Will We See a Hard Fall or Soft Landing? It's the Million Dollar Question for the Farm Economy This Year

March Ag Economists' Monthly Monitor

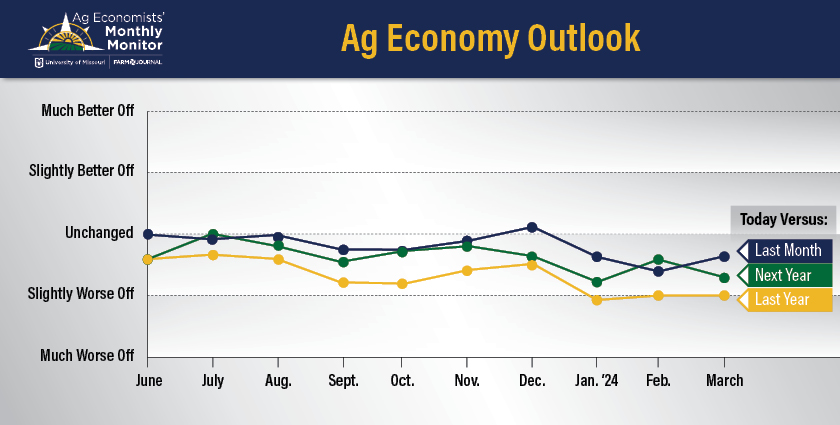

A reset in agriculture seems to be underway. For 10 straight months, the Ag Economists’ Monthly Monitor has tracked the health of the ag economy through the lens of ag economists. The anonymous survey is a gauge of 70 economists from across the country. In March, economists’ views on the ag economy grew weaker, but it’s the erosion in the future outlook that is sprouting fresh concerns.

“I think we just have to continue to watch the downside,” said Scott Brown, interim director of Rural and Farm Finance Policy Analysis Center (RaFF) at the University of Missouri, who also helps author the Ag Economists’ Monthly Monitor. “I think it's certainly more negative as we look ahead, but if we plant a lot of corn and we get trend yields, I think I know the directional corn prices, and it’s perhaps even lower than where the economists have been today.”

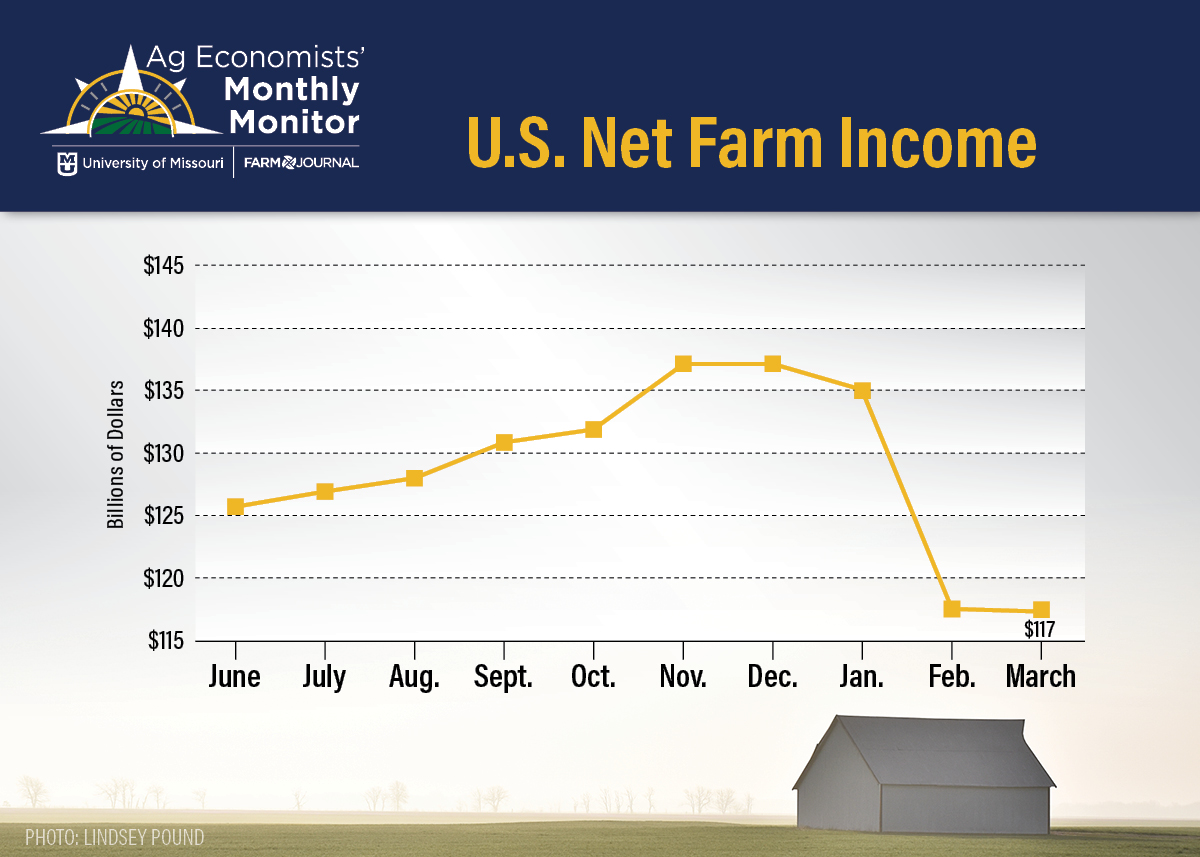

Economists’ views on the net farm income picture took a nosedive in February but held steady in March around $117 billion. The projection is a sharp drop from the $160 billion USDA forecast for 2023 and a 42% fall from the record set in 2022.

“We think farm income does drop very sharply in 2024, but it’s just back down to the levels we saw in 2020 and remains above the levels we saw between 2015 and 2019,” said Pat Westhoff, director of the Food and Policy Research Institute (FAPRI) at the University of Missouri.

Fallout from Falling Net Farm Income

The anonymous survey exposed several possible outcomes from a sharp drop in net farm income. One economist pointed out, for those producers who thought 2021/22 was a new normal for commodity prices, they might be overextended heading into the latest downturn. Another economist said corn farmers could face the steepest losses this year.

“It looks like corn prices will be below production costs for many producers,” one economist said. “We have not had that for a long time, especially since the ethanol boom started almost 20 years ago. The struggles this time will be for corn farmers. Producers of other crops like cotton, wheat and rice have had difficult years.”

“Low row crop prices will depress farm incomes in the Midwest in 2024,” said another economist. “In 12 months, it will be interesting to see how much working capital erosion has taken place and how serious of a problem that becomes.”

Forecasts show margins will continue to get squeezed, but will it be a soft landing or a hard fall? It’s a debate that will continue to play out in 2024.

“I’m still in the soft-landing side of things, but I want folks to do enough risk management to hopefully prevent the hard fall,” Brown said.

“I think if things play out the way we have them currently projected, it’s a relatively soft landing in the sense it’s not a continued crash, where we see a repeat of some of the horrible times you’ve had in the past, but the risks are there” Westhoff said. “I could easily tell you stories that are much more negative, and the opposite is also true that we can have a better picture as well.”

What Factors Will Drive the Economy and Commodity Prices in the Next 6-12 Months?

The March survey asked economists to list the two most important factors driving agriculture's economic health today and in the next 12 months. Economists said:

- Declining prices for many commodities, and the mixed impact of higher cattle and hog prices

- Higher cost of production, including input costs, interest rates and land rental rates

- Concerns regarding exports and global economic growth, as well as regulatory and policy uncertainty.

When economists were asked what factors will impact crop prices in the next 6 months, they said:

- Domestic and global weather impacts on planting and the growing season.

- Planting intentions and production prospects for the U.S.

- Global impacts related to export demand, competitor production, economic health and conflicts; specific mentions made of

- South American crops, Hamas conflict in the Suez Canal and Chinese demand.

- Domestic demand strength and general economic health.

The March survey also asked economists to outline what factors will impact livestock prices in that same time. Economists said:

- Consumer confidence and demand driven by economic growth.

- Supply conditions remain tight for cattle as herd rebuilding conditions.

- Potential drought conditions impacting forage recovery, among other things.

Cow-Calf Producers in the Driver’s Seat

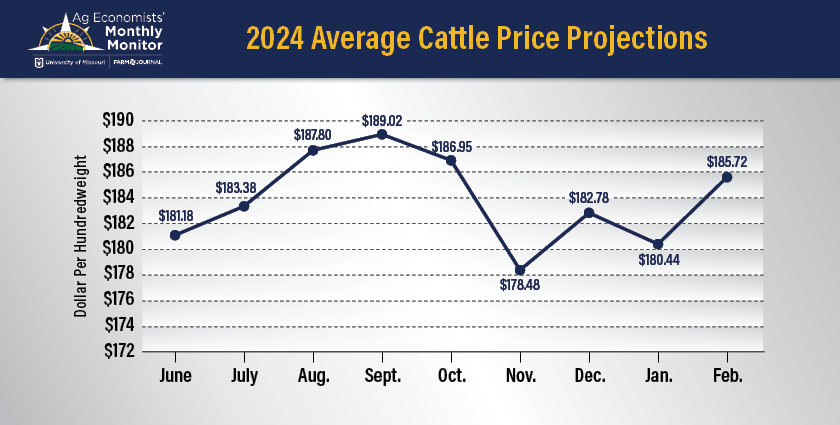

While the doom and gloom forecasts continue to haunt row crops, in 2024, the Ag Economists’ monthly Monitor continues to highlight the one bright spot in the ag economy this year.

“The outlier for me is cattle,” Brown said. “I think cattle prices, frankly, could get even higher. Whether that’s good in the long run for us, in terms of some pieces of the industry that we need, like processing capacity, we’ll have to wait and see, but cow calf producers are going to be in the driver’s seat for the next year and a half to two years.”

The March Monthly Monitor asked economists what two factors will drive agriculture’s economic health today and in the next 12 months.

Economists say declining prices for many commodities, with a mixed impact of higher cattle and hog prices; higher production costs including inputs, interest rates and land rents; as well as concerns about global economic growth and regulatory uncertainty.

What could impact crop prices over the next six months? Economists say supply is the overriding factor for grains.

“If we have an average crop in 2024, we’ll be looking at lower prices for most of the major commodities as the most likely outcome. So that tends to push down not just farm receipts but also net farm income this year as production costs remain relatively high overall,” Westhoff said.

On the livestock side, the supply of cattle is known. With the fewest cows since 1961, and tightening supplies of beef and cattle, the supply side is creating mounting pressure toward higher prices. The biggest wild card, however, is demand.

“Will consumers continue to buy at their current rate that they did last year, with higher prices, because we’ve got record-high retail beef prices? That’s the real interesting part there,” said David Anderson, a livestock economist with Texas A&M and one of the 70 economists surveyed each month.

“From a live animal standpoint, cheaper grain leads to cheaper feed costs that boost prices,” he adds. “That’s, you know, one part of it, certainly tighter supplies and the demand for those cattle from packing plants that now are having to fight for animals. That's part of boosting prices, too, as well as that consumer demand at every step of the chain, so to speak.”

Just how much higher can cattle prices go? This month’s monthly monitor, which was done before Highly Pathogenic Avian Influenza (HPAI) was confirmed in U.S. dairy cattle, jumped another $3 per hundredweight to $188.30. Anderson thinks that means it could be 2028 or even 2029 before we start rapidly expanding beef supplies, a sign that elevated cattle prices could be in for a long ride if demand can hold.

“Even if we started herd expansion this year, let’s say a calf that is born this spring, that calf is held back into the herd, she’s not going to have her first calf for two years. It’s another 18 months before that animal is at their finished weight and becomes beef,” Anderson explained. “That’s almost four years of higher prices if we started aggressively expanding today.”

Digging Into Demand

The strength in demand hinges on the health of the U.S. economy. Anderson thinks while there are mixed signals with the economy, fundamentally, the signals are working in favor of beef and meat demand.

“One is we have a growing economy: GDP is growing, real incomes and real wages are growing. What that means is incomes are growing faster than inflation. We also have very low unemployment,” Anderson said. “If we think about a growing economy and low unemployment, historically, those are very good. That’s a very good economic outlook for beef demand.”

“I don’t think we’re yet seeing a lot of indications of weakness in demand just yet,” Brown says. “It’s the one that I watch the most as inflation is still not back to the Federal Reserve’s target of 2%.”

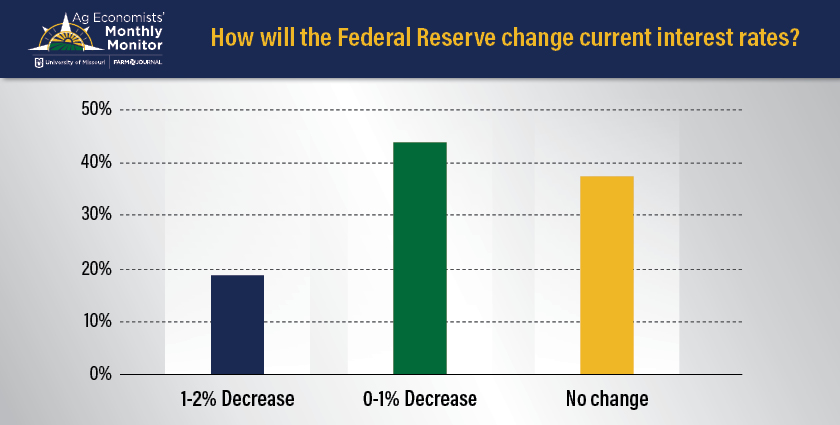

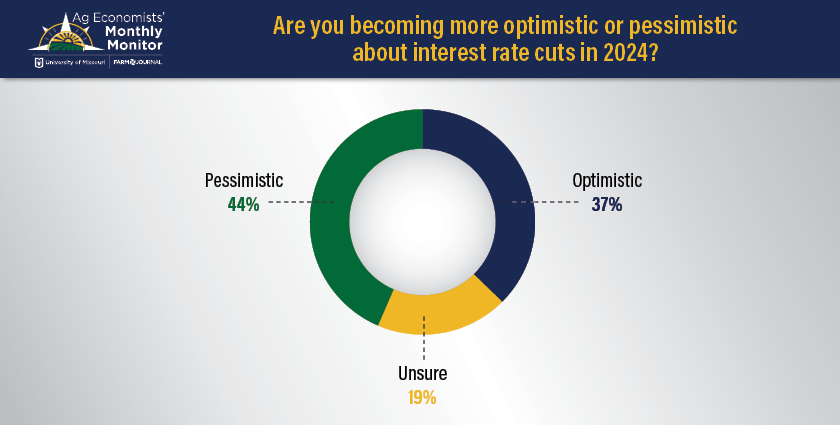

In the February Monthly Monitor, economists cast doubt on not only if the Federal Reserve will make interest rate cuts in 2024, but by how much. Forty-four percent of economists said they are growing more pessimistic about rate cuts in 2024; 37% are more optimistic. The majority of ag economist are forecasting interest rates to fall zero to 1% this year.

Turbulent Times for Pork

Hog producers are coping with a plethora of challenges. 2023 produced the worst margins on record. Now, consolidation concerns are setting in as pork processing plants have already made closure announcements, with economists expecting more on the way.

“We expect 2024 to be a better year for producers’ margins,” Brown said. “If you look at the Month Monitor’s forecasts for corn prices, back in December, we were suggesting 2024/25 price of a little more than $4.70. We’re sitting below $4.50 in the March survey, so cheaper feed costs should help on the productivity side.”

Even if 2024 is a breakeven year for producers, economists warn it might help stop the bleeding but won’t be enough to help producers dig out of the hole that was created last year.

“It’s not enough to recover from all of that because those were black record large losses,” Anderson said. “One of the interesting things on the hog side is why don’t we see a lot more cutback in production already because of those losses? We don’t really see that, but some of its productivity gains are offsetting fewer sales. It’s a pretty interesting industry to look at.”

Clarity on China

China continues to be a major question mark for grain and meat demand. The country recently announced it will sharply expand its budget to stockpile grains and edible oils to help improve food security; however, not all economists are sold on that motive. The Monthly Monitor asked economists if they think there are other motives at play.

“Yes, helping internal prices for farmers,” one economist said.

“No, I actually do think that China likes holding large stockpiles of feed grains. Now that grain prices have fallen, they are taking advantage of low prices to build stocks,” another economist responded.

“China is preparing for the possibility of increased conflict with the U.S. after changing the wording contained in its policy paper regarding Taiwan,” said another economist in the anonymous survey.

“There may be concerns about what might happen if there were to be a change in U.S. administrations in 2025,” another response stated. “Given past experience, I'd pay more attention to actual market behavior than announcements.”