Market Highlights: Feedlots Sweating Bullets

By: Andrew P. Griffith, University of Tennessee

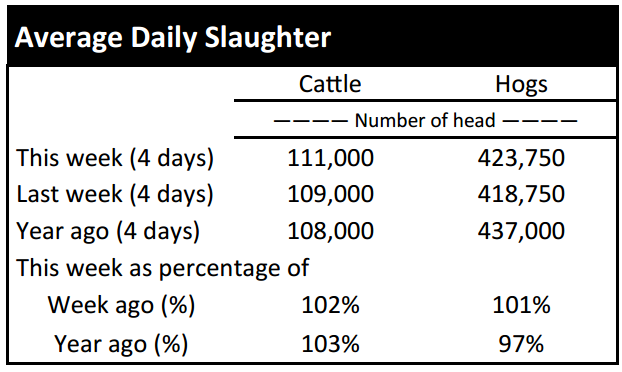

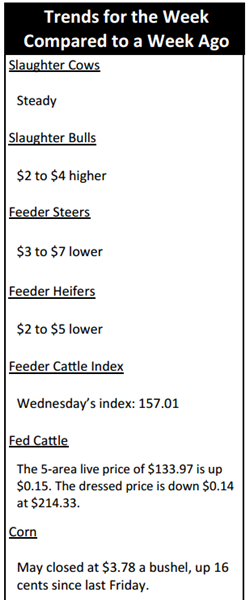

FED CATTLE: Fed cattle trade was $1 higher than a week ago on a live basis. Live prices were mainly $134 to $135 while dressed trade was mainly $214 to $215. The 5-area weighted average prices thru Thursday were $133.97 live, up $0.15 from last week and $214.33 dressed, down $0.14 from a week ago. A year ago prices were $162.71 live and $255.96 dressed.

There was little change in finished cattle prices this week which likely has feedlot managers sweating bullets. The expectation is for finished cattle prices to make a positive price movement in the spring which could lift cattle feeders out of the losses they have been experiencing the past several months. However, packers have been able to push wholesale beef prices higher while keeping cattle feeders at bay with even pricing this week.

Some of the leverage that packers have right now is due to heavy cattle. The industry put themselves in a situation the back half of 2015 that resulted in heavier finished cattle and the trend has continued. This has resulted in cattle feeders not being current in their marketings and reducing the marketing flexibility.

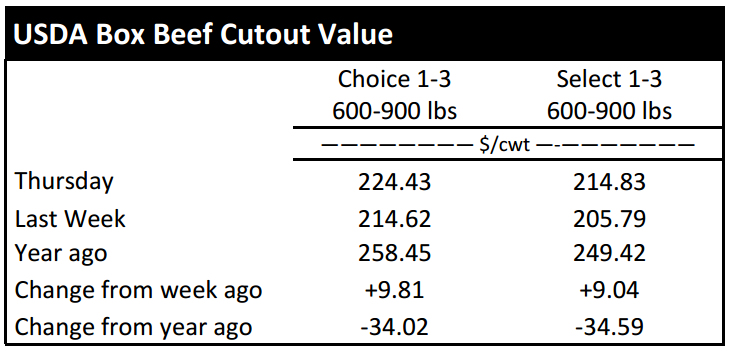

BEEF CUTOUT: At midday Friday, the Choice cutout was $225.03 up $0.60 from Thursday and up $9.85 from last Friday. The Select cutout was $216.30 up $1.47 from Thursday and up $10.68 from last Friday. The Choice Select spread was $8.73 compared to $9.56 a week ago.

The beef cutout prices caught fire again this week as both the Choice and Select cutouts witnessed large gains compared to a week ago. Most of the support for the price increase on Choice meats came from the chuck, round, and loin while rib prices were unchanged from a week earlier.

The market expects middle meats to gain momentum heading into the grilling season, but it appears the end cuts are driving this week’s price increase considering the strength in the chuck and round. This information may point more toward ground beef demand relative to middle meat demand. The increase in the loin price, however, is likely a factor of the retail sector and restaurants gearing up for beef features in the coming weeks. It is likely the ground beef market will remain a key component for the beef industry in 2016 as beef prices continue to moderate.

Additionally, higher valued cuts will receive a little more attention in 2016 than they did in 2015. Similarly, more consumers will be at the beef counter in 2017 than in 2016 as prices continue to moderate.

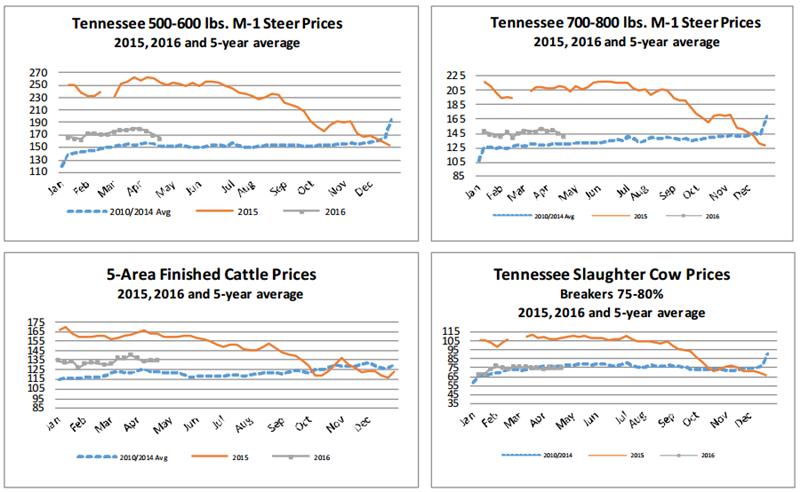

OUTLOOK: Lightweight calf prices continued to soften this week as the spring highs are likely behind the market. The continued price decline provides some indication that lightweight calf prices will continue to soften through the summer and fall time periods as is seasonally expected. Over the past ten years, the spring price peak for 500 to 600 pound steers in Tennessee has occurred in February three times, March two times, and April five times.

The true implication related to how high spring prices reached is in relation to where they will go from here as producers look forward to marketing cattle later in the year. Based on monthly auction data in Tennessee from 2006 through 2015 on 500 to 600 pound steers, the average price break from the spring high to the fall low is 13.1 percent. Thus, if March was the spring high for 2016 then producers in Tennessee are feasibly looking at a fall price low of $155 per hundredweight for freshly weaned calves weighing between 500 and 600 pounds. The expected price trough for the fall of 2016 is equivalent to the fall low price experienced in December of 2015.

Marketing calves during the spring price apex or avoiding the fall price low is well and good, but it may make more sense to consider what the expected price declines are from April into the fall months. Over the past ten years, the monthly price of 500 to 600 pounds steers has declined on average 7.6 percent, 8.8 percent, and 8.5 percent from April to the months of October, November, and December respectively. Thus, given the current data through the first half of April and analyzing the average price declines from April to the months of October, November and December would have the fall price dipping somewhere between $154 and $156 per hundredweight in the October to December timeframe.

This information should provide producers information to improve marketing strategies whether that is to market calves earlier, later, or to use price risk management of some sort. Considering the current futures market pricing and average basis values in Tennessee for 500 to 600 pound steers, the use of price risk management does not appear advantageous at this time. Producers are encouraged to watch the market closely for a favorable pricing opportunity.

ASK ANDREW, TN THINK TANK: This week, a broad based risk management question was asked. Much of my time is spent educating producers about price risk management, but there are several types of risk that producers look to mitigate. These risks include production, price, market, financial, personnel, and several other risks. Managing risks is a large portion of the work load for any business and it is often an integral part of survivability during times of low output prices. It is always appropriate to manage risk, but sometimes that management means doing nothing while at other times it requires doing something. It is integral that producers identify the risks associated with their operation and develop a plan to manage those risks.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle –April $131.48 -0.28; June $122.18 0.43; August $118.03 0.63; Feeder cattle - April $155.08 0.15; May $150.55 0.63; August $151.63 0.65; September $150.40 0.55; May corn closed at $3.79 up $0.05 from Thursday.