Speer: Beef Checkoff Changed the Game

The Rub: Checkoff opponents contend the program is failing. The Checkoff was established in 1985 – with subsequent producer referendum occurring in 1988. The critics have long pointed to consumption as being the litmus test; over the past thirty years, per capita beef consumption has fallen by a third, from ~81 lb (1985) to ~55 lb (2015).

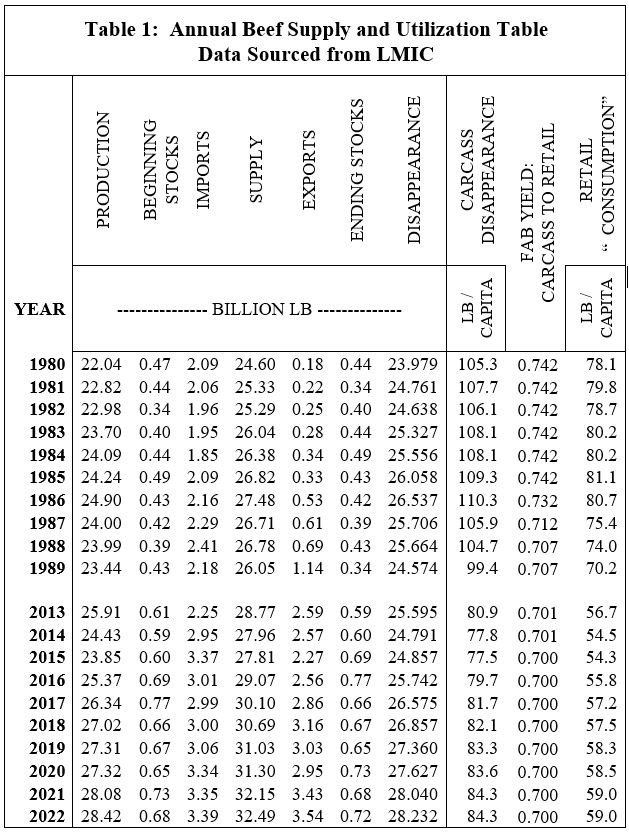

Consumption: So let’s dive into that contention with some added granularity and precision compared to a previous column. To begin, retail consumption isn’t any sort of direct measure (because there’s no real way to do so). Rather, it’s a derived value – and more appropriately termed “per capita domestic disappearance.” Below is a step-by-step outline to derive retail consumption (detailed in Table 1):

1. Supply = Total Production + Beginning Stocks + Imports

2. Disappearance = Supply – Exports - Ending Stocks

3. Per Capita Carcass Consumption = Disappearance / Domestic Population

4. Per Capita Retail Consumption = Carcass Consumption * Conversion Yield

Data: Table 1 outlines annual data for consumption derivation across two time periods:

- 1980-1989 – reflecting business conditions leading up to, and including, full implementation of the Checkoff.

- 2013-2022.

Because consumption is a statistical artifact, it’s important to mention the measure will inherently be biased downwards over time in the event of: 1) increased exports, 2) the rate of population growth outpacing production and/or import growth, and 3) adoption of closely-trimmed retail fab practices. All of which have occurred during the past 30 years.

Review: Several items from Table 1 are important to highlight:

1. Before industry-wide adoption of closely-trimmed (1/4”) retail cuts, the industry sold excess waste fat. Consequently, carcass-to-retail yield was generally penciled at 74%; USDA’s official yield is now 70%. IF yield had remained at 74%, the 2022 reported consumption calculation would equal 62 lb – not 59 lb; the reported difference being roughly an added +3.5 lb per capita.

2. Exports in ’22 also established a new record (3.5+ B lb) – nearly eight times bigger compared to the ’80-’89 average. The difference equivalent to an additional +6.5 lb per capita not included in the domestic disappearance calculation.

Combined, that’s an additional +10 lb (just due to math) and would put 2022 consumption right in line with 1989 – the year following the referendum.

3. Let’s not forget it’s a per capita measure; U.S. resident population has grown by over 100 M people since 1980 (+46%). Never mind items #1 and #2, consumption (disappearance) equals 59 lb times an additional 100+ M people.

4. To that end, total disappearance in 2022 established an all-time new record (28.23 B lb) – 12% bigger than the ’80-’89 average.

5. Then let’s throw in exports. Exports plus disappearance totaled 31.8 B lb in 2022 – also a new record – and 23+% bigger than the average of the 80s.

6. There’s also the pesky issue of trade. Imports outpaced exports during the 80s by 16.5 B lb, the difference during the last ten years is only 1.75B lb. That is, the trade imbalance has been reduced by 90% over time.

That said, if you avoid the trap of cursory review and talking points, those all indicate a favorable trend over time.

What Really Matters: However, that’s all supply oriented. Dr. Wayne Purcell (A Primer on Beef Demand, 1998) explains why focus on supply (i.e. consumption) doesn’t really get us to anything meaningful:

Is it not starting to be clear that just talking about some measure of quantity, like per-capita consumption, is not enough? Selling lots of product this year or any year at low and unprofitable prices certainly does not meet intuitive notions of what "strong demand" should be all about.

Thus, the more important question becomes, “Has the Beef Checkoff made the industry more resilient over the past 30+ years?” Because what really matters is dollars.

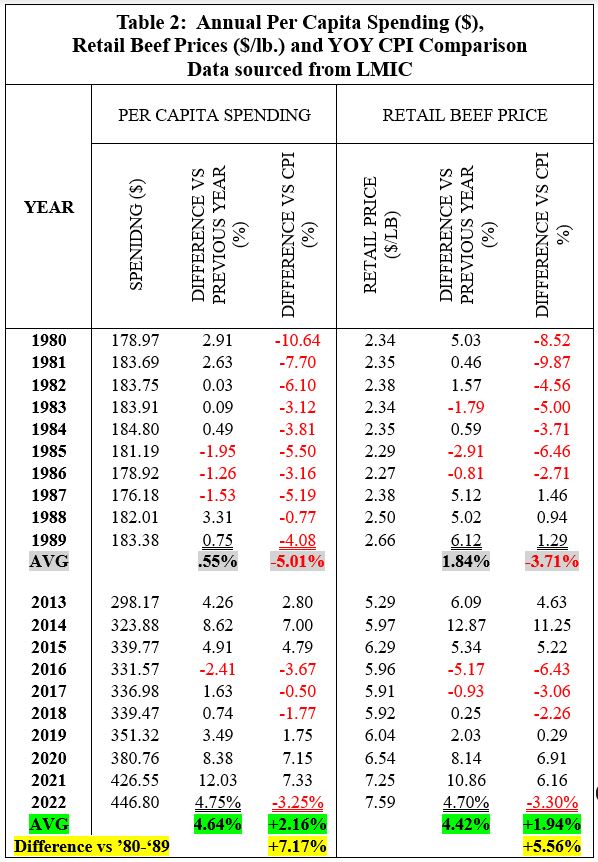

To answer that question, Tables 2 and 3 detail price and spending data across the same time periods. Most notably, demand was waning so sharply during the 80s, both retail prices and per capita spending trailed inflation by a large margin (Table 2). The industry didn’t have any pricing power. The only way to clear product was to lower the price.

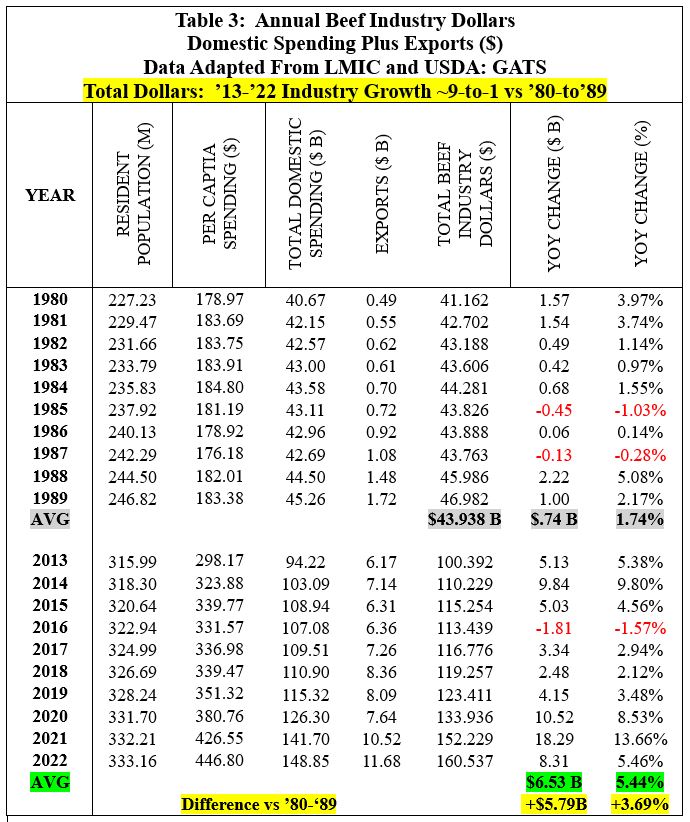

It's a different story today versus then. Most importantly, total industry dollar growth during the past decade surpasses’80-to-’89 by nearly a factor of 9-to-1!! (Table 3) That’s the direct result of improved demand over time.

Game Changer: The Checkoff was instrumental in jumpstarting beef’s decommoditization in the marketplace; creating new consumer value and industry pricing power over time.

Now, ask yourself this question, “What if the Checkoff hadn’t been implemented?” Sure, producers would have saved $1/head. However, the beef industry would still be looking for traction and working to clear product at ever-lower prices – fighting an unwinnable commodity game against pork and poultry. But fortunately, Beef Checkoff changed the game.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.