Market Highlights: Thanksgiving Cattle Leftovers

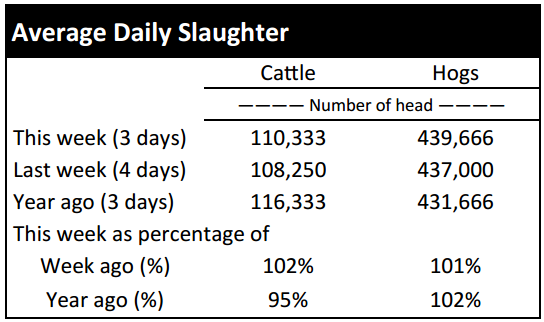

Trade for cattle was much lower for Thanksgiving week than last year, but slightly up from the previous week.

By: Andrew P. Griffith, University of Tennessee

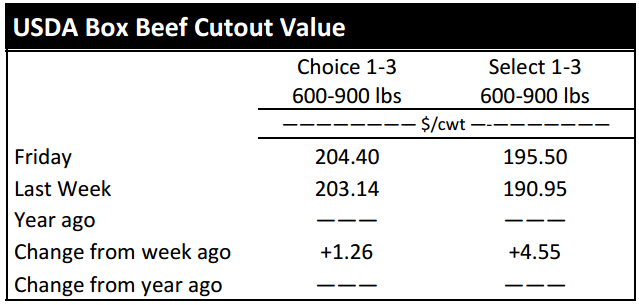

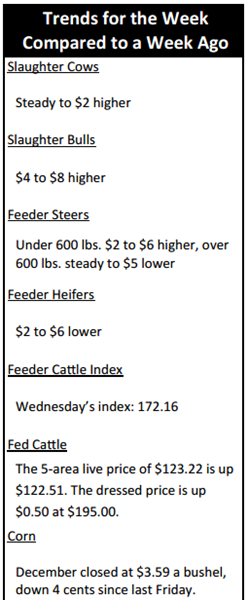

FED CATTLE: Fed cattle trade was not well established this week to determine a trend relative to one week ago. The holiday shortened week resulted in few cattle being traded, but there was a stronger undertone. The 5-area weighted average prices thru Thursday were $123.22 live, up $0.71 from last week and $195.00 dressed, up $0.50 from a week ago. A year ago prices were $171.96 live and $266.41 dressed.

Even though few cattle were traded this week, there was some indication of a strengthening market. Futures contracts attempted to move north towards the end of the week. It would be an overstatement to say that futures market prices strengthened, but most contracts did see positive movement on Wednesday and Friday. Similarly, the cash market had a bullish undertone to end the week.

It is not likely cattle prices will make a very strong run the next couple of weeks as a sideways trade may be more likely than any other movement. Packers will be hard pressed to pay higher prices unless wholesale beef prices pick-up the next few weeks, but rest assured that cattle feeders will try to hold out for higher prices.

BEEF CUTOUT: At midday Friday, the Choice cutout was $204.98 up $0.89 from Thursday and up $0.21 from last Friday. The Select cutout was $195.67 up $1.91 from Thursday and up $2.68 from last Friday. The Choice Select spread was $9.31 compared to $11.78 a week ago.

Now that Thanksgiving has passed, the thought is that retailers will focus on featuring beef items instead of alternative meat proteins. It is likely some retailers will feature a few beef items, but trying to guess how much these features will bolster the beef cutout is a crapshoot.

Consumers have been pushed away from many beef items due to retail prices which have surged the past 24 months. The beef features may bring some consumers back for a short time as they get in the holiday spirit. However, the best guess is that holiday features will provide a minimal amount of support the next few weeks, but the support will disappear when retailers move beef item prices back to the pre-feature price.

Retailers cannot afford to lower beef prices for very long, because they have to make up for the margins lost as the beef cutout escalated. Following Christmas and the New Year celebration, beef will continue to come under pressure as end meats receive most of the attention from consumers and middle meats get pushed to the side.

OUTLOOK: Feeder cattle prices this week compared to last week were marked as stronger based on cattle receipts in Oklahoma City, but that was not the case this week based on the few markets reported in Tennessee. It may not be very telling of what happened based on Tennessee cattle markets using the limited quantity of data available.

Due to the Thanksgiving holiday, several auction markets did not host a sale while some of those that did market cattle were not reported by market reporters. Feeder cattle futures had a stronger undertone late in the week and traded sideways early in the week which would indicate a steady to slightly stronger market.

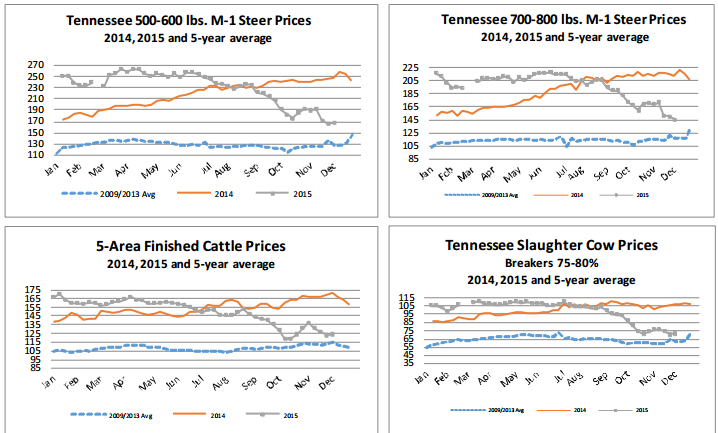

Based on Tennessee auctions, light steers did find some support this week while the price of feeder steers and all weight classes of heifers softened. As has been said several times in the past couple of months, there is little information to support a sudden increase in calf and feeder cattle prices before year’s end. Any positive price movements will likely be delayed until after the first of the year and it may be February or March before any substantial price increase is witnessed.

It still appears the market is offering stocker producers and backgrounding operations the opportunity to purchase cattle fairly inexpensively and potentially return a positive margin. The opportunity appears even more enticing with the expectation that feeder cattle prices will increase slightly relative to current prices. On a secondary note, the slaughter cow market has declined nearly $30 per hundredweight since the middle of August.

This decline would be worth $360 per head for a 1,200 pound cow. For someone looking to get one more calf out of an underachieving cow, all profits gained on the calf have been lost due to the value of the cow declining. Slaughter cow prices are expected to round back into form by late April and through May, but it will be tough for them to exceed the $1.00 per pound mark like they did in the late spring of 2015. Producers are encouraged to watch the cow market closely in order to make timely marketing decisions with poor producing cows.

ASK ANDREW, TN THINK TANK: One question that has been thrown at me several times in recent weeks concerns the price of bred heifers. This is a tough question because the quality of the heifer should play a major role in what she is worth. There have been several heifers bred in the past 24 months that should have found their way to the feedlot, and they are not as valuable as top quality or good quality heifers. However, it is likely producers will continue to pay $2,200 to $2,400 for good quality heifers in 2016. If feeder cattle prices rebound at all then the aforementioned prices will be paid regularly.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle – December $131.83 0.88; February $133.85 0.73; April $134.13 0.18; Feeder cattle - January $166.03 1.05; March $163.68 0.55; April $165.13 0.45; May $165.33 0.10; December corn closed at $3.59 down $0.07 from Thursday.