Market Highlights: Prices on the Rise

Volatile cattle market sees a $5 to $7 increase for fed cattle.

By: Andrew P. Griffith, University of Tennessee

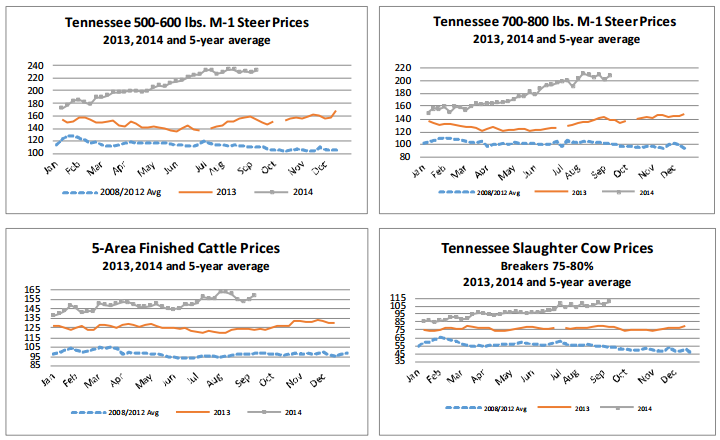

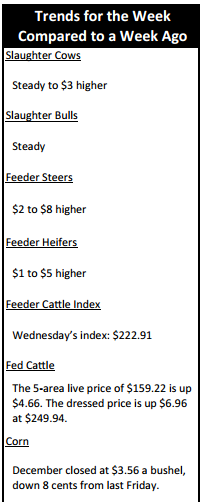

FED CATTLE: Fed cattle traded $5 to $7 higher on a live basis compared to last week. Prices on a live basis ranged from $158 to $163 while dressed trade occurred between $248 and $252. The 5-area weighted average prices thru Thursday were $159.22 live, up $4.66 from last week and $249.94 dressed, up $6.96 from a week ago. A year ago prices were $122.42 live and $194.22 dressed.

Live cattle futures set a torrid pace this week for most contract months. Prices on the October contract increased about $5 over the first three days of trading this week.

The increase in prices is not the surprise. It is the magnitude of the price increase that has folks in the cattle business searching for answers. Going back to August 21st the October contract price has increased $11.50. Similar trends can be seen in deferred contracts as well.

The large increase in futures prices has cash cattle traders in a frenzy trying to negotiate cash cattle trades as market equilibrium is less certain. The volatile market has resulted in many traders suffering severe cases of whiplash which can either be extremely expensive or profitable.

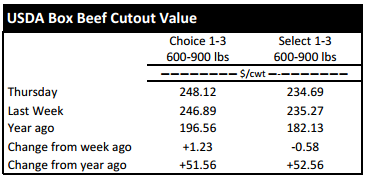

BEEF CUTOUT: At midday Friday, the Choice cutout was $248.56 up $0.44 from Thursday and up $2.57 from last Friday. The Select cutout was $237.30 up $2.61 from Thursday and up $2.52 from last Friday. The Choice Select spread was $11.26 compared to $11.20 a week ago.

Boxed beef prices have finally resurfaced for air after being pressured the past five weeks. The Choice and Select cutouts both experienced modest gains this week, but modest gains go a long way to protecting packer margins that are constantly being pressured by live cattle prices that continue to find a way to surge back toward the $160 mark.

The month of August may or may not be the lull in beef prices that is common during the summer months. However, it will take a lot of market pressure to push Choice beef prices below the $240 mark and keep them there for any sustained period of time. Similarly, it may be even tougher to force Select beef prices lower during a time period of record Choice beef prices.

Choice beef prices have a tendency to have their fire rekindled in the fall as the beef market heads into winter holidays. The holiday spark has potential to push prices back to record levels this fall, but consumers’ reaction to record retail beef prices during the holiday season may be a little less receptive than during the summer.

TENNESSEE AUCTIONS: On Tennessee auctions this week compared to a week ago steers and bulls were $2 to $8 higher. Heifers were $1 to $5 higher. Slaughter cows were steady to $3 higher while bulls were steady. Average receipts per sale were 474 head on 10 sales compared to 542 head on 12 sales last week and 633 head on 9 sales last year.

OUTLOOK: Market volatility remains extremely high throughout the cattle complex. Cash prices for calves and feeder cattle rebounded this week. Steer and bull prices regained most of what they lost the previous week while heifer prices did not make the full recovery witnessed for steer and bull calves.

Market volatility is a result of uncertainty in the marketplace. Cattle markets, as well as other commodity markets, inherently contain uncertainty. Many times, the uncertainty in agricultural markets is driven by weather and climatic conditions as well as some other basic production factors. Volatility in grain markets generally has a seasonal tendency that coincides with the growing season while volatility in livestock market prices has a less defined pattern.

Cattle on feed placements generally increase in the last quarter of the year as producers wean and market calves and as feed grain harvest is in full force. Many feedlot managers are in search of inventory to fill pens and are not sure where the cattle will be sourced if they can find them at all. Many calves were marketed early by cow-calf producers looking to capitalize on strong summer prices, but this has feedlot managers scurrying. Additionally, there is uncertainty with regards to herd expansion.

Some parts of the nation are attempting to rebuild cattle herds to capitalize on future expected earnings while other producers figure they cannot market cattle quick enough. Retaining heifers now can put strain on feedlots needing to fill pens in the near future. However, failing to retain heifers now could place an increased strain on feedlots in future years if cattle inventory continues to decline. These are just a couple of examples of uncertainty fueling cattle price volatility.

Producers with the intent of purchasing or selling cattle within the next couple of years should consider managing price risk to avoid large financial blunders.

TECHNICALLY SPEAKING: Based on Thursday’s closing prices, October live cattle closed at $157.05. Support is at $155.56, then $152.63. Resistance is at $158.48, then $161.41. The RSI is 66.08. December live cattle closed at $158.50. Support is at $156.45, then $152.22. Resistance is at $160.68 then $164.90. The RSI is 66.63. February live cattle closed at $156.70. Support is at $156.05, then $155.90. Resistance is at $158.10, then $158.60. The RSI is 59.29. November feeders closed at $221.00. Support is at $219.85, then $219.55. Resistance is at $221.03 then $222.00. The RSI is 64.59. January feeders closed at $215.23. Support is at $214.25, then $213.00. Resistance is at $215.33 then $215.35. The RSI is 63.86. March feeders closed at $215.38. Support is at $212.75, then $212.43. Resistance is at $215.40, then $215.41. The RSI is 66.17. Friday’s closing prices were as follows: Live/fed cattle – October $159.75 +2.70; December $160.93 +2.43; February $159.20 +2.50; Feeder cattle - October $224.38 +2.38; November $222.93 +1.93; January $216.55 +1.33; March $216.23 +0.85; September corn closed at $3.47 up $0.11 from Thursday.