Speer: Beef Forging Ahead With Consumers

Inflation: Ask any consumer about inflation and the first thing they’ll likely mention are food prices. For example, results from a November Yahoo Finance/Ipsos survey detail it this way:

Americans are feeling the impact of inflation and rising interest rates, particularly in the food and housing costs. Regardless of political affiliation, a strong majority of registered voters say inflation over the

last two years has been unusually high (88%). Inflated prices are widely affecting food prices, as over two-thirds of voters (67%) say this is the area they have seen most impacted by inflation.

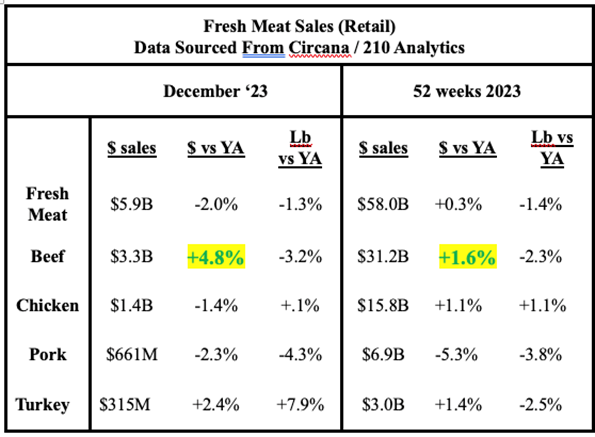

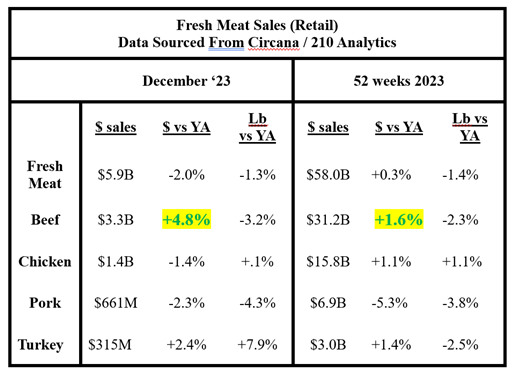

Retail Sales: How does that play out in the meat case? Not like you might think. In mid-January, Circana and 210 Analytics (Anne-Marie Roerink) released the 2023 year-end results for retail meat sales (outlined in the table below). A couple of items are especially significant.

- December ‘23: Beef’s monthly sales comp was the clear winner. Total sales were up nearly 5% - while fresh meat sales, in general, were down.

- 52-week Comps: Beef also generated the largest dollar gains (1.6%) across the protein sector.

Now compare chicken’s year-over-year dollar sale comps; the dollar increase is directly associated with volume growth. However, for beef it’s the other way around - more dollars on lower volume.

Pricing Power: All that speaks to the beef industry’s continued pricing power in the marketplace. That’s especially significant given consumers are especially ouchy about inflation. One would expect that consumers would have been more prone to trading down when inflation is front-of-mind. Why is that occurring?

Should Be / Not Happening: Now, let’s turn to the pork industry. Sale results reveal a sharp decline (-5.3%) in 2023. The industry’s challenges were underscored in a recent Wall Street Journal article: We’re Not Eating Enough Bacon, and That’s a Problem for the Economy. The first sentence reads like this: “The American pork industry has a problem: it makes more tenderloin, ham, sausage and bacon than anybody wants to eat.”

The column featured a 27-year-old consumer in Chicago, Andrew Rasmussen – “the kind of person pork producers hope to win over.” (And one the beef industry needs to win over, too.) Mr. Rasmussen said he eats steak and burgers when they fit his budget and picks chicken when trying to save on his grocery bill. And then remarks, “Pork is kind of a third thought.”

Here’s the most important part highlighting beef’s pricing power. The article also features Scott Ferry who owns a small pork processing plant in Michigan – and concludes by quoting him with this observation (emphasis mine): “There should be greater demand for pork with beef prices where they are, but it’s not happening.”

Forging Ahead: Let’s pull it all together. Good things happening for the beef industry – all the while when consumers are looking for cheaper alternatives. They’re price shopping, but they’re not – at least when it comes to beef. And those added dollars flowing into the business helped underpin 2023’s record market. All this underscores the importance of maintaining a consumer focus: make beef better and promote it effectively. Build it and they will come.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.