Speer: Bettin’ On The Grid

Higher Prices: Much of the noise around the cash market has quieted down. As noted in some previous columns (see one and two), “I haven’t received any emails recently proclaiming the ‘market is broken’…High prices make everyone feel better.” Given that reality, let’s put some of the emotion aside about the “market” and turn to the “business”.

Grid Marketing: USDA defines negotiated grid sales like this:

The base price is negotiated between buyer and seller and is known at the time the deal is struck and delivery is usually expected within 14 days. However, the final net price will be determined by applying a series of premiums and discounts after slaughter based on carcass performance. The base is reported when established. The net is reported after slaughter and grading occurs.

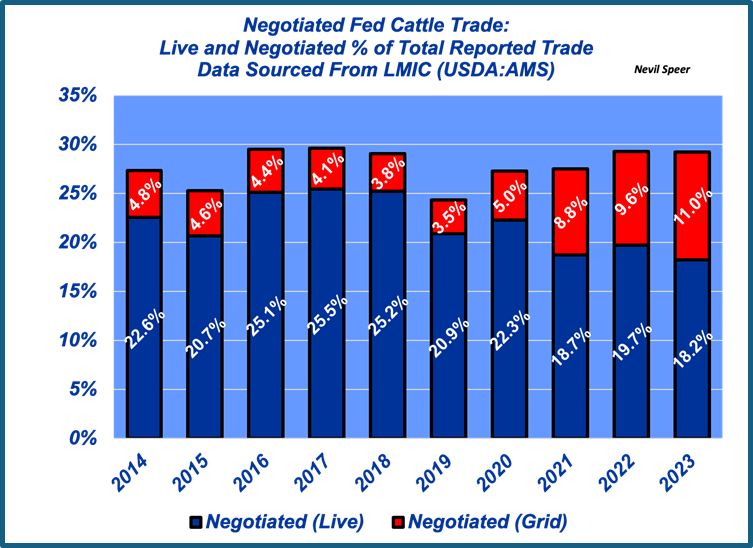

Cattle feeders are increasingly committing less cattle to live sales and more to selling via a negotiated grid. Last year’s negotiated grid transactions comprised 11% of the slaughter mix –up over 3X versus just a few years ago (see first graph below).

That has some important implications for the beef industry. Most notably, it speaks to the increasing confidence cattle feeders have in their respective marketing mix. Selling on the grid means the seller assumes most (all) the risk in terms of performance. There’s no guesswork involved; you get paid on how the cattle perform after the fact. Full stop.

Premium Cattle: Cattle feeders respond to economic incentives (just like everyone else). If it works, do more of it (and if it doesn’t, do less of it). And seemingly grid marketing (either via a formula or negotiated base price) is self-reinforcing as indicated by negotiated grid numbers. There are real dollars at stake - incentivizing feedyards to sell less cattle live and more on the grid.

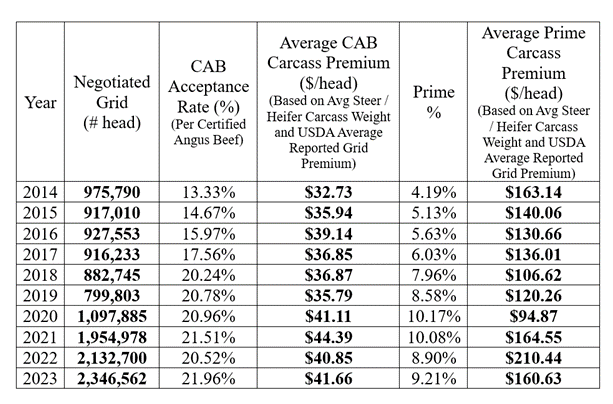

Let’s just look at part of that equation from just a quality grade perspective – notably CAB and Prime. The table below details total number of negotiated grid (not formula marketed cattle), along with CAB acceptance rate and average proportion grading Prime (across the entire slaughter mix). Working just off broad averages (not worrying about regional differences), the number of cattle plus better premium conversion rates equates to more dollars.

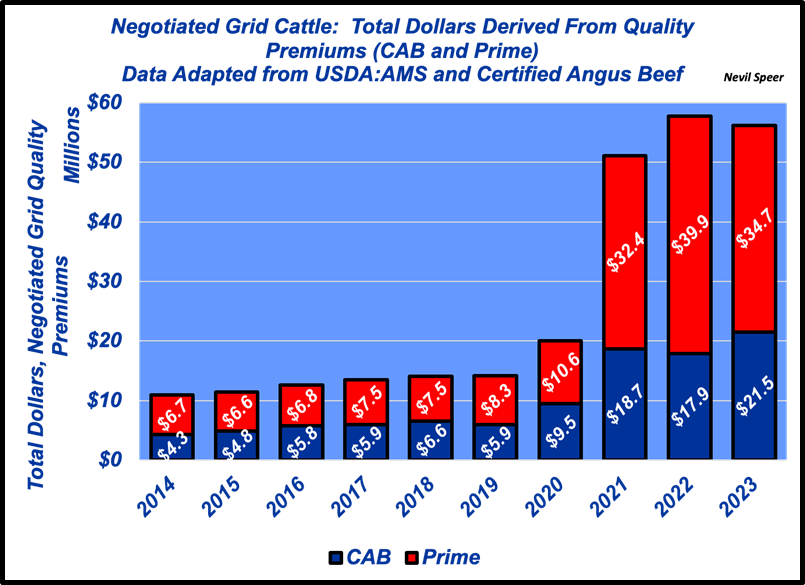

Dollars: The second graph details aggregate dollars (just for negotiated grid cattle) by year, respectively. They’re a function of:

- Total number of cattle in each quality category. (per the table above);

- Annual weighted average carcass weight (across steers and heifers);

- Average grid premium for CAB and Prime, respectively (as reported weekly from USDA – NOT the Contract Library).

Again, these are broad assumptions, but what really matters is the trend. The reliability of marbling in the slaughter mix is making a difference – and cattle feeders are taking advantage of that.

Bottom Line: As noted above, marketing cattle on the grid means there’s no guesswork – the check is dependent on how the cattle perform on the rail.

Let’s consider just the $40/head premium for CAB. That represents nearly $3+/cwt on a live basis – that likely was NOT being fully captured or differentiated directly in the live market (albeit, there was likely some premium incentive added to the base if selling live and/or built in to the formula arrangement).

Even more significant, $40/head represents an extra 1.5%+ return on a $2600 steer. That translates to ~3.0% on an annualized basis (180-day feeding period). That’s especially important over time (power of compounding). Those extra dollars add up over time!

Cattle are NOT fungible. Cattle feeders are increasingly taking advantage of that reality. That trend likely won’t reverse anytime soon. Bettin’ on the grid is paying off. Better genetics, better management and grid marketing are converging to create opportunity and deliver more dollars.