Market Highlights: Demand for Quality Beef Driving up Prices

By: Andrew P. Griffith, University of Tennessee

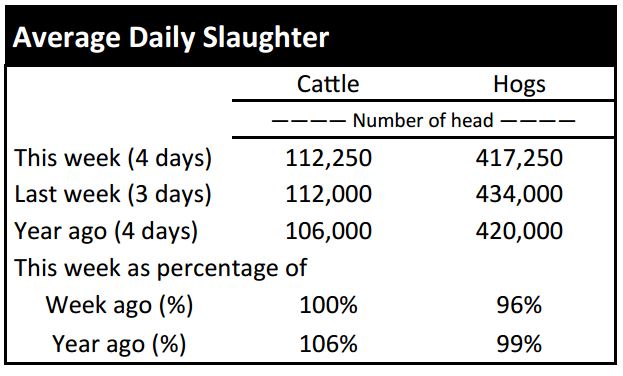

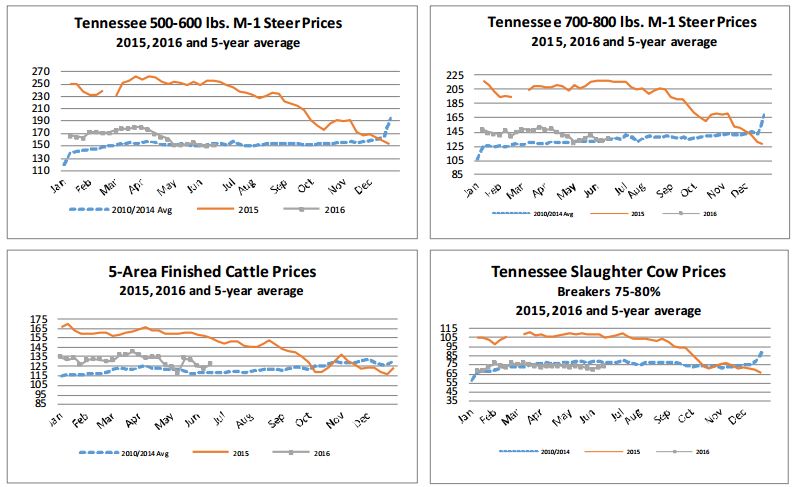

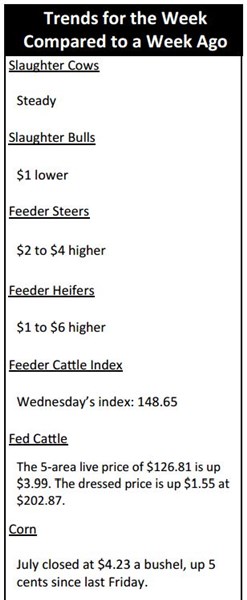

FED CATTLE: Fed cattle trade was steady to firm compared to a week ago. Live prices ranged from $126 to $128 while dressed price bids were $200 to $206. The 5-area weighted average prices thru Thursday were $126.81 live, up $3.99 from last week and $202.87 dressed, up $1.55 from a week ago. A year ago prices were $154.86 live and $245.19 dressed.

Finished cattle prices had a wide range this week. The wide range is due to the boxed beef spread. High grading cattle are bringing great premiums compared to their lower grading pen mates because the Choice boxes are trading at a huge premium compared to Select boxes.

Cattle feeders are pushing cattle through the system to take advantage of the strong prices and the profitable margins. Cattle continue to grade fairly well considering many calf fed animals are being harvested. The most recent data has 68.5 percent of cattle grading Choice which is about 0.75 percent below a year ago but 6.4 percent higher than the five year average. If conditions remain favorable, cattle feeders will continue pulling cattle forward.

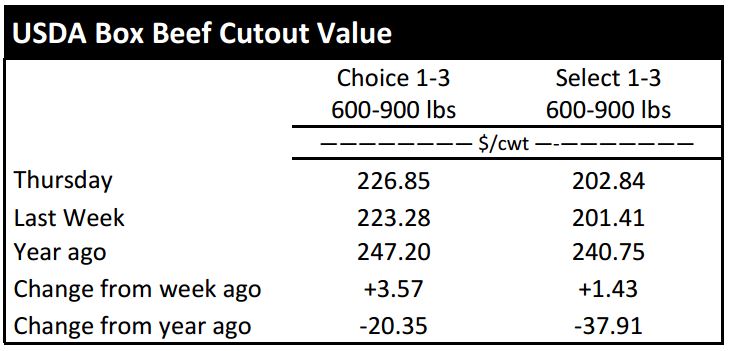

BEEF CUTOUT: At midday Friday, the Choice cutout was $226.98 up $0.13 from Thursday and up $4.25 from last Friday. The Select cutout was $203.72 up $0.88 from Thursday and up $2.95 from last Friday. The Choice Select spread was $23.26 compared to $21.96 a week ago.

The beef cutouts received support this week, but the magnitude of each cutout is not the storyline. The storyline is the Choice Select spread which is the widest it has been since October of 2003, just prior to the first reported case of BSE in the United States.

The weekly Choice Select spread has exceeded $20 only 25 times prior to this week dating back to January of 1999. In 2003, there was an eight week span from September into November in which the spread exceeded $20.

The Choice Select spread peaked the week ending October 4th at $33.12 which is the largest spread recorded. The spread again exceeded the $20 level for three consecutive weeks in May 2004. Two years later, a run of nine consecutive weeks with the spread exceeding $20 was witnessed from May through July. It took until November and December of 2012 before the spread widened to $20 again and it stayed above that mark for four consecutive weeks.

Last week was the 25th time for this occurrence, but the question is what is driving it? One thing that is driving the spread is consumers’ demand for higher quality beef.

OUTLOOK: A small resurgence in calf and feeder cattle prices occurred this week on Tennessee auctions which is in step with the feeder cattle futures market. The biggest supporter of local auction prices for feeder cattle may have actually been the upward price movement in live cattle futures. Regardless of the cause, steers were $2 to $4 higher while heifer prices increased $1 to $6 depending on weight class.

Cow-calf producers should not sit at home with expectations of calf prices making an unseasonably strong run this summer. Calf and feeder cattle prices may be supported by cattle feeders and packers as finished cattle continue to be pulled through the system.

The profitability of cattle feeders has feedlot managers moving cattle at a fairly rapid pace and this pace has been sustained for several months. As cattle are moved, feedlot managers will be looking for cattle to fill the pens and this may result in stronger prices. However, feeder cattle prices are generally strong through the summer months. This strength is usually sustained through early September before feeder cattle prices once again come under pressure along with calf prices.

Cow-calf producers should already be considering their marketing alternatives for calves born this spring. There is always a fall run of calves, but this is also the time and event that pressures calf prices lower.

Similarly, stocker producers should be evaluating late summer and early fall purchasing opportunities as the market often offers favorable buying conditions and weather conditions in late September and early October.

At this time, it is difficult to predict where cattle prices will be this fall as several conditions could push the market one way or another. Weather is likely the biggest factor.

Corn planting is all but over and soybeans are being planted fairly rapidly. Most of the country has plenty of moisture for forage growth right now, but those conditions could change quickly. Abundant forage and a strong corn harvest will support calf and feeder cattle prices this fall, but drought conditions could easily kick it the other way. There is more downside risk than upside opportunity at this time for the fall market.

ASK ANDREW, TN THINK TANK: There were no questions raised this week, but it might be beneficial to share part of a discussion from a farm visit earlier this week. I along with a couple of other people met with a farmer this week to discuss several aspects of the operation. The discussion was fairly productive and included talking about the current operation, potential changes, alternative opportunities, and potential pitfalls. This particular producer is very progressive and is a student of the game. However, one subject that was broached was the most valuable resource on the farm. It is important for producers to know that it is not the land, the cows, or the equipment that is the most valuable resource. The most valuable resource for any operation is the people and the management provided by those people. This includes hired labor and the management provided by these people. The operation exists or does not exist because of management.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle –June $122.45 -0.75; August $117.35 -1.50; October $116.80 -1.30; Feeder cattle - August $145.55 -1.75; September $144.13 -1.35; October $142.65 -0.98; November $139.30 -0.90; July corn closed at $4.24 down $0.03 from Thursday.