The Case for AMAs

The predominance of alternative marketing agreements (AMA) in 2020 meant that the Big 4 packers — Tyson, Cargill, JBS and National Beef — had much of their slaughter needs filled well in advance, reducing their interest in offering cash bids. Meanwhile, demand for beef spiked higher creating historic windfall profits for packers. Many independent cattle feeders were squeezed for months.

“Perhaps no relationship is currently more relevant than the relationship of fed cattle inventory to processor capacity,” Kansas State livestock economist Glynn Tonsor told members of the Senate Ag Committee at a hearing in June.

Many cattle producers see a broken market with packers wielding too much leverage. That chorus grew loud enough to catch the attention of influential farm-state lawmakers. The disparity between wholesale beef prices and live cattle prices hurts both cattle producers and consumers, according to South Dakota Senator Mike Rounds. He sent a letter to the U.S. Department of Justice seeking protection for consumers and producers from what he called “anticompetitive practices.” In a tweet, Rounds says “independent cattle producers are going broke despite the high demand for their product.”

Other senators offered a legislative fix. Nebraska Sen. Deb Fischer says the Cattle Market Transparency Act of 2021 will “help facilitate price discovery.” A key provision would establish regional mandatory minimum thresholds of negotiated cash and negotiated grid trades to enable price discovery.

Iowa Sen. Chuck Grassley and Montana Sen. Jon Tester reintroduced legislation that would require a minimum 50% of a meat packer’s weekly volume be purchased on the open or spot market. Referred to as the “50/14” bill because it requires cattle be delivered within 14 days, they say the bill is designed to “foster efficient markets while increasing competition and transparency.”

Market Balance

Proponents of the two bills say new regulations are needed to help restore balance to cattle markets while increasing competition and transparency among meat packers.

At June’s Senate Ag Committee hearing, U.S. Cattlemen’s Association vice president Justin Tupper testified his group views the 85% market share control by the Big 4 packers as an “oligopoly,” with only two ways to level the playing field.

“We can either work to eliminate the occurrence of anti-competitive practices and market manipulation in the meatpacking sector, or we can break them up.”

However, breaking up the Big 4 is unlikely the fix cattle producers seek. Tonsor says the large packers benefit from efficiencies that would be lost if their size was reduced.

Quest for Quality

A generation ago the beef industry was in peril. The landmark 1991 National Beef Quality Audit confirmed beef was losing market share and one out of four beef eating experiences was unsatisfactory. Former American Hereford Association executive Hop Dickinson summed up the 1991 study, “Cattle are too big, too fat and too inconsistent.” It was either the beginning of the end for beef, or the beginning of a revolution. Indeed, by the end of the 1990s, beef had made a remarkable turn-around.

“From 1980 to 1994, we saw a 12-lb. drop in per capita beef consumption,” says Randy Blach, president and CEO of CattleFax. Even with declining supplies, cattle prices traded in a $20 per cwt range throughout that time period because, Blach says, “We weren’t doing a good job of putting a product in front of consumers that they really enjoyed, and they were voting with their pocketbook.”

The mid-1990s saw many producers begin to embrace the concept of value-based marketing. They became intent on improving the quality of their cattle, and they wanted to be paid for doing so. Preconditioning gained popularity, and many niche markets emerged, such as natural and non-hormone treated cattle (NHTC).

At the next step, Blach says, producers began to see value when cattle were sold on a grid or formula basis. A higher trending Choice-Select spread during the late 1990s and early 2000s, he says, was the economic signal for producers to strive for quality.

Fast-forward to 2020, and grid and formula arrangements, or AMAs, comprised 64% of fed cattle marketings. USDA data says 23% of cattle sales were negotiated cash, with 5% negotiated grids and forward/basis contracts at 8%. Critics of AMAs call them “turn-in cattle,” but producers are finding average premiums of $31 per head.

“Value-based marketing has demonstrated the ability to transition or transform an entire industry,” says Certified Angus Beef CEO John Stika. For instance, the CAB brand needed 5.5 million head of cattle last year to meet the growing demand in the U.S. and 51 foreign countries. Stika says in 2020 the brand sold “1.2 billion pounds, which translates into $92 million in premiums that flowed directly back into the hands of cow-calf and feedlot operators.”

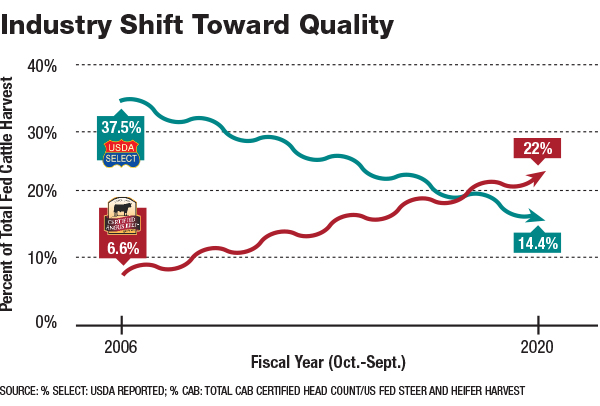

Consumer demand for higher-quality beef is evident by comparing CAB with Select, Stika says. In 2006 CAB represented just 6.5% of the annual fed cattle harvest, while Select stood at 37.5%. By 2020 CAB had grown to 22.0%, while Select declined to 14.4%.

Producer Premiums

“Producers don’t make that change by accident,” Stika says. “It’s intentional, because of the economic signals that we’ve seen.”

During his remarks to the Senate Ag Committee, Gardiner Angus Ranch CEO Mark Gardiner said beef’s quality shift over the last quarter-century has been driven by the premiums producers earn through value-based marketing.

“The smallest producers have reaped the highest dollar per head value on value-based grids,” Gardiner said. Solutions such as AMAs benefit producers, and he urged the committee, “Please do not create regulations and legislation that have the unintended consequence of harming value-based marketing. Doing so would undo many years of progress for producers such as our customers.”