Market Highlights: Cash Cattle Price Better Than Futures

By: Andrew P. Griffith, University of Tennessee

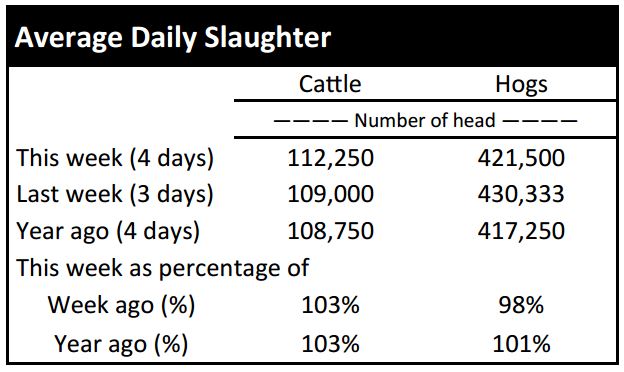

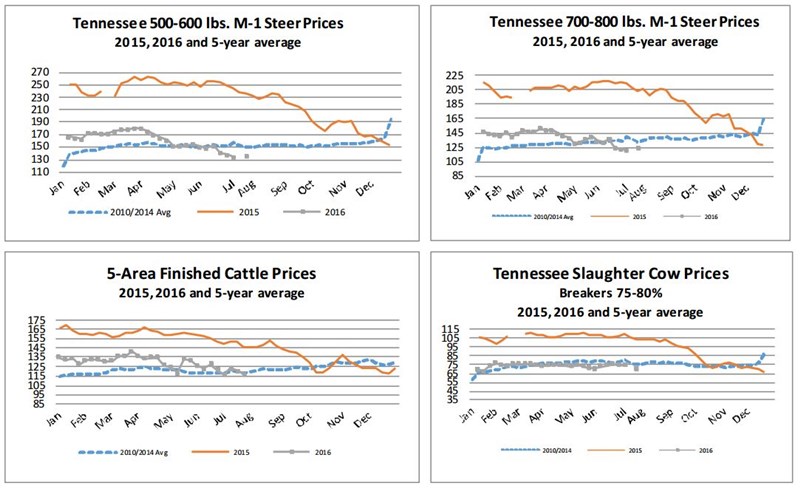

FED CATTLE: Fed cattle trade light at press but prices appeared to be $2 to $3 lower compared to a week ago. Live prices were mainly $117 to $118 while dressed bids ranged from $187 to $188. The 5-area weighted average prices thru Thursday were $117.00 live, down $3.38 from last week and $187.42 dressed, down $3.24 from a week ago. A year ago prices were $146.00 live and $235.00 dressed.

The limited cash trade to this point makes it difficult to make comparisons to the previous week. However, summer is putting stress on the live cattle market and pushing prices lower. Where the bottom is to the market is unknown until it is in the rearview mirror, but there is little indication that there is much more downside to the current market.

The market is well supported at the current cash price levels even though live cattle futures continue to fall. The strong positive basis will continue to pull cattle forward out of the feedlot because the swap is positive for cattle feeders which means cattle feeders can sell what is ready to market and purchase feeder cattle at a lower breakeven price than what they are selling cattle for in today’s market.

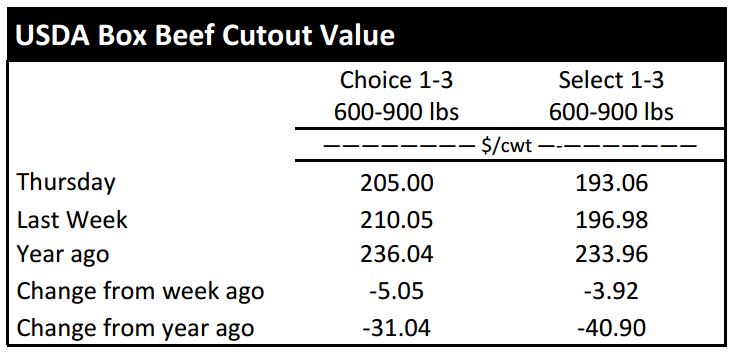

BEEF CUTOUT: At midday Friday, the Choice cutout was $205.37 up $0.37 from Thursday and down $4.49 from last Friday. The Select cutout was $193.24 up $0.18 from Thursday and down $3.73 from last Friday. The Choice Select spread was $12.13 compared to $12.89 a week ago.

The traditional slump in July beef demand is beginning to show up in boxed beef prices. It will be difficult for packers to push prices very much the next several weeks as there is no holiday until Labor Day to promote beef products.

The slowdown is not unexpected, but packers are always looking to capitalize on as much profit as possible. As packers sell at lower prices, the retail price of beef will continue to slowly decline. This slow decline will result in consumers slowly moving back into the beef market if they exited it when prices escalated.

Additionally, consumers who moved from middle meats to more ground beef products will begin purchasing more middle meat cuts as beef prices soften. The move back to higher quality and higher valued cuts by consumers will support beef prices and cattle prices, but that move will not change the downward trend that is expected.

It will be interesting to see how beef demand calculations progress as beef prices soften and supply increases. Beef demand may or may not change.

OUTLOOK: The number of cattle marketed in Tennessee this week picked up compared to two weeks ago due to many markets being closed last week. The good news is that steer and heifer prices firmed this week compared to a couple of weeks ago with most weight classes being $1 to $4 higher than two weeks ago.

The bad news is that the expectation is for calf prices to be relatively low during the traditional fall marketing time period. Cow-calf producers with spring calving herds should already be looking towards the marketing season to determine optimum market timing or to determine if calves should be weaned and backgrounded and marketed at a later time.

On the opposite end of the spectrum, many fall calving herds are 60 to 90 days into the backgrounding stage and will soon be marketing feeder cattle. The late July through early September market is generally strong for feeder cattle. However, there is definitely some concern that the yearling cattle market is not going to be as strong the next couple of months as was expected at time of weaning.

In the first week of May, August feeder cattle futures were trading around $150 per hundredweight, but the August contract is now sitting around the $141 price point. There is low probability that futures prices will push forward to the $150 mark again prior to the August and September marketing time frame. However, there is potential for the market to move back to the $144 to $147 range the next few weeks.

From the stocker cattle perspective, margins have turned severely negative for cattle purchased in the spring, and it has put a negative taste in many folks mouths. However, the lower expected prices for calves this fall are a welcome occurrence. Lower prices reduce capital needs and reduce some risks simply because of the lower investment.

Based on expected fall purchase prices and expected marketing prices in the January to March time period, the expected value of gain ranges from 87 cents to 93 cents. Stocker producers should not let the bad experience from last year weigh too heavily on their decision making this year as a more traditional buy-sell margin is expected.

ASK ANDREW, TN THINK TANK: A question about changing basis values was asked this week. First off, basis is a term used to describe the difference in the cash price received in a local market and the futures market price. Basis values change across weight class and class of cattle as well as changing seasonally. However, the question asked was related to basis changing relative to the price of energy and fuel. Economically speaking, as energy costs decline then basis values should strengthen which means the cash price should strengthen relative to the futures price. However, it may take several months for basis values to reflect such changes. Human nature from the buyer’s standpoint will slow the process as buyers will be slowly adjust cash prices to reflect the market.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle –August $110.93 -1.80; October $109.85 -2.23; December $111.45 -1.90; Feeder cattle - August $139.58 -2.13; September $138.40 -2.70; October $137.38 -2.60; November $134.50 -2.70; July corn closed at $3.52 down $0.06 from Thursday.