Speer: Price Discovery and Packer Margins

The Rub: Price discovery was the topic of the previous column and ended with the following observation: “The data detailed below likely won’t lead the “more trade, better price” camp to perhaps rethink their perspective; that’s because their position often starts with an adversarial perspective of the business. That is, less cash trade punishes the cattle feeder while benefitting the packer.”

With that, let’s jump into the fray and review the link between cash trade and packer margins.

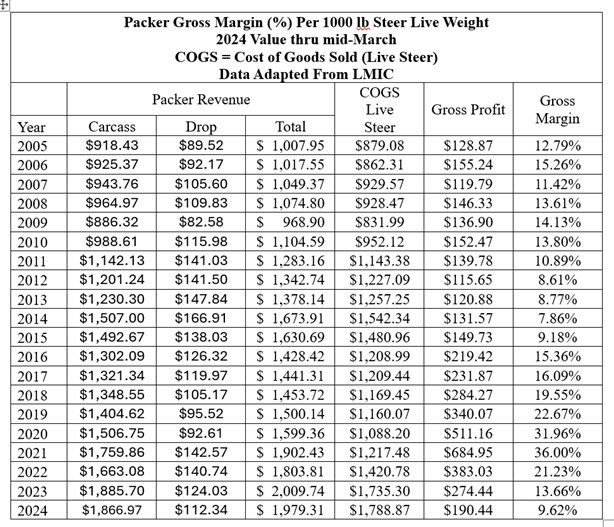

Gross Profit: To go there, first we need to get some handle on packer margins. Generally, the term refers to gross profit (also known as the live-to-cutout spread). It’s calculated as follows:

- Gross profit = sales (cutout and drop) minus cost of goods sold (live cattle).

Gross profit does NOT account for costs associated with owning and operating a processing plant (that’d be operating profit) – nor does it account for interest, depreciation and taxes (that’s net profit).

From there, to enable a more accurate analysis of trends over time, it’s helpful to look at it in a normalized manner: gross margin. The measure reflects gross profit as a proportion of total sales – and will be the measure we focus on from this point forward:

- Gross margin = gross profit divided by sales (or revenue). (see table at end of column for calculations per 1000 lb live steer)

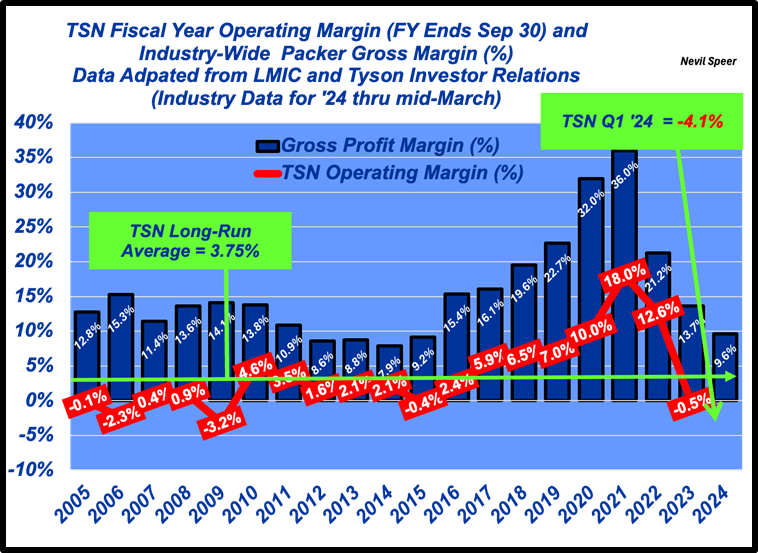

Tyson / Operating Margins: Because Tyson is publicly traded, the company provides the most accessible and long-standing financial data for the sector and thus provides some insight into the general financial backdrop among beef processors. However, the company does NOT report gross profit or gross margin; however, it does report operating margins.

- Operating margin = gross profit less operating expenses; operating margin represents operating profit as a percentage of sales.

Note – the company also does NOT report net profit by segment (for breakdown on that see: Exports Benefit Producers).

Tyson’s long-run (excluding ’18-’22) operating margin average is 3.75% (or ~4 cents of every dollar of sales – before any accounting for interest, taxes and depreciation. Meanwhile, Tyson’s first-quarter ’24 (Oct-thru-Dec) operating margin was negative 4%.

Nevertheless, the first graph lines up the two measures (industry wide gross margin and Tyson operating margin) side-by-side. It provides some macro-micro context. Not surprisingly, the two move together in tandem. In other words, based on the comparison, the gross margin estimate is a fair starting point to assess the impact of cash trade on packer profitability.

The difference between gross margin and operating margin undoubtedly varies from company-to-company and certainly from plant-to-plant – but that’s another discussion for another time.

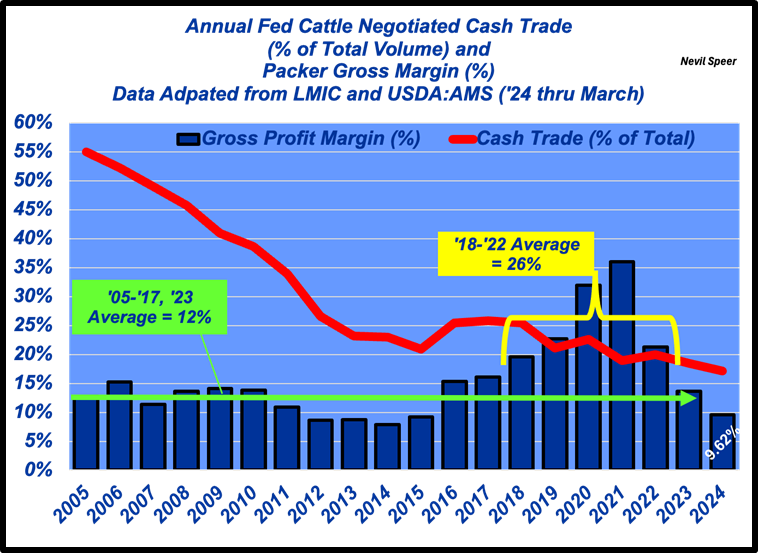

Cash Trade: With that background, let’s turn back to the macro / broader-industry analysis. The second graph below details annual cash trade (% of total volume) and packer gross margin. Several things are noteworthy.

Namely, the correlation between gross margin and cash trade is -.25 – the trend reflecting more negotiated trade means less margin for packers. But the correlation is weak…therefore, cash trade also accounts for only about 6% of variation in margin. In other words, any notion about the trend of declining cash trade being disproportionately beneficial to packers is seemingly tenuous. That’s especially true in context of 2024 as packer gross margins have plunged sharply independent of cash trade.

What’s Right With The Market?: Undoubtedly, some will overlook the data, and read all this with some contempt and/or cynicism. For example, some time ago, one reader following my column, Free Market Doing Its Thing, responded by asking, “…do you think their [sic] shouldn't be any cash market for fat cattle?”

Of course, promoting that sort of thinking was never the intention; neither it is the purpose here. Rather, the aim is to bring some objectivity to the conversation and ensure the business avoids emotional, knee-jerk conclusions and over-reaching solutions.

As a result, the discussion lends itself well to Humphrey Neill’s great observation in his book, The Art of Contrary Thinking (first edition printed in 1954). His directive proves useful amidst the rancor on the topic:

Have you noticed the tendency we all have of immediately asking “What’s wrong?” when some economic or political question comes up for discussion? You can think of any number of examples: If arguing about the general business situation, someone is sure to ask: “What’s wrong with business today, anyway?” Or, about the stock market: Brokers are asked over and over, every day—“ What’s wrong with the market?” Did you ever hear anyone inquire, “What’s right with the market?” Yet I’ll venture to assert that if you ask what’s right about economic trends, when you’re thinking about them, you will get an entirely fresh slant on things. Your mind will travel in different channels. Try it sometime—indeed, make it a habit. It is a contrary habit much to be recommended.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.