Market Highlights: Futures Help Cattle Prices

By: Andrew P. Griffith, University of Tennessee

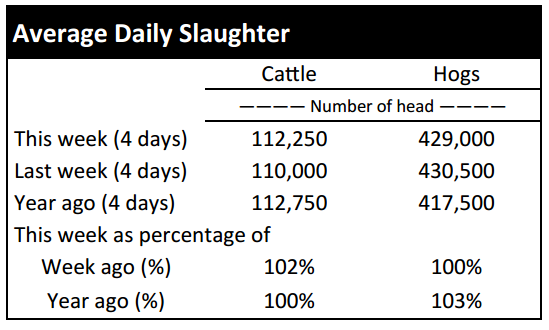

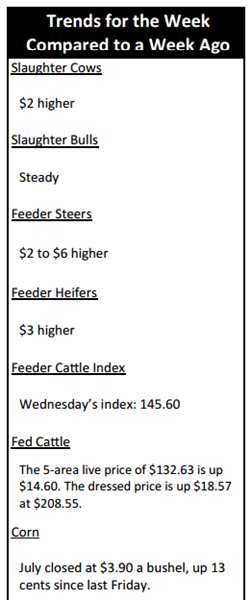

FED CATTLE: Fed cattle traded $7 higher on live basis compared to a week ago. Live prices were mainly $132 to $134 while dressed prices ranged from $205 to $210 with most near $210. The 5-area weighted average prices thru Thursday were $132.63 live, up $14.60 from last week and $208.55 dressed, up $18.57 from a week ago. A year ago prices were $160.82 live and $256.55 dressed.

Market ready cattle prices were spurred by a relatively strong futures market and a strengthening in wholesale beef prices. The positive price movement for finished cattle this week will go a long way in pulling cattle feeders out of the red, but it does not mean they are out of the woods just yet.

The key will be the ability of cattle feeders to sustain fairly healthy prices for a couple of weeks even though they are marketing cattle that were placed in the feedlot at a much lower cost than those cattle in previous months. Live cattle prices will follow wholesale beef prices which likely means a decline will be in store as the market moves into the summer marketing timeframe. Cattle feeders will be managing margins closely.

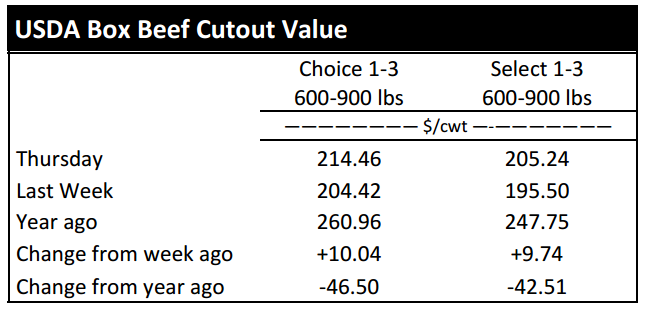

BEEF CUTOUT: At midday Friday, the Choice cutout was $217.94 up $3.48 from Thursday and up $14.28 from last Friday. The Select cutout was $205.82 up $0.58 from Thursday and up $10.91 from last Friday. The Choice Select spread was $12.12 compared to $8.75 a week ago.

After struggling with declining prices for three weeks, the Choice and Select cutouts surged back this week. Most of the strength is likely coming from purchases for the Memorial Day weekend which will mark the unofficial beginning of summer. Retailers are making some last minute purchases to stock the meat counter with the hope of drawing a few dollars out of consumers’ wallets and pocketbooks.

Beef demand in May is generally strong relative to most other months and that strength is largely due to consumers firing up grills and enjoying the long weekend presented by Memorial Day. The holiday itself is a huge driver of prices in this week’s market, but the question that packers are already asking is if this price level can be sustained into June or if prices will fizzle with the summer heat.

The large volume of competing meats available could very well put a damper on the beef sector following the month of May, but packers will try almost anything to continue supporting prices. Time is likely running short on higher beef prices, but prices are strong for now.

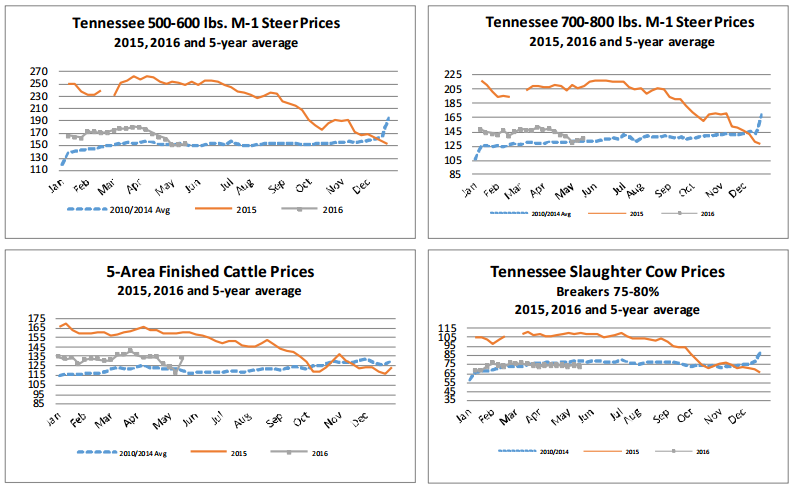

OUTLOOK: Calf and feeder cattle prices received a boost this week on Tennessee auction markets with most classes up $2 to $6 compared to one week ago. The price support came from stronger futures prices in both live cattle and feeder cattle late last week and early this week. However, feeder cattle futures struggled late in the week which does not bode well for cattle going to market early next week. It is tough to pinpoint why prices are fluctuating for both live cattle and feeder cattle.

In general, feeder cattle price fluctuations are closely tied to live cattle prices and corn prices. Thus, if corn price increases then the cost to feed cattle increases which reduce feeder cattle price while a decline in corn price generally supports feeder cattle price. Similarly, if live cattle price increases then the expectation is for feeder cattle price to increase and vice versa.

Additionally, the live cattle price is tied to wholesale beef prices, retail beef prices and consumer demand while corn price is impacted by demand for corn from several different industries such as the feed industry, ethanol industry, food industry, and exports. Thus, the fundamentals that generally drive the feeder cattle market continue to be pushed to the way side and this is likely because the fundamentals of the live cattle market also appear to be overshadowed by speculation and technical trading. This can be considered either positive or negative depending on one’s perspective.

From a cattle producer’s standpoint, markets failing to be representative of supply and demand can inhibit business decisions because market signals are more likely to be misinterpreted. Additionally, it makes it difficult for producers to manage price risk using futures, options, and LRP. It also can make it difficult to use forward contracting as feeder cattle buyers may be more hesitant to purchase cattle too far into the future. Just because it increases the degree of difficulty of using price risk management tools does not mean producers should totally discard them.

There are instances and circumstances that support the use of these tools even during volatile times. Producers are encouraged to evaluate pricing opportunities on a regular basis to determine if a beneficial opportunity arises.

ASK ANDREW, TN THINK TANK: This week an email question was received concerning the investigation into the 2015 cattle market price collapse and if it is possible meat packers manipulated the market. This investigation was brought on by a request from R-CALF USA because the group thinks there is potential that packers colluded against the cash market which forced more cattle to formula contracts and thus accelerating the price decline or even causing the price decline late in 2015. Anything is possible and that is why the Senate Judiciary Committee is looking into the request by R-CALF. However, maybe they should be asking why prices escalated so quickly or what caused prices to escalate! The answers to these questions would provide insight into why prices declined so rapidly. It is most likely not collusion but rather market forces that caused the market to react accordingly.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle –June $123.43 0.85; August $118.73 -0.18; October $117.98 -0.13; Feeder cattle - May $147.05 -0.78; August $146.25 -1.00; September $144.23 -1.45; October $142.38 -1.60; May corn closed at $3.82 down $0.04 from Thursday.