Is Time Running out on Potential for Stronger Cattle Prices?

By: Stephen R. Koontz, Colorado State University

Spring time marches on: Prospective Plantings was quite the surprise, a major moisture event causes flooding in the southern plains with concerns of excess up through Nebraska and generous needed snowfall in Colorado, and the deadline for filing your income taxes passes. So how about the fundamentals and technical picture in the cattle and beef markets?

The USDA Choice-Select spread posted a bit of a rally through the prior weeks. The spread widened from it seasonal low of about $4/cwt to a little short of $9/cwt. This change was as anticipated, very comparable to last year and about a month early. It will be worth watching to see if this strength continues or has run its course. Slaughter numbers continue to be strong and carcass weights continue a modest decline. Probably some of the most optimistic news over the prior weeks was from the byproduct market. The value of these products aggregated to the live animal level increased $1/cwt of live animal weight. This total market has seen more than a 30% decline in value over the past year. Much of this product is exported and that is made difficult by the strong dollar. This decline in byproduct value is now comparable to the appreciation in the dollar. Strengthening of byproduct markets are a good overall sign. And all this is good news for cattle producers.

However, the boxed beef market is showing some softness and that is being mirrored by the fed cattle market. Further, the hunt for good news is a bit difficult. There are modest pieces but little observed to drive price strength and, I think, time is running out for much more good news this year. Expansion of the cow herd promises more calves this fall and the Prospective Planting report promises abundant feed. And exports continue to be weak at best. Sounds to me like a bit like last year. And the deferred live cattle and feeder cattle futures appear to be in agreement. These markets are pricing substantial discounts into the fall months.

The futures markets have reversed roles with cash over the past week plus and are offering a cautious tone. Fed cattle and feeder cattle contracts all were lower through last week. In mid-March the markets pushed through resistance set in February and January by moving higher. Then selling pressure emerged that has pushed all the contracts down and contracts are sitting above support planes.

I will be very interested in the April USDA Cattle on Feed this coming week. Yes, placements will likely be up but what does the report suggest about showlists? The March report showed the calculated 120 days on feed inventories were sharply higher. We are a good month past the time when I thought this cattle market wreck would be cleaned up. It started late last summer with huge slaughter weights and expanding market ready fed cattle inventories. But these long-fed inventories persist. Will the industry clean-up showlists prior to the seasonal increases in supplies starting in August and continuing through October? This week will help inform but time is getting short.

The markets

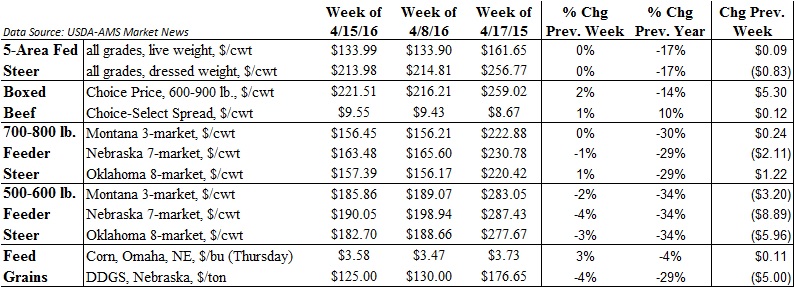

The five-area fed steer price ended the week averaging $133.99 for live sales, and $213.98 for dressed; respectively, up $0.09 and down $0.83. Nebraska feeder cattle were trading $2.00 to $8.00 lower on the week with 500-600 pound steers averaging $190.05 and 700-800 pound steers averaging $163.48. Corn was $0.11 higher on the week trading at $3.58/bu in Omaha on Thursday.