Feeder Price Slides Challenge Stocker Operators

By Tom Brink, Top Dollar Angus, Inc.

The price slide between feeder cattle of various weights are setting extreme records this year

Anyone who has ever taken their children to a water park can attest to how much fun the slides can be. There’s a long afternoon of sun and laughter, with both kids and adults getting wet and riding the slides down into a pool.

The exception, perhaps, is on those really big slides where fun verges on fear. The tallest, fastest and steepest water slide in the world is located in Kansas City, Kan. At 17 stories high, the Verrückt slide (German for “insane”) is higher than Niagara Falls by almost 2', and more than 15' taller than the Statue of Liberty. Speeds on the way down exceed 60 miles per hour.

How do waterslides relate to the cattle business in 2015? Price differences between feeder cattle and calves of varying weights, also called “spreads” or “slides,” are setting records in the extreme. These slides are like nothing we have ever experienced before. They are big, steep, fast and possibly a little dangerous. They might even leave stocker operators and backgrounders shocked and dismayed by the time they finish the ride on marketing day.

The typical stocker scenario went something like this:

1. Buy a 550-lb. steer calf.

2. Put on 200 lb. of gain using a forage-based diet

3. Market the yearling steer at 750 lb.

The main objective was to put on weight for less than the market price of a 750-lb. steer, which ultimately is the price received for the 200 lb. of added weight. Put the gain on for $60 per cwt, sell the steer for $120 per cwt and everything works out fine. Yes, there was always price depreciation to deal with on those original 550 lb. of purchased weight. However, when feeder price slides were of the historically tame variety, this loss was

usually not of great concern.

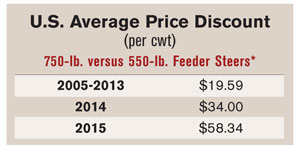

Enter the Verrückt cattle slide of 2015. During January and February, the average price discount on a 750-lb. steer versus a 550-lb. steer was an off-the-charts $58.34 per cwt. The typical 750-lb. steer sold that much below a 550-lb. steer calf ($215.28 versus $273.61 per cwt).

Assuming the market structure remains essentially the same while those 200 lb. of gain are being added, the initial 550 lb. will devalue by an unbelievable $321 per head.

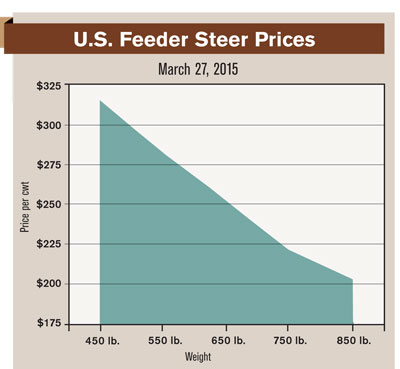

Rapid price descent from one weight group to the next heavier weight group equals rapid devaluation of the pounds initially purchased. The result is a big financial hole to dig out of for anyone adding weight to cattle this year. This is a slide that will take you down far and fast and could rough you up along the way.

|

The price discount on a 750-lb. steer is nearly three times larger in 2015 versus the average discount from 2005 to 2013, showing more risk for backgrounders. |

As shown in the table to the right, the discount on a 750-lb. steer is three times larger in 2015 versus the 2005 to 2013 average. This means purchased pounds are devaluing three times faster as well.

The good news (this market does have some of that to offer, too) is the 200 lb. being added is worth a lot of money. Using the price scenario mentioned, 200 lb. of added weight priced at $215.28 per cwt amounts to a value add of $430.56 per head. That’s another very big number and is fortunately more than enough to cover the devaluation of the initial pounds purchased and yield a gross margin of $109.71 per animal (before feed and other expenses).

There is hope for profitability, but note those 200 lb. must be added efficiently and, for sure, at a low cost per pound of gain. Simple math applied says that each 100 lb. of added weight must cost no more than $55, or there is no chance of reaching a breakeven—short of the entire market trending higher. The market might, in fact, move higher or lower while the weight is being added. However, the salient point is this is a market structure that affords very little room for error, little room for death loss and no room at all for anything but a super-competitive cost of gain.

Harvested forage costs have generally come down over the past 24 months, which will help many stockers and backgrounders add weight cost effectively. National average non-alfalfa hay prices during January this year were down $10 per ton compared to January 2014 ($152 versus $162 per ton). Some important cattle states, such as Nebraska, Colorado, Kansas and Texas, have recently experienced even larger year-on-year declines in hay costs.

Grazing costs are another matter. The federal grazing fee for 2015 has been set at $1.69 per animal unit month (AUM) for public lands administered by the Bureau of Land Management and $1.69 per head month (HM) for lands managed by the U.S. Forest Service. The comparable 2014 fee was $1.35.

In the Kansas Flint Hills, pasture rental rates hit a new high in 2013 at $23.70 per acre with full care provided. The unabated uptrend in lease rates for this important stocker region has been tracking along for nearly a decade and is almost certain to hit another new high this summer. Why? Because most pasture rents are tied very closely to the absolute price of cattle. Landowners watch the cattle market too, and as prices go up, they expect to be paid more.

Obviously, producers will continue to grow cattle from calves into yearlings as always. The bigger question for 2015 is whether they can do so profitably. High prices may offer the illusion that profits are easy to come by, but reality is different. High cattle prices and relatively low grain prices have produced a feeder cattle market with the steepest slides in history. For stocker/backgrounders, the best advice is: Hold on, keep both eyes open and analyze your costs and breakevens carefully. This year’s insane price slide is certain to challenge even the best managers in the business.

|

This graph represents the average feeder cattle price slide on prices reported by USDA Market News on March 27, 2015. The visual reputation shows the increasing amount of risk for stockers and backgrounders. |