CAB Insider: Rib and Tenderloin Defy Gravity

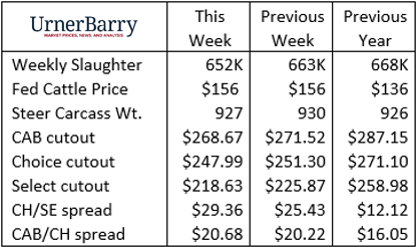

Fed cattle prices found a stable range in the past three weeks after making the $3/cwt. upward leap the week of Thanksgiving. Last week’s negotiated cash trade was on a smaller weekly head count and packers kept a lid on the upward price momentum. The weekly average of $155.65/cwt. was 65-cents under the prior week, which was the highest price realized in 2022.

Higher trending fed cattle values this year have culminated in the latest 10.6% year-over-year increase in fed cattle cost to packers. At the same time the comprehensive carcass cutout is 9% cheaper than a year ago. Analysts currently estimate packer margins at a loss in a range from $73/cwt. to $115/cwt. These estimates are based on cash spot market values and don’t account for risk management postions or contracts.

The bottom line is that, logically, packers will be less likely to push production schedules to the extent that they have in the weeks and months preceeding the estimated dip below their production breakeven. Easing off the pace both pushes back on escalating cattle prices while pulling upward on wholesale boxed beef values. Saturday slaughter is a determining factor in modern weekly production volume, making this the most obvious point where the pace will be trimmed as cattle supplies tighten.

The volatility in daily carcass cutout values has recently been given much attention. Indeed, the seasonal pattern for the month of December is for Choice cutout values to break 4.5% lower from Dec. 1 through the third week of the month. This December started with a $253.57/cwt. Choice price subsequently dipping to the $242.65/cwt. low on Dec. 6. However, this has been followed by a rally back to $260.33/cwt this past Tuesday morning. Many cuts bottomed to 52-week lows last week in an amazing bidirectional pricing scenario where ribs and tenderloins have provided total carcass value lift, despite faltering wholesale prices across much of the carcass.

Rib and Tenderloin Defy Gravity

The CAB carcass cutout price has remained resilient into the middle of December, giving up only $5.41/cwt. or 1.9% in the past month. The Choice cutout, for comparison’s sake, has held on in similar fashion, down just 2.5% in the same period. These facts alone are not fascinating on their own since these trends match those seen a year ago.

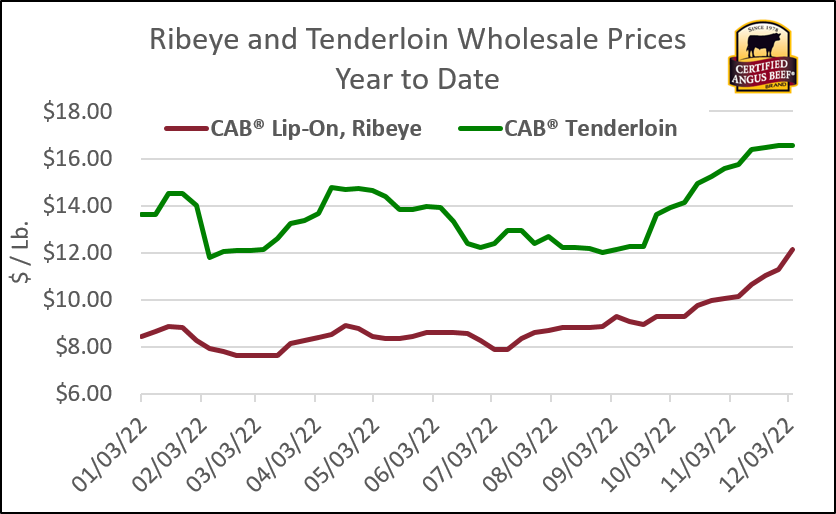

What is surprising is the vast contrast that stands between the rally in both rib and tenderloin prices compared to most other cuts from the beef carcass. Starting with the CAB ribeye, spot market prices have increased 28.5% since the week of October 10. This is similar to the 2020 price pattern. There again, not terribly exciting. But there’s more.

Let’s turn to CAB tenderloin prices. This coveted gem has climbed a whopping 35% from the week of September 19 through last week. That gain is a shock to the system given that the average inflation on tenderloins was just 5.9%, on average, for the past three years.

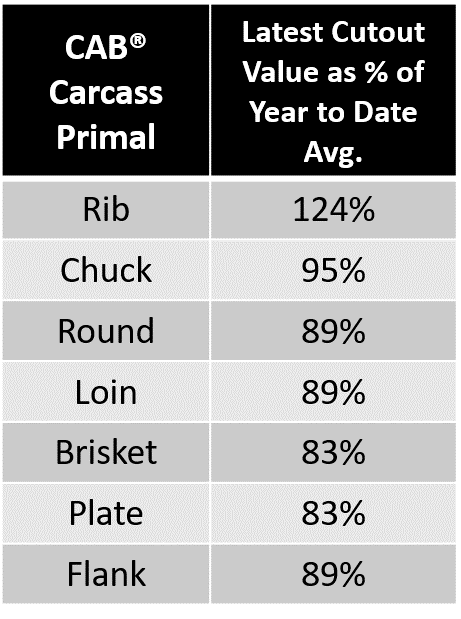

On the other side of the coin there were 15 items in last week’s CAB cutout report that were at 52-week price lows. The list included some expected items, such as most of the round cuts. However, some of these items represent popular, high-eating quality cuts that simply are not high-demand items for December. These include strip loins, tri tips, briskets and skirts. Quality steak items like the teres major and flat iron are not technically at a 52-week low but are certainly in that territory. CAB grinds have traded in a much steadier range over the past couple of months.

Very strong December spot market rib and tenderloin values are effectively propping up total carcass values at this time. Once the final throes of last-minute holiday demand for those two items is behind us, the likelihood is great that their lofty values will deflate rapidly. This will, in turn, be quickly reflected in a recoil to lower cutout values for a few weeks. One must realize that very tight supplies of these items can reflect very high prices on a limited volume of sales.

The rib primal of the carcass represents about 11.4% of total carcass weight and currently 23.7% of total carcass value. Rib value stands to decline by 25% by year’s end if the seasonal demand decline happens as it has in the past.