Speer: Where’s Your Thermostat?

Different Complaint: The preceding column featured criticism about CME’s June Live Cattle contract. One analyst believed basis was out of whack with blame largely directed towards speculators. Fast forward about 30 days. Same commentator, more grumbling, different offender:

[June live cattle are trading at] $177.57 which doesn’t sound very good when they were trading cattle on Thursday from $185 to $188 and we’re getting so close to the end of the June live cattle contract and they don’t converge anymore and very frustrating for a lot of people that are watching. Your hedged cattle feeders they love it because they always get a basis and they’re getting where they count that and they figure that into their breakeven. They’re gonna have to change that contract to get it to where they converge together….

Let’s focus on 1) convergence, and 2) cattle feeders.

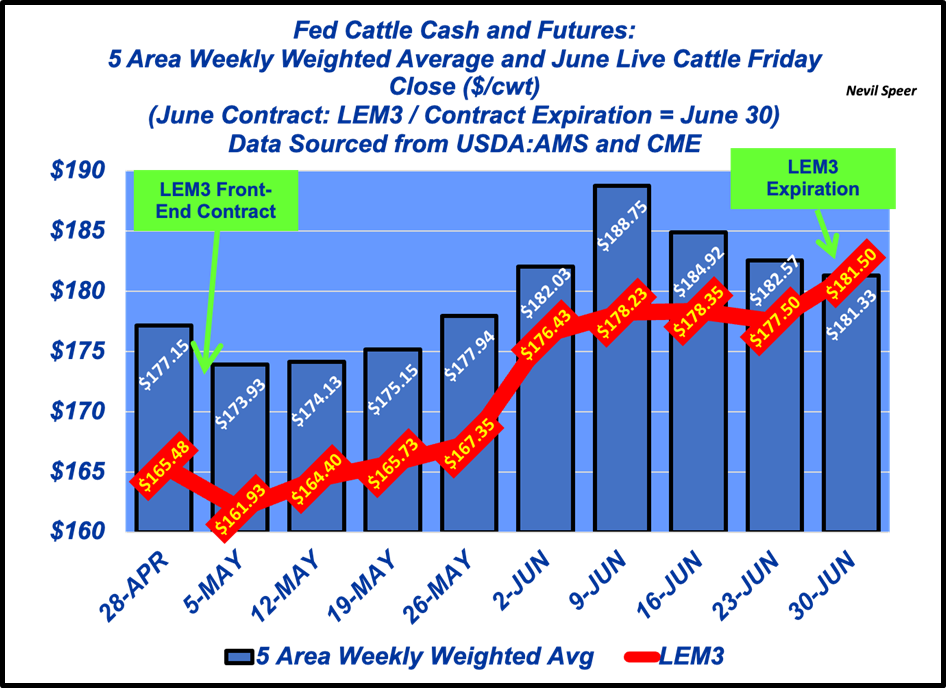

Convergence: The June Live Cattle contract settled on June 30 at $181.50. That’s just 17 cents (emphasis) over the week’s cash market. That reality refutes any claim to “[cash and futures] don’t converge anymore” and “they’re gonna have to change that contract.”

Sure, they may not trade in lockstep a month from expiration but that’s not indicative of need for alarm. It calls to mind Virgil’s great observation: “Fortunate is he who understands the cause of things.”

Basis Jumpers: Did you catch the subtle dig at “hedged cattle feeders”. (Remember just a month prior it was the speculators’ fault.). They’re often portrayed as “basis jumpers” with the underhanded implication they don’t pull their weight. The critics complain the hedgers will stall the rally because they’re disinterested in the cash market (despite evidence to the contrary: see 55 – 0).

But isn’t that the very purpose of the hedge in the first place? Disciplined hedgers protect themselves against noise and volatility –the very essence of why futures markets exist.

It’s perplexing why anyone would bash cattle feeders for wanting such a backstop and minimizing their respective value at risk. That’s like criticizing fighter pilots for implementing the tailhook when making a carrier landing.

Currentness: Punching the “basis jumpers” also overlooks the importance of currentness to the market. Several years ago, Randy Blach (CEO, Cattle Fax) discussed that topic with Ron Hays (Radio Oklahoma Network); he explained the influence of increased risk management:

It’s been a major, major change…People are willing to take singles and doubles instead of swinging for the fences….” It’s also important to reinforce the importance of risk management to the overall market. As alluded to previously, hedging helps make disciplined marketers. And that’s largely buffered against uncurrentness in the face of record-large feedyard inventories.

(see Business First, Market Second).

Breakevens: Did you also note the quip, “they figure that [basis] into their breakeven.” It insinuates disciplined hedgers not only undermine the cash market, but they also make it more competitive to buy feeder cattle. In other words, “hedged cattle feeders” are working both sides of the ledger.

The result being an enduring divisiveness. The commentary pits cattle feeders against one another: hedged feedyards versus cash-to-cash operators.

They: Therein enters the overarching preoccupation with “they”. Generally, that equates to the packer. Now “they” also includes the speculator (per the prior column) and/or the CME and/or the hedged cattle feeder. Per the discussion above, it’s all unsubstantiated rhetoric (for rhetoric’s sake).

Successful people never waste time or energy on “they”. Any such claim is disempowering; it’s the equivalent of putting your thermostat in someone else’s house.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.