CAB Insider: Short Supplies, Higher Beef Prices

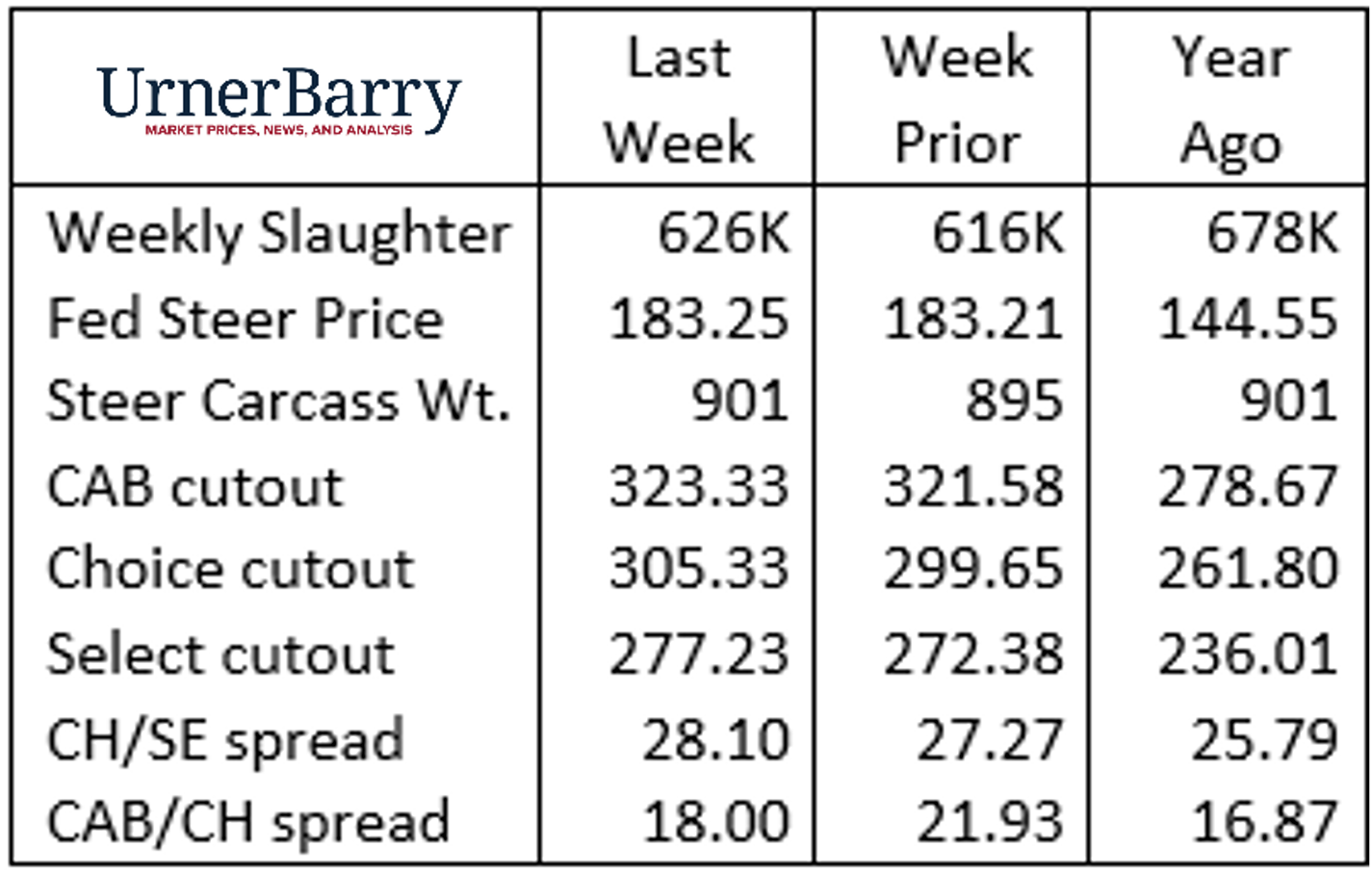

The fed cattle market has stagnated since mid-July, encumbered primarily by exceptionally small slaughter head counts. Last week’s $183/cwt. fed steer price was the smallest since mid-July.

In the meantime packing sector margins are solidly in the black again after dipping below breakeven levels from late July through most of August. Three weeks ago fed cattle slaughter reached the smallest non-holiday weekly total (471K head) since January. The two following weeks brought on increases of 13,000 head and 10,000 head, respectively.

With slaughter productivity depressed, carcass cutout values responded as expected. The comprehensive boxed beef cutout value increased from the early August low of $297.17/cwt. to last week’s $310.79/cwt., a 4.6% move. The CAB cutout touched a seasonal low the first week of August at $312.49/cwt. before rallying 3.5% through last week to average $323.33/cwt.

With slaughter productivity depressed, carcass cutout values responded as expected. The comprehensive boxed beef cutout value increased from the early August low of $297.17/cwt. to last week’s $310.79/cwt., a 4.6% move. The CAB cutout touched a seasonal low the first week of August at $312.49/cwt. before rallying 3.5% through last week to average $323.33/cwt.

Besides the inflationary impact of restricted steer and heifer slaughter, the uptick in prices is within seasonal expectations as well. Just ahead of Labor Day the market typically experiences price increases as spot market fill-in orders from end users pulls prices up from early August lows.

The upward price action was seen on many chuck and round items last week even though many of them are typically not in high demand by consumers for Labor Day. However, ribeyes and tenderloins are simultaneously posting higher price points in the latest report, with prices just below the 2021 record-high prices for this time of year.

Several thin meats have recently seen price cuts from historically high price points, such as flank and skirt meats. Short loins, strip loins and top butts all priced lower last week within the seasonally anticipated trend for each of these items.

Short Supplies, Higher Beef Prices

In the waning days ahead of Labor Day spot market beef prices are posting positive numbers, boosting a bit of optimism into the total beef complex. Historically, the uptrend will subside following the holiday, and wholesale prices will seek an early fall low mid-October. In the last 5 years, the CAB cutout price dropped 7% from the last week in August to the third week in October.

The five-year average also shows the fourth quarter trend brings on a nearly 5% price recovery from the October low through early December. Interestingly, the August CAB cutout value has consequently been higher than the fourth quarter high in this period. This is a result of the increasing trend toward forward sales of middle meats in the August timeframe for fourth quarter demand discussed in the previous Insider.

While we could expect cutout prices to follow the outlined historic pattern, fed cattle supplies are set to be tighter for the period. As well, weekly spot market beef sales in the fourth quarter will center on holiday middle-meat roast demand due to highlight items capturing high prices.

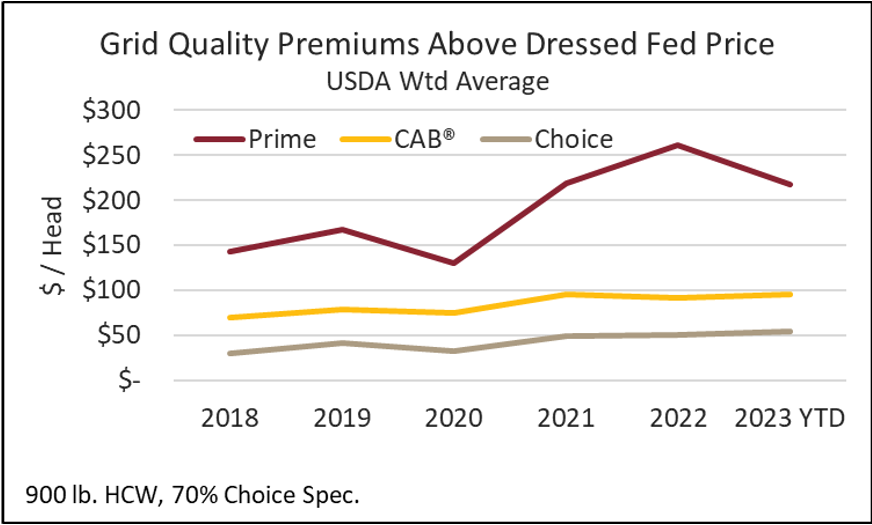

This discussion factors back to grid pricing for fed cattle and expected quality price spreads. CattleFax recently points out that the Prime cutout premium over Choice, roughly $35/cwt., is nearly half what it was a year ago. This is a sign of buyer price sensitivity and pushback for the highest priced, highest quality beef (disregarding niche products). However, the weighted average grid premium across packers for Prime carcasses this week is $18.49/cwt., just 25% lower than a year ago.

This narrowing premium gap is typical of a market where short supplies result in higher prices across all quality offerings. The CAB traditional (Premium Choice) cutout premium above Choice is currently record-wide, pulling back from $21.93/cwt. to $18.00/cwt. in the past two weeks. One might estimate that this premium spread could also be subject to further compression in the near term given what we’ve observed with the Prime premium.

This narrowing premium gap is typical of a market where short supplies result in higher prices across all quality offerings. The CAB traditional (Premium Choice) cutout premium above Choice is currently record-wide, pulling back from $21.93/cwt. to $18.00/cwt. in the past two weeks. One might estimate that this premium spread could also be subject to further compression in the near term given what we’ve observed with the Prime premium.

The Choice/Select spread remains historically robust at $26.07/cwt. in today’s USDA report. While lack of demand for Select carcasses is an archaic price measure for carcass values, the Choice/Select spread remains the foundational and most seasonally variable quality grade component on most packer grids. Thus, the feedyard’s realized price for every carcass at, or above, Low Choice quality grade is highly dependent on the Choice/Select spread. With the feedyard’s share of the Choice/Select spread typically ranging near 30% of the total, a spread value larger than $20/cwt., for instance, is a key driver to motivate high quality carcass production. Current market values are providing confidence in this direction.