How Production Claims Affect Retail Sales

When a consumer enters a retail store, they have more options today than ever before. Fresh beef receives a lot of focus from consumers and the beef industry is diverse and innovative in the fresh products it offers. Whether it is aging, USDA grade, or what breed of cattle the beef was derived from, consumers can find products in their local retail store to satisfy their needs.

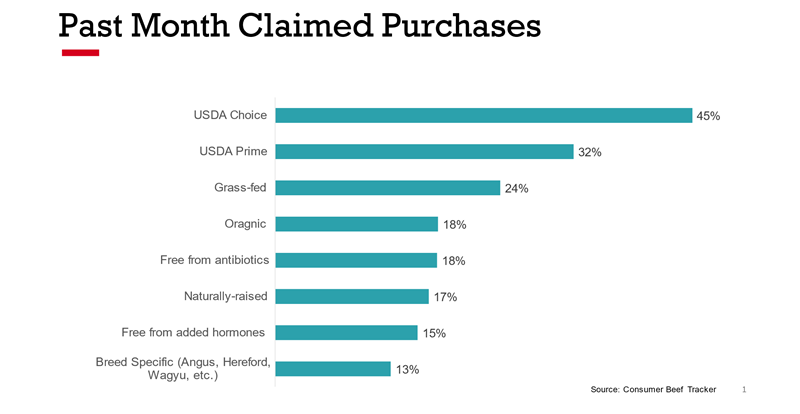

Regardless of choice, the beef industry continues to enjoy strong consumer demand. According to the Beef Checkoff’s Consumer Beef Tracker, 71% of consumers ate beef at least weekly throughout the 2020 calendar year.[i] Additionally, we know consumers are most apt to purchase items that indicate USDA grade, but around 25% of consumers claim they have purchased a beef product labeled with a production claim.1 This article will discuss some of these production claims and analyze the demand surrounding them.

To start, while reported past month purchases hover around 15-25% by each claim, volume associated with production claims such as grass fed, natural/naturally-raised, organic and antibiotic free, when aggregated together, represent about 3% of beef’s share of volume.2 This indicates that purchase frequency is actually only occasional for most consumers.

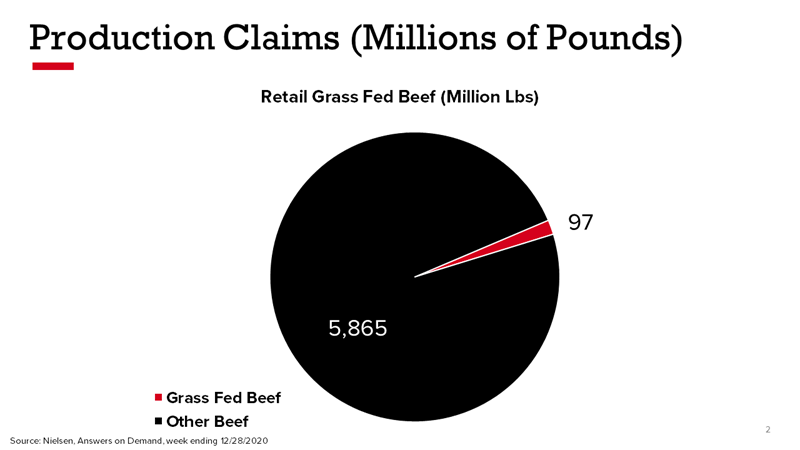

The United State’s Food Safety and Inspection Service (FSIS) is responsible for providing guidelines for what beef products can be considered “grass-fed or grass-finished”. FSIS defines grass-fed beef as beef that comes from cattle that spend their whole lives eating grass or forage.3 Grass-fed beef only makes up a small fraction of beef volume, while most cattle are grain-finished. Grain-finished means the cattle spend most of their lives eating grass or forage and then the last portion of their lives eating a balanced diet including grains.

Although most cattle raised in the United States are grain-finished, there has been a slight increase in demand for grass-fed beef since 2012. Beef marketed as grass-fed comprised 96.6 million pounds of retail beef’s 5.96-billion-pound annual market in 2020 (total beef volume sold in 2020 grew 605 million pounds year over year.) From 2019 to 2020, the market share grew 0.2% for grass-feed beef, an increased demand of 21 million pounds. Ground beef is the most popular of these labeled products, making up 80% of 2020 demand for grass-fed beef sold.2 While there is slight growth for this particular product category, market share continues to be small and will likely remain small for the near future.

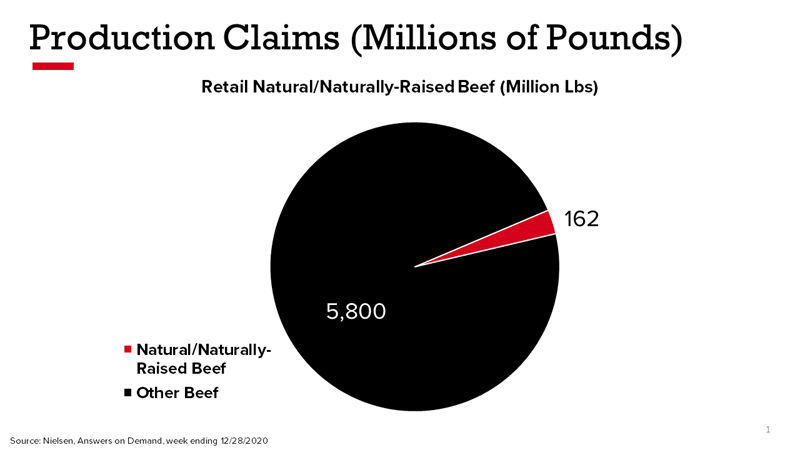

The natural and naturally raised claims at the retail level are the largest category of claims-based beef products sold. FSIS defines a product as “natural” if it is minimally processed…and does not contain any artificial flavor or flavoring, coloring ingredient, or chemical preservative.4 The “naturally-raised” claim has a slightly different definition, with the USDA defining it as cattle raised with no growth promotants and no antibiotics that can be either grain- or grass-finished. At the retail level, the claims natural and naturally raised have a significant amount of overlap. They also share a significant overlap of the market with antibiotic-free claims, because to be “naturally-raised” the product must never be given antibiotics or added hormones. Natural and naturally raised beef demand at retail saw a 0.325% increase in market shift from 2019 to 2020. In terms of total volume, year over year natural beef demand increased by 34 million pounds.2

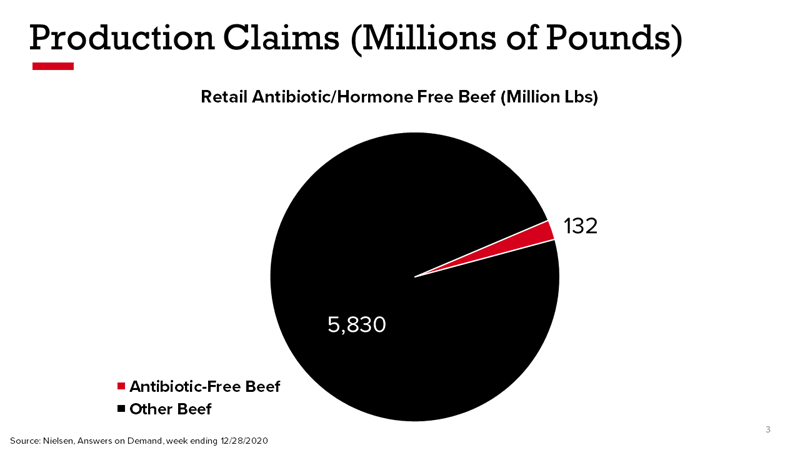

Another production claim that is often seen in the marketplace is for beef products that are free of antibiotics and/or hormones. Examining 2020 data versus 2019 data, beef labelled as “antibiotic-free” or “hormone free” experienced an 0.26% increase market share, with consumers purchasing 27 million more pounds in 2020.2 While all beef products at retail saw year over year growth due to increased demand at the retail level, the 0.26% shift in market share shows that slightly more consumers wanted the option to purchase beef that was antibiotic or hormone free in 2020.

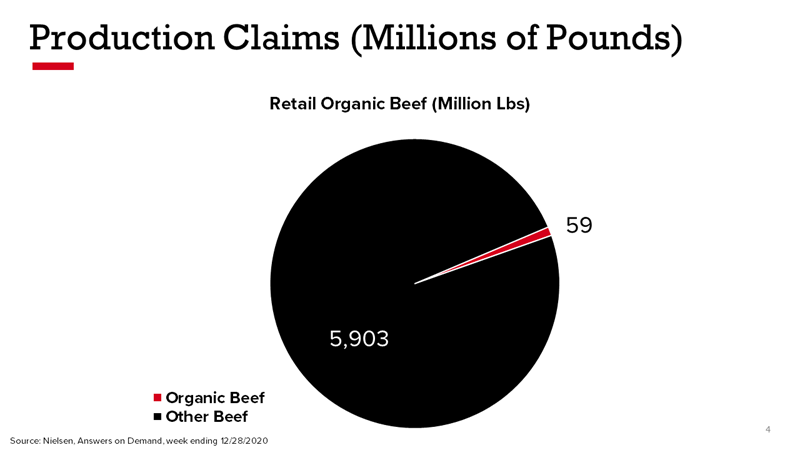

The last beef production claim we will touch on is “organic” beef. Beef products may be labelled as organic, according to the FSIS, if the production method meets these characteristics: “producers must feed their livestock 100% organic feed products, and, any animal treated with antibiotics or given growth promotants may not be sold as organic.”5 In 2020, 1% of beef sold at the retail level was labelled as organic. This has grown slightly over the past two years, with organic beef increasing its market share by 0.15% from 2019 to 2020. Ground beef products comprised 50.4% of total beef volume sold in 2020; however, the ground beef category represented 88.1% of organic beef volume sold.2

In addition to the retail segment, the foodservice industry comprises ~60% of beef demand in a traditional year; demand in 2020 will be significantly lower, due to the supply and demand shocks resulting from the COVID-19 pandemic. However, in a typical year, the foodservice industry sells ~8 billion pounds of beef. Of these 8 billion pounds, ~3.8% are sold with a natural/naturally-raised claim, 0.6% with a grass fed claim, 0.2% with an antibiotic-free claim, and 0.001% sold as organic beef.6 The 2020 pandemic’s effect of halting or slowing restaurant activity had a slightly negative impact on the percentage of beef sold under a production claim at the foodservice level, with claims-based demand holding steady or slightly dropping in 2020. While most of the foodservice volume for beef labeled with a production claim is rooted in natural and naturally raised claims, overall volume for beef labeled this way is like that seen in the retail segment.

While beef at retail sold with a production claim label represents a small minority of total beef sold, consumers do have options to choose beef products that carry production-based claims. The beef industry has shown that it is willing to adapt and provide the choices some consumers are looking for, and this production related claim data is evidence of that. Conventional beef is still the overwhelming favorite at the meat department; however, production claim-based products are expected to continue to be part of the many choices consumers have either at the grocery store or their favorite restaurant. Find an infographic explaining beef choices here and read more about how beef is responsibly raised on BeefItsWhatsforDinner.com/raising-beef.

1. NCBA / Beef Checkoff Consumer Beef Tracker, 2019-2020

2. NielsenIQ, Answers on Demand, Retail Beef Data, week ending 12/26/2020

3. United States Department of Agriculture, Food Safety and Inspection Service, Labeling Guideline on Documentation Needed to Substantiate Animal Raising Claims for Label Submission, December 2019

4. United States Department of Agriculture, Food Safety and Inspection Service, Food Standards and Labeling Policy Book, August 2005

5. United States Department of Agriculture, Agricultural Marketing Service, Organic Standards

6. 2019 Beef at Foodservice Volumetric Study, Technomic, Inc