching conclusion regarding the Checkoff’s effectiveness:

…CBB had a positive and significant impact on beef demand compared to what it would have been in its absence…total domestic beef demand would have been 14.3[NS3] % lower... U.S. beef export demand would have been 5.5% lower…

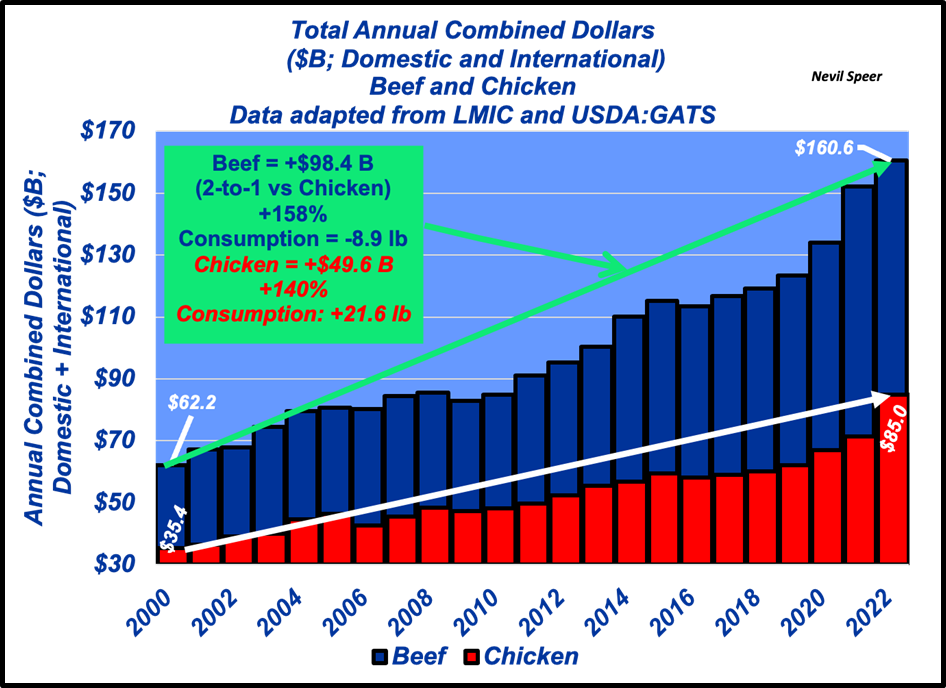

Beef vs Poultry $: With that in mind, let’s now approach the beef vs chicken comparison. But we’ll do so from a dollar perspective; that’s what really matters. Domestic beef consumption (i.e. availability / disappearance) has waned, but that doesn’t mean the industry is shrinking. To the contrary, new industry dollars have exceeded 4.5% annual growth since 2000. Moreover, since that time, beef industry growth has outpaced chicken by a factor of 2-to-1. (see second graph)

One Or The Other – Not Both: On a separate note, RCALF has seemingly embraced twisted logic. On one hand, we’re supposed to believe the anti-Checkoff talking point: chicken’s consumption trend means the poultry industry has a better mousetrap. On the other hand, Congress is being told the chicken industry’s model is broken, having reached the “point of no return”. You can’t have it both ways.

Not Even Close: To sum this up - the consumption measure doesn’t really matter. As noted above, dollars are the difference maker. And new dollars are ultimately the direct outcome of demand accretion (domestically and globally) over time.

So, back to the top; those dollars are underpinning this year’s market. All this underscores the importance of maintaining a consumer focus, and the ongoing work of the Beef Checkoff (game changer). That’s where opportunity happens.

Chicken winning against beef? Not even close.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.