Want to Grow Your Farm? Ask These 10 Questions First

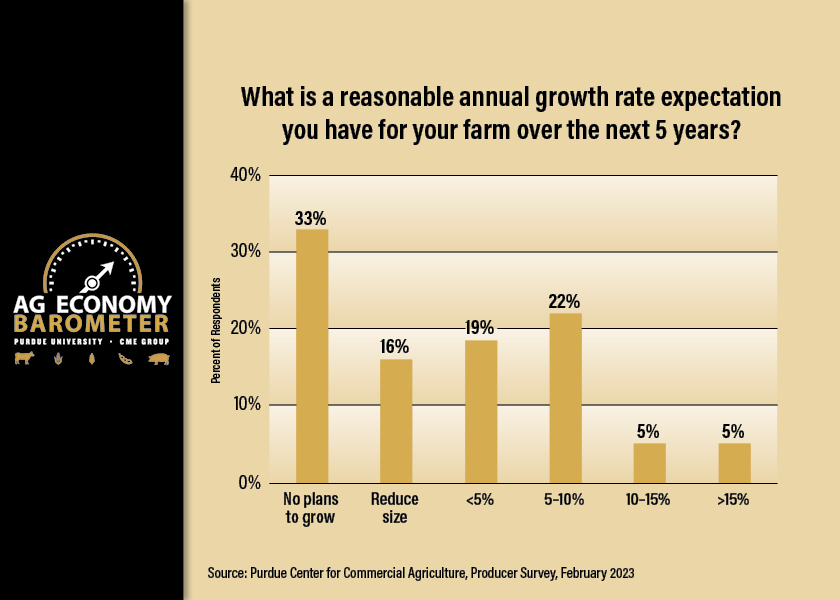

More than 50% of farmers intend to grow their operation, based on responses in Purdue’s February 2023 Ag Economy Barometer.

If you’re thinking about scaling your farm, Michael Langemeier, Purdue ag economist, says it’s important to first ask these questions.

1. Why should I grow my operation?

Before an operation expands, consider the vision and direction you want your farm to take.

“Are you interested in a commodity-based approach or a differentiated product strategy? Commodities will focus on cost control while products will be centered around value-added production and above-average prices for your crops,” Langemeiers says. “Start here and consider how growth impacts your direction.”

Once an approach is chosen, it’s time to decide which dominoes you want to play in the expansion game.

2. What ways I can grow my farm?

There are many ways to expand an operation: acquire land, new equipment and technology, upgrade facilities, etc. However, Langemeier says some producers need to think outside the box.

“Don’t just think about what you currently do or have always done. This step is a good time to do some soul searching to consider where you want to be in five to 10 years. Do you want to be the same enterprise, or do you want to make changes?”

Langemeier says this soul-searching step is especially important when someone is coming back to the farm.

“We’re seeing that a lot of students who come from farms want to go back, and we have to look into whether there are opportunities there or not,” Langemeier says. “There’s always new interest and ideas that come with the transition back to the farm.”

After establishing how you want to grow, consider your growth approach.

3. What should my growth approach look like?

A strengths, weaknesses, opportunities and threats (SWOT) analysis is a common growth approach in business. Langemeier says another way to think about SWOT is in terms of internal and external analysis.

“Internal analysis means looking at key resources and capabilities of a team or operation,” Langemeier says. “Does someone possess a unique skill you can maximize? Take advantage of those unique skillsets.”

Internal analysis mainly centers around strengths, but weaknesses play a role here, too. Are there areas in your operation that need professional development? Langemeier says this is the time to work on both.

External analysis, on the other hand, examines economic and market trends.

“The easiest example is in livestock; raising pasture pork, poultry or beef, or offering direct meat from a producer rather than a grocery store, are all growing trends,” Langemeier says. “If you have those opportunities, think about how they might fit into your operation.”

While there’s more risk in external factors, Langemeier says “the risk can be worth the reward” for producers who understand what trends they can support.

4. How do I evaluate my farm’s growth ventures?

Now that the growth options are laid out, how does a producer choose which option to pursue?

These eight criteria can help:

• Strategic fit

• Expected returns

• Risk

• Capital required

• Cost and ease of entry and exit

• Value creation

• Managerial requirements

• Portfolio fit

Strategic fit is one of the biggest points to consider, according to Langemeier.

“A few years ago, many growers were interested in hemp production. I would ask them if hemp would require new machinery and if they were used to dealing with contracts,” he says. “If the answer was yes and no, then it probably wasn’t going to be a good fit.”

He says ease of entry and exit is the second criteria he points farmers to.

“If your farm were to pursue a new venture and it fails, would it mean you could lose the whole farm? Because there will be things that fail,” Langemeier says.

If a specific venture requires a lot of capital, he says it is pivotal to explore how the investment could affect balance sheets in the long run.

5. What skills are needed to grow, especially in people returning to the farm?

Taking stock of employees’ skillsets, this is the part where growers consider the strengths and weaknesses of human capital currently on the farm and those soon returning to it.

“When someone’s thinking about coming back to the farm, that’s the time to assess the skills that are currently needed, and then try to encourage the younger person to garner some of those skills,” Langemeier says. “We might have the skills to expand our operation, but do we have the skills to start a new venture in a different enterprise? Think about it from all angles.”

6. How do I finance?

Are you willing to take on debt to expand? If so, how much debt are you willing to take on? Langemeier suggests looking at debt as enabling you to take advantage of an opportunity, not as a negative.

“If you have 2,000 acres and are thinking about adding 1,000 acres, even if that’s leased ground, you’re still going to need more machinery and people. You probably don’t have that retained earnings, so you’re going to take on debt,” he says. “As long as you’re making a profit on those additional acres, and you can make the debt payment, it’s not a problem.”

Langemeier warns that a small profit margin can quickly turn into an issue when a venture flops. He advises producers keep a somewhat equal balance of debt and projected venture profits.

7. What business models do I use to grow?

Expanding internal growth with retained earnings and debt is a typical business model for most operations, according to Langemeier. He says there’s a new trend in this arena.

“I’ve seen a lot of production ag cases recently where a farm acquires assets from a retiring farm,” he says. “Not only do they farm the land, but they also buy the machinery, the bins and the whole farm. This really works for some operations.”

Another model that’s becoming somewhat common is a joint venture. Agribusinesses use this model frequently, but Langemeier says more mid-sized operations are leaning toward this option.

“One of the advantages of joint-venture contract turkey, laying or finishing operations, especially in the Corn Belt, is that there’s a partner with you,” Langemeier says. “It allows us to grow effectively.”

Finding a partner to go-in on the venture isn’t always easy. However, Langemeier says producers often look in the wrong places.

“Some farmers say they don’t have any outside investors, so I tell them to think about family or non-farm heirs. Pitch it as a way of investing in your business so that you don’t have to make them partners or an operating entity,” he says. “Land, for instance, could be an outstanding source of outside equity with non-farm heirs.”

8. How would an expansion impact my current operation?

When considering growth options, it’s vital to your growth success to consider how each option will impact the farm’s balance sheet and income statement. Langemeier suggests running three projected scenarios — worst, most likely and best case — through a spreadsheet or a software, like the University of Minnesota’s FINPACK system.

If you choose to run the projections by hand, this is the process Langemeier suggests:

a. Impacts on cash flow and balance sheet

“A growth change will impact both — don’t just look at cash flow,” he says.

b. Debt versus equity

“Maybe the change will reduce your liquidity and increase your solvency too much,” he says. “If that’s the case, you can’t pursue that particular venture.”

c. Time management

“There are only so many hours in the day, and some of us sometimes work too much,” Langemeier says. “Say you’re going from conventional to organic, it’s going to be management intensive. Be realistic about what you and your team can handle.”

9. What challenges would an expansion create?

Construction delays, cash flow shortages, depleted working capital, short-term inefficiencies and management bottlenecks are often at play when starting a new venture, according to Langemeier. He advises producers to be proactive.

“If a venture creates massive cash flow shortages and eats into your working capital, you need to have a plan to deal with those issues. If you don’t, it will lead you into other challenges, like inefficiencies, and you’ll end up with a failed venture,” he says. “Make sure you have a contingency plan.”

10. What is my sustainable growth rate?

Calculating a sustainable growth rate means saying what a growth rate would be if retained earnings is the only money used, and then compare that to what a growth rate would be if only debt was used. Langemeier says this equation has other variables that often go unchecked.

In the debt scenario, he says you have to think about the downside of debt — the chance of going bankrupt and variability.

“Even if your operating cash flow is low, the lender still wants his payments,” Langmeier says. “You have to think about the coping strategies to make those debt payments even when corn is at $5, compared to $6.50. Make sure you run all the numbers imaginable.”

The Main First Step When Considering Expansion

With all 10 points in mind, Langemeier says the first stage of growth shouldn’t include producers running to formulate a 50-page business plan. He says step one starts with a conversation.

“You should be having regular farm and family meetings, at least once a year, to brainstorm with your employees and family members about the things you could do differently on-farm, and allot time to consider continued improvement, opportunities and threats,” he says.

According to Langemeier, these meetings will offer more than exploring growth; they will ensure farm, family and employee survival.