The following information is bonus material from Top Producer. It corresponds with the article "Basis Gets a Boost” by Charles Johnson. You can find the article on page 22 in the Summer 2009 issue.

Drive the nation's highways this summer and you can't help but notice railcars parked on sidings across the countryside. That idled equipment is a harsh indication of transportation companies' distress during this recession.

Reduced trade means fewer railcars, trucks and ships are needed. In the short term, less competition for freight is helping farmers and grain handlers (see sidebar). Long-term, though, possible transportation industry consolidation as a result of the recession might make it more costly for agricultural shippers.

"Right now there's all sorts of excess capacity in the transportation industry. But a year from now, as the carriers contract, things might be somewhat different,” says Jerry Fruin, University of Minnesota ag economist specializing in transportation.

Class I railroads have idled more than 200,000 railcars due to the recession, says Matthew Rose, BNSF chairman, president and chief executive officer. His company alone has 43,000 railcars parked. "My biggest problem right now is finding a place to store all this stuff,” Rose says.

Many privately-owned railcars are out of service, as well, says Ken Eriksen, Informa Economics senior vice president for transportation. And when railcars are parked on privately-owned sidings, the railroads pay daily storage fees of $3 to $20 per car, Eriksen says. "On a monthly basis, that can be more than a car leases for,” Eriksen says.

However, even with excess cars, railroads have not yet significantly dropped tariffs, Eriksen notes. "But with lower fuel costs and therefore lower fuel surcharges, rail rates actually paid are lower on an annual basis.”

On the Roads.

Trucking companies have likely been hit even harder than railroads. "There probably are 600,000 too many trucks in the system,” says Eric Starks, president of Freight Transportation Research Associates, which tracks and forecasts the industry. "The public guys are shedding equipment at a fast pace. It's somewhat alarming. There's a significant amount of idled equipment and it will continue to grow over the next two years.

"Truckload rates have been coming down,” he adds "Through 2010, it'll be difficult for these guys to push rates up at a substantial pace. Rates should still be low for a while because there's plenty of capacity out there to move stuff.”

Truck manufacturers feel the squeeze, too. "Truck manufacturers have pulled back production at an alarming pace. They're back to a level we haven't seen since 1982. It's going to be painful out there for several years for truck manufacturers,” Starks says.

Steamships have also been idled as shipping rates plummeted for ocean-going drybulk and container vessels. When the economic downturn hit, ship owners had as many as 3,500 new vessels on order, Eriksen says. Relatively few orders have been cancelled so far but he thinks as many as half could possibly be put on hold. It should all still add up to increased capacity.

Over the Waves.

Rates to ship grain from Gulf and Pacific Northwest ports are currently running less than half what they were a year ago. Containerized grain shipments, which accounted for a sizable portion of U.S. exports to Taiwan not long ago, have virtually stopped. "Last year about 4% of our total grain exports went in containers. That is down to 2% now, and we have much lower exports than we did a year ago. Even though container freight rates have collapsed, right now it's better value to move in bulk rather than in containers,” Eriksen says. "The container excitement has really cooled off. It's my understanding that some container operations are for sale.”

The intermodal shipping business based on containers is also doing poorly. "The ones really struggling are those in the Pacific Northwest or California where they have to rely on grain cars being brought to them, and then they transload at the ports,” Eriksen says.

Barge rates declined along with the other transportation sectors. "It's attractive to get grain down to the Gulf. You've got fairly weak barge freight rates and it will probably be that way for the foreseeable future,” Eriksen says.

However, the barge industry continues to shrink. "This is the tenth year in a row that the barge fleet has been smaller than the year before. Old barges are being scrapped or sent to South America,” Eriksen says. "Twenty-eight percent of the barge fleet is 25 years or more old. All those aged barges could be gone in five years, the way things are going.”

Ag Rules the Rivers.

Due to the recession, grain is about all that is moving on barges right now, except for some fertilizer coming northward along the Mississippi River.

Tough times in the transportation sector may be positive for agriculture, at least in the short term. "You have less congestion and more favorable shipping conditions in the short run,” Fruin says. "It gives farmers and grain handlers a break.

"But I think the big trucking firms and railroads are looking at some losses this year and that will contract the rolling stock and the number of trucks that will be available next year,” he adds. The question is how soon the transportation companies come out of it and how much damage is done to them before that event,” Fruin says.

If operators take railcars, towboats or ships out of service hoping to preserve some rate stability, it will tighten up the capacity, Eriksen says. "Then, if you get a snapback in the economy and we get things going really hard, we could see some accelerated freight rates just because we've got stuff moving again.”

Silver Lining for Farmers

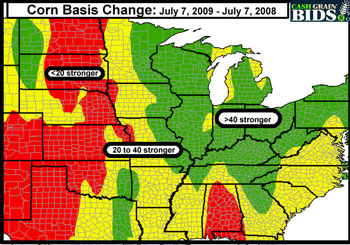

Basis has improved through much of the Corn Belt, reports Kevin McNew, president of CashGrainBids.com. "We've seen basis levels return to what we used to think of as normal in the early 2000s. Farmers are not having to bear the impact of high transportation costs, so they've won in that sense.”

As the map shows, weaker barge rates have helped raise basis levels, especially in the Illinois and Ohio River regions, where barge rates fell 40¢ in the last six months (Mississippi rates fell 20¢).

"Eastern Corn Belt basis also has strengthened more than the Western Corn Belt, partly because corn use for ethanol has been sluggish,” says McNew. That may turn around a bit in 2009/10 because of new ownership of some key Verasun plants, energy prices moving high and corn prices dropping, he believes.

In addition, "Western Corn Belt acres were up more than the Eastern portion, according to USDA's June acreage report,” he says. "Iowa, Nebraska and South Dakota, which account for about a third of the U.S. corn crop, are pegged to have 5.4% more acres this year, while all U.S. corn acreage is up only 1.8%.”

"Looking ahead for fall, the barge market is still struggling with trying to get the high prices of the past when they look ahead to fall delivery,” says McNew. "Fall barge rates are contracted at levels we were accustomed to last ya when prices were still high. My gut says that those will come down when we get to harvest, so I think basis levels should be fairly favorable this fall. The barge market has worked in the farmer's favor for the past six months and I expect it will continue reasonably good for the next six months as well.”

-- Charles Johnson