Speer: Cow Inventory - Things Aren’t Always What They Seem

“Lowest cow numbers since 1962”: That’s seemingly been a key talking point following USDA’s Jan 1 inventory report. Industry critics claim the occurrence represents all that’s wrong with the beef industry. But to that end, the talking point is misleading.

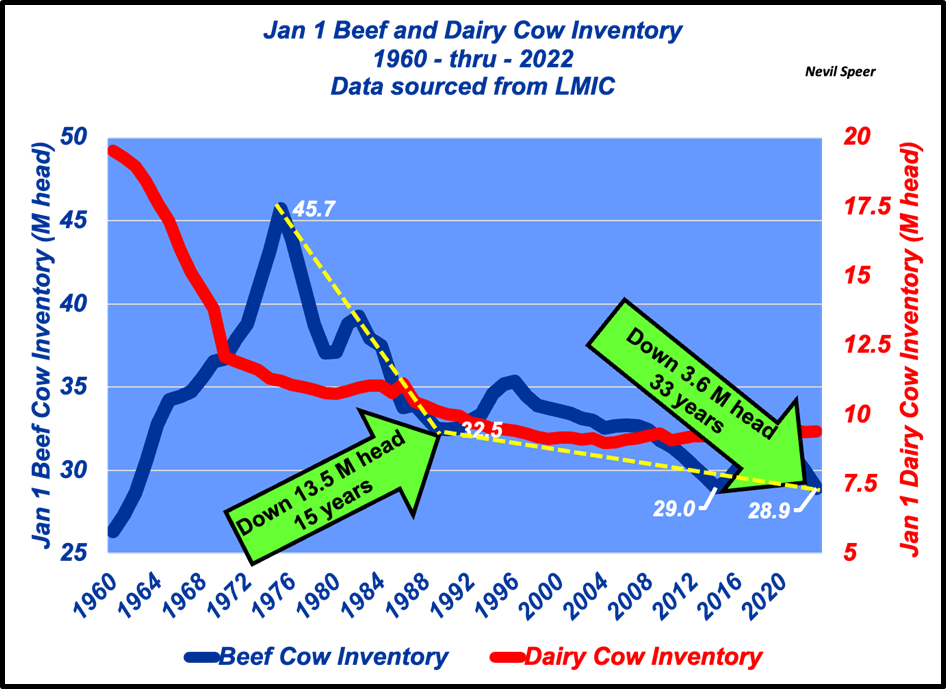

Cow Numbers: Let’s begin with the data. The first graph details Jan 1 beef and dairy cow inventory dating back to 1960. Several items are significant and provide some broader context.

- Beef cow numbers peaked in 1975 at nearly 46 M head.

- Inventory then plunged 13+ M head in just 15 years, bottoming out at 32.5M head in 1990 (the decline averaging 880,000 head annually).

- Meanwhile, 2023 inventory represents a decline of only 3.6M head versus 1990; equivalent to ~109,000 head annually (just 1/8 the pace between ’75 and ’90).

- Finally, dairy cow inventory in the early 60s was ~20M head. The current ten-year average stands at ~9.35M head. Hence, beef cows represented only ~55% of total cow population in early 60s, versus 75% in 2023 (thus making a larger contribution to beef production over time).

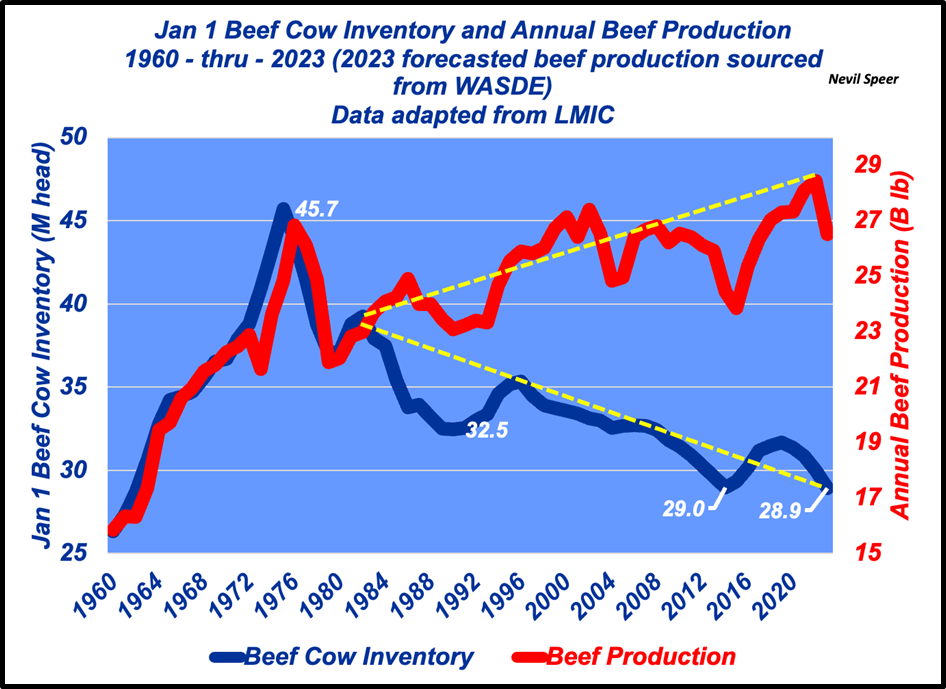

Beef Production: Next, let’s go one step further: the second graph details annual beef cow inventory and annual beef production. Clearly, the business has changed dramatically over 60+ years in terms of genetics and management. Again, some key items to point out.

- Last year’s beef production total marked a new record of 28.4B lb! The industry is doing more with less (and producing better quality beef, too).

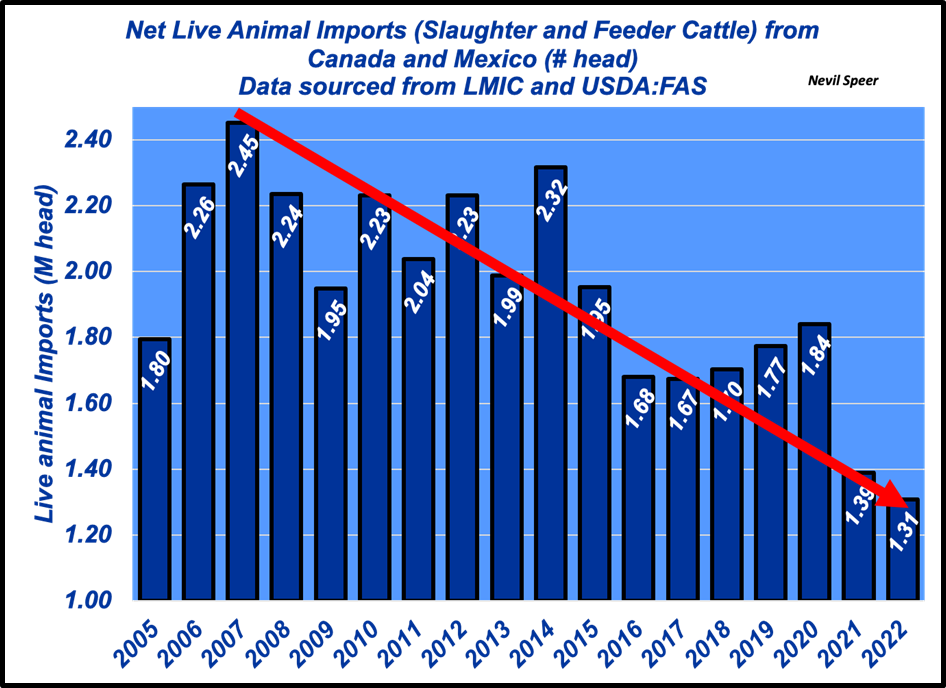

- The protectionists will immediately point to imports: “We’re importing more beef and animals than ever – beef production number misrepresents what’s really going on in the industry.” Two key items to consider with respect to that argument.

- Beef imports aren’t reflected in beef production numbers; they contribute to overall supply – not production. (Besides, it’s a spurious argument anyway.)

- Live animal imports are on the decline. The third graph highlights net imports (accounting for feeder cattle exports to Canada). Net imports in 2002 were only 53% of the peak that occurred in 2007. Therefore, live animal imports (both feeder and slaughter cattle) are a smaller percentage of total beef production than ever.

Land Enterprise: The inference of talking point is too simplistic.

- Two rounds of severe and widespread drought in the past decade have made a huge impact on decision-making and capped any upside potential during that time.

- Moreover, weather has been confounded in the recent selloff by any number of factors including age of producers, production costs, interest rate uncertainty, etc….

- Last, and most importantly, the cow enterprise is a first and foremost a land enterprise. Then consider two very significant governmental programs that dramatically influence the land / cow equation – both converging on the business ~15 years ago.

- CRP: introduced in 1985, enrollment peaked in 2007 at 35+M acres. (The current enrollment is closer to 25M acres. At current average U.S. cow density, that represents potential for an additional 750,000 cows.).

- Ethanol: the mandate began in 2006 and initiated an entirely new equation with respect to the battle for acres.

Things Aren’t Always What They Seem: The critics will keep pointing to waning cow numbers – contending it’s an indication of the business’ demise. But that dodges all the considerations outlined above. Moreover, it’s doubtful any producer wants to turn back the clock to 1975.

Meanwhile, the beef industry owns an incredible success story during the past 20 years. The business is getting better. As such, cow inventory is NOT a reliable proxy of the industry’s viability. Things aren’t always what they seem.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.