Market Highlights: Time to Get Savvy Selling Cattle

By: Andrew P. Griffith, University of Tennessee

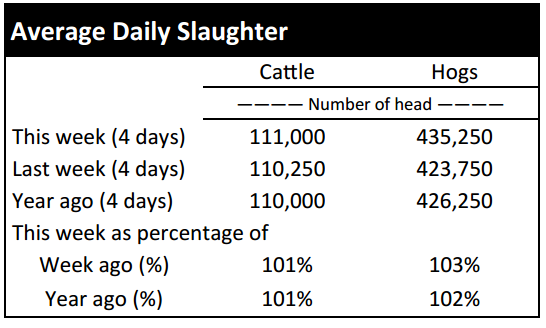

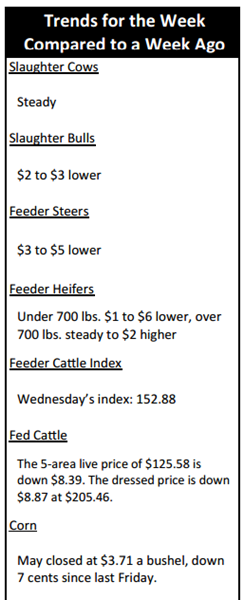

FED CATTLE: Fed cattle trade was $7 lower than a week ago on a live basis. Live prices were mainly $125 to $127 while dressed trade was all over the board. The 5-area weighted average prices thru Thursday were $125.58 live, down $8.39 from last week and $205.46 dressed, down $8.87 from a week ago. A year ago prices were $158.91 live and $252.14 dressed.

The cash fed cattle market is suffering from a complete implosion of the live cattle futures market. The April live cattle contract has declined $9.65 in the past two weeks which is a 7.2 percent price decline. Similarly, the June contract has declined $9.38 over the same time period which is a 7.6 percent price decline.

The price decline the past two weeks is a reduction in total revenue per finished animal of $125 to $135. Cattle feeders have been trudging through negative margins for some time now and the only relief they have received is through feeder cattle prices declining. Now their concerns will turn to finished cattle prices declining and corn prices beginning to rise. Digging out of the hole will continue to be a tough chore.

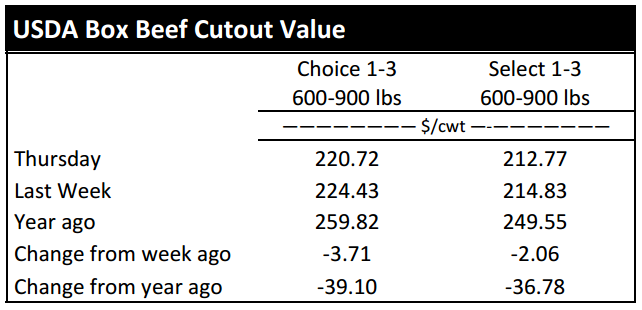

BEEF CUTOUT: At midday Friday, the Choice cutout was $220.50 down $0.22 from Thursday and down $4.53 from last Friday. The Select cutout was $211.56 down $1.21 from Thursday and down $4.74 from last Friday. The Choice Select spread was $8.94 compared to $8.73 a week ago.

Packers lost the better part of 40 percent of what they gained the previous week in relation to beef cutout prices. However, this has not set packers back too far as packer margins remain relatively strong for the time of year. The biggest factor positively impacting packer margins so far is the failure of finished cattle prices to gain any traction. Packers have no qualms about what they are paying for finished cattle and will likely have no complaints continuing to pay current prices if the cutout prices remain steady or strengthen. Cattle feeders will eventually regain some leverage which will put pressure on packers as they attempt to secure harvestable cattle, but that may still be several months down the road.

One aspect of the beef cutouts to make note of is the Choice Select spread. The spread was near $3.50 in the middle of February before shooting to $10.16 by the middle of March which is a wide spread for the time of year. It has had a sideways pattern since then. However, the current spread is higher than its seasonal tendency and will likely widen a little more in May and June.

OUTLOOK: It would almost seem that fundamentals have little to do with the movements seen in feeder cattle futures contracts these days. The futures market is supposed to be reflective of what is happening in local cash markets and thus provide producers the opportunity to use the futures market for price risk management purposes. However, the ability to successfully hedge feeder cattle appears difficult since it seems technical trading supersedes fundamental trading.

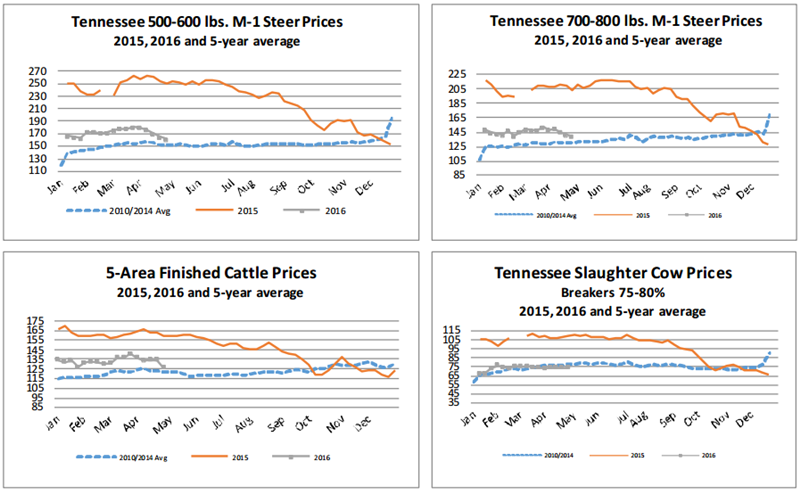

Thus, producers are going to have to be a little more savvy in marketing calves and feeder cattle since forward pricing opportunities appear limited. It is difficult to outguess the market so the best bet may be for producers to look at the historical trends of calf and feeder cattle prices.

For producers with lightweight freshly weaned calves, market prices will trend downward from now through the summer and into the fall. If downward trending prices are a concern for producers who just had a crop of calves hit the ground then considering a weaning and preconditioning program to carry those calves into January or February of 2017 might be an alternative worth evaluating.

For producers with 400 to 600 pound calves in the current period then a preconditioning program may also be appropriate for these operations as feeder cattle prices tend to strengthen through the spring and into the summer months. High cattle prices the past couple of years have resulted in strong profitability for most cow-calf producers. However, profitability the next several years will likely be more dependent on cost management during a time of relatively strong prices.

Stocker producers’ biggest challenge will not be the sale price but rather the purchase price of calves. Depending on the intended marketing strategy, stocker producers may have to reconsider the class and weight of calves they purchase while also making sure that weight class fits the feed, labor and land resources. Prices may seem terribly low compared to 2014 and 2015, but profits can still be made in the cattle business.

The April cattle on feed report for feedlots with a 1000 head or more capacity indicated cattle and calves on feed as of April 1, 2016 totaled 10.85 million head, up 0.5% from a year ago, with the pre-report estimate average expecting an increase of 0.9%. March placements in feedlots totaled 1.89 million head, up 4.6% from a year ago with the pre-report estimate average expecting placements up 7.0%. March marketing’s totaled 1.75 millon head up 7.1% from 2015 which is consistent with the pre-report estimate of up 6.9%. Placements on feed by weight: under 700 pounds down 2.0% and 700 pounds and over up 8.2%.

ASK ANDREW, TN THINK TANK: No questions were received this week. Therefore, it provides the opportunity to discuss pregnancy checking cows. Producers should utilize some form of pregnancy detection following the breeding season. There is a tremendous cost of carrying a cow or heifer that did not get bred during the breeding season. Some producers may desire pregnancy detection soon after the breeding season while others may wait until weaning of the current calf crop. Regardless of the timing, there is a tremendous cost savings associated with marketing open cows and not feeding them until the calving season. Producers not utilizing a pregnancy detection method should evaluate the impacts to their operation.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle –April $124.73 -1.78; June $114.65 -2.25; August $111.55 -2.38; Feeder cattle - April $147.95 -1.50; May $142.45 -3.00; August $142.10 -3.95; September $141.58 -3.45; May corn closed at $3.72 down $0.13 from Thursday.