Game Changer for Soybeans? USDA Ignites Fireworks in the Markets With Two Major Acreage Surprises

USDA released a few big surprises in the June acreage report, including a spike in corn acres and a large reduction in soybean acres. The agency also forecasts grain stocks below trade expectations. The markets had a lot of news to digest on Friday between the report news and the rain and derecho damage across the Corn Belt, but analysts called Friday's reports a "game changer" for soybeans.

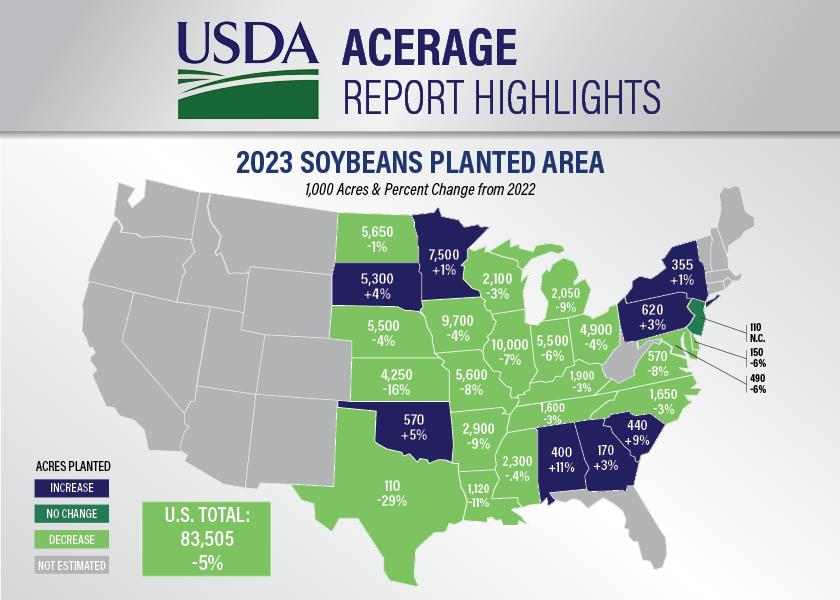

According to USDA, farmers made a big cut to their intended soybean acreage. USDA Jun acreage report shows farmers planted 83.5 million acres of soybeans, a large reduction from the the 87.51-million-acre intention in March. This year’s planted acreage for soybeans is 5% below last year.

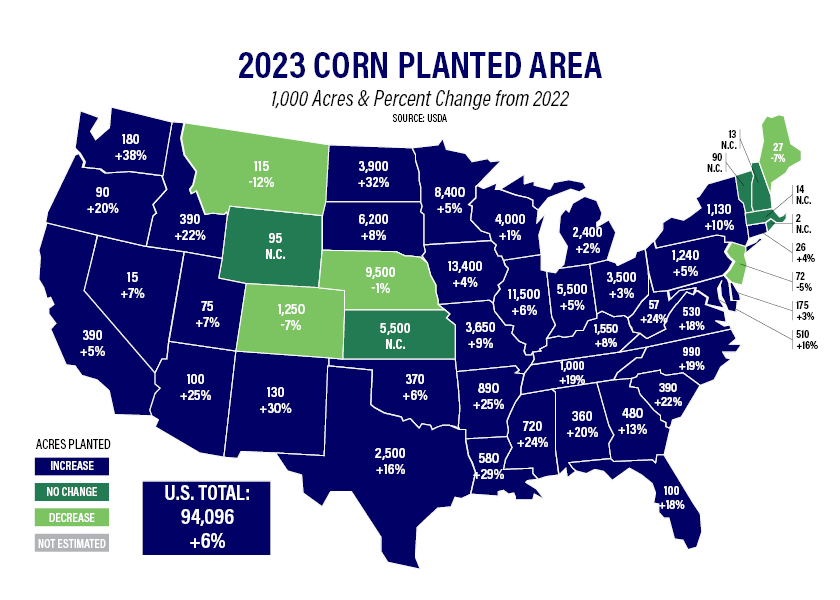

The other big surprise came in corn. USDA says farmers planted 94.1 million acres of corn this year, which is up from the 91.9 million acres reported in the 2023 Prospective Plantings report in March. The 94.1 million acres planted is also 6% higher than what farmers planted in 2022.

Other acreage highlights include:

- Cotton Acres: 11.1 million, down from 11.3 million reported in USDA’s March planting intentions survey, a 19% reduction from 2022

- Wheat Acres: 49.6 million acres, slightly lower than the 49.9 million acres in March, a 9% increase from last year

A Major Market Game Changer

The biggest surprise was in soybeans, with analysts saying this could change the course for soybean prices.

"It's an absolute game changer in regard to the soybean balance sheets," says Joe Vaclavik of Standard Grain. "What it means it gives you very, very little room for error in regard to yield and production given this lower acreage number. And on the flip side, we saw a higher corn acreage number that went up to 94.1 from 92, even in March. So it was it was a big divergence in the markets sell off in corn on a higher acreage number and a sharp rally in soybeans on a drastically lower acreage number."

Mark Gold of StoneX Group says this year proves when April weather is dry, farmers will plant more corn.

"It's just the corn acres going up as much as they did wasn't that big of a surprise. It's the beans coming down," says Gold. "That was the bigger surprise. And now you're left with very tight carry outs on the beans. And this is assuming the government's right on yield at 181.5 bu. per acre on corn and 52 [bu. per acre] on beans. And I don't believe we're near there, even with the rains that we've seen."

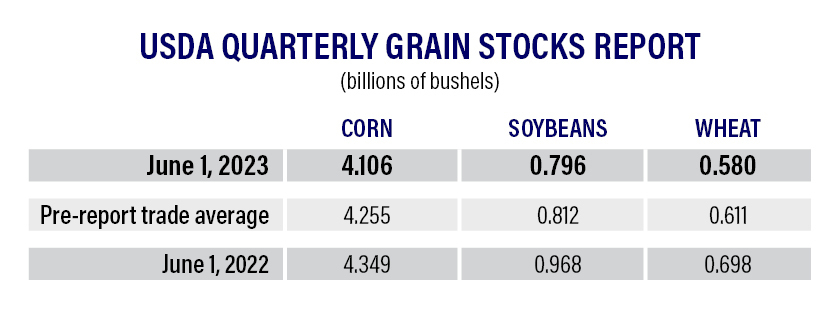

Tighter Stocks Theme Continues in June Report

USDA's March Grain Stocks report showed tighter stocks, which stole headlines. That theme continued Friday, with USDA's estimates coming in lower than what the trade expected.

As of June 1, 2023, USDA shows the following adjustments in grain stocks:

- Corn: 4.106 billion bushels, which is lower than the 4.35 billion at this time last year.

- According to USDA, soybean stocks sit at 796 million bushels, also lower than the 968 million in June 2022.

- Wheat stocks are projected at 580 million bushels, lower than the 698 million a year ago.

Vaclavik says he doesn't view the grain stocks report alone as bullish or bearish, but when you step back and look at the larger picture, demand is still an issue, but the supply story is changing after Friday's reports.

"New crop demand for U.S. corn and U.S. soybeans is not good," Vaclavik says. "The book of export sales is terrible. Ethanol production has not been where it needs to be. The one bright spot would be soybean crush, and we're going to continue to set records there because of the crush expansion. But I think that as prices rise, especially in soybeans, you've probably got to look at the demand side and you could this you could say for the corn balance sheet to USDA is in all likelihood overstating new crop demand for both of those crops on the balance sheets given what we know today."

The Yield Debate Heats Up

USDA's reports definitely caused some fireworks, but says traders will digest those reports in a couple days. Then, the focus is back on weather.

"I'll tell you this, the yield number and the acreage numbers are going to be digest not not the yield number. But the acreage numbers that we saw today, they will be digested by the trade very quickly. It'll take maybe another day or two. And we're going to be on again trading weather and yield prospects," says Vaclavik.

The other possible crop impact is the derecho that blasted across the Midwest on Thursday. While the system brought crop-saving rain, it also packed a punch of winds topping 100 mph. According to agronomist Ken Ferrie who lives in Heyworth, Illinois, he thinks the earlier planted corn will be impacted the most.

“April-planted corn is pushing tassels and trying to pollinate, so unfortunately, it'll get hit the hardest because it's hard for tasseled corn to stand back up; it'll just curve at the top,” Ferrie told AgWeb's Rhonda Brooks. “And that down that's corn creates pollination problems. So, from a yield problem that'll be the tough spot, and that'll be the tougher stuff to harvest because it just won't stand back up.”

Yesterday, @NOAA's #GOESEast 🛰️ tracked a destructive #derecho as it raced across the Midwest, causing widespread damage across several states. This visible imagery shows the bubbling clouds, and the satellite's Geostationary Lightning Mapper allowed us to see the frequent… pic.twitter.com/SvYbnuf5em — NOAA Satellites (@NOAASatellites) June 30, 2023

Ferrie points out farmers could have done without the wind, but the rains could be extremely beneficial for much of the Illinois crop. That's as crop conditions last week dropped to the lowest since 1988. Gold says now it's a debate of just how beneficial those rains were this week.

"Before we had these rains this week, we were looking at a corn yield of maybe maybe 174 bu. per acre or 175, somewhere in that range. I think he got to bump it up a little bit, because a lot of areas did get some rains without the damage. But we don't know the derecho damage, we'll have to see what the crop progresses on Monday, but I'm not sure it's going to show all the damage by any stretch of the imagination. And the bottom line is, the corn yield, in my opinion can't get anywhere near 181.5 [bu. per acre]. We've had rains, we're gonna get more rains here this weekend. What is it a little bit too much too late. We'll have to see. The crops are resilient. We know that.

Peter Meyer of S&P Global Commodity Insights says the rains this week will help, but he thinks damage has been done to the crops. He doesn't think it's as bad as 2012, but he sees some similarities to 1992.

"In 1992, conditions were lower than 2023 levels early in the season, but rebounded with early-July rains, resulting in a corn yield that was 8% above trend at the time while soybean yields outperformed trend by 10%," says Meyer. "While the 2023 weather pattern has changed with the transition to an El Nino, U.S. corn and soybean acres are/were dry enough to require constant moisture at this point. 1992 was also an El Nino year but that El Nino started in the summer of 1991 and was already entrenched for 12 months. 1992 also saw on the wettest July’s on record, a tall task at this point."

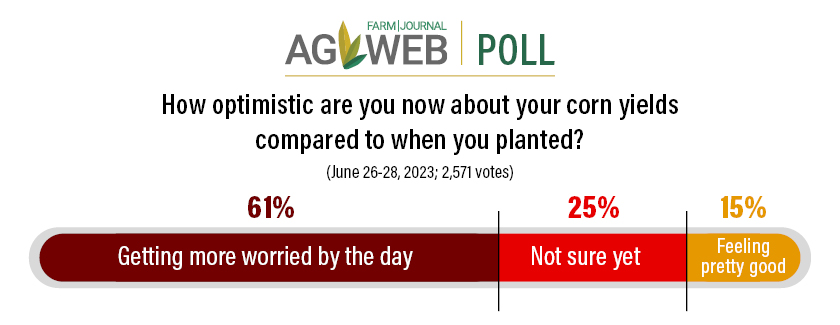

Before this week's rains, an AgWeb poll showed growers were extremely concerned about yields. The poll found 61% of respondents are getting more worried by the day when it comes to corn yields. 25% aren't sure. 15% say they are feeling good about current yield potential.

There is more rain in the forecast for Illinois, as Ferrie points out, with the possible crop prospects improving now that they had the initial rain, even if it did come with high winds.

“That inch of water, many farmers would probably take the wind in the corn to get the water, because it looked like we weren’t going to get any of it, and suddenly our forecast has rain for the next five out of six days,” says Ferrie. “So, it kind of broke that bubble that was holding us in the drought.”

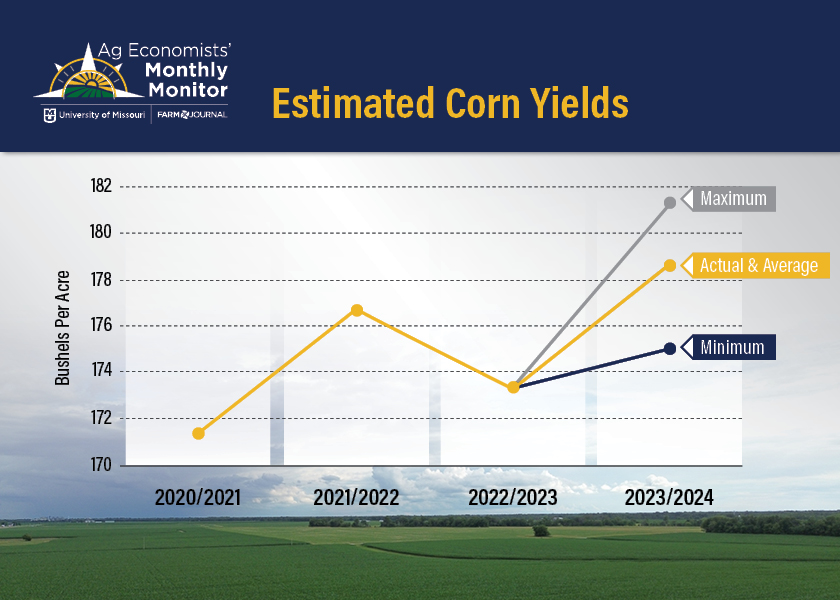

Wide Range of Yield Estimates in Ag Economists' Monthly Monitor

Ahead of USDA’s updated look at planted acres in the June acreage report, a new survey of ag economists shows a wide range of yield estimates. The June Ag Economists’ Monthly Monitor, conducted by University of Missouri and Farm Journal, shows the average estimate by economists is below USDA's current projection for all crops, except cotton.

The survey showed:

- Corn: 178.68 bu. per acre versus 181.5 bu. per acre (USDA’s current estimate)

- Soybeans: 51.06 bu. per acre versus 52 bu. per acre

- Wheat: 44.47 bu. per acre versus 44.9 bu. per acre

- Sorghum: 68.17 bu. per acre versus 69.2 bu. per acre

- Cotton: 855.18 pounds versus 841 pounds

Scott Brown, an agricultural economist with the University of Missouri, points out the yield variation largely depends on upcoming weather, but the dry weather in June is creating a wide range of yield estimates this year.

“I think when you look at both corn and soybean acres, there wasn't a lot of deviation from the Prospective Plantings report USDA came out with a few months ago, so we didn't see a big change there,” Brown says. “On the yield side, there are certainly some differences. The average yield estimate, on the corn side from the survey was a little more than 178 bu. per acre, with a downside of 175 bu. Likewise on soybeans, that came in at about 51 bu. per acre. Both corn and soybeans are below where USDA currently sees yields. I will say those are going to change quickly as we look at weather and what's occurred since the survey would have gone out roughly a week ago now.”

Economists also expect crop prices to decline this year and next; however, there is a wide range in estimates signaling volatility will continue.

The average corn price is estimated to hit $4.99 per bushel for the current crop year and $4.74 for 2024/2025. The high range of the estimate for this year is $6 per bushel, with a low of $4.25 per bushel. Soybeans are also expected to trend lower, with an average estimate of $12.52 per bushel this year. The high came in at $14 per bushel. The low estimate was $10.85 per bushel. The average estimate for 2024/2025 is $11.90 per bushel.

Wheat prices are estimated to average $7.63 per bushel this year, with a low of $7 and a high of $8.49. The average estimate for wheat prices in 2024/2025 is $7.10 per bushel, with a high of $8 and a low of $6.49.

Related Stories:

USDA Reports Hold Bullish Surprise for Beans, But Bearish for Corn

Derecho Packs Punch Of 100 MPH Winds, Flattens Cornfields and Crushes Grain Bins Across the Midwest

High Production Costs Could Weigh on the Ag Economy Through 2024, New Survey of Economists Finds