Market Highlights: Cattle and Beef Price Drop

By: Andrew P. Griffith, University of Tennessee

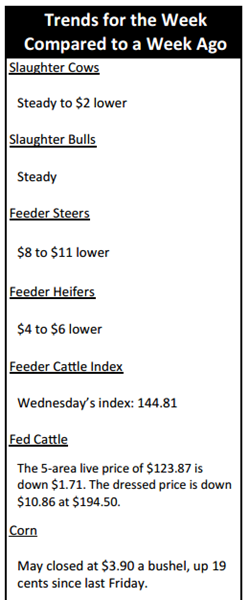

FED CATTLE: Fed cattle trade was $2 to $3 lower than a week ago on a live basis. Live prices were mainly $124 to $126 while dressed trade was primarily $193 to $196. The 5-area weighted average prices thru Thursday were $123.87 live, down $1.71 from last week and $194.50 dressed, down $10.86 from a week ago. A year ago prices were $159.17 live and $253.90 dressed.

After struggling through the week, live cattle futures found support on Friday. However, the damage had already been done. The April contract is now off the board and June is the leading month. The June contract is trading around a $10 discount to the close of the April contract which means market participants are anticipating more weakness in the market.

The futures price says there is incentive to pull cattle forward with the large positive basis relative to the June contract. Thus, feedlot operators are likely trying to push cattle out of the pens and replace them with some low priced feeder cattle. The cash price and futures price will have to converge and it will just take time to figure out which one is more wrong!

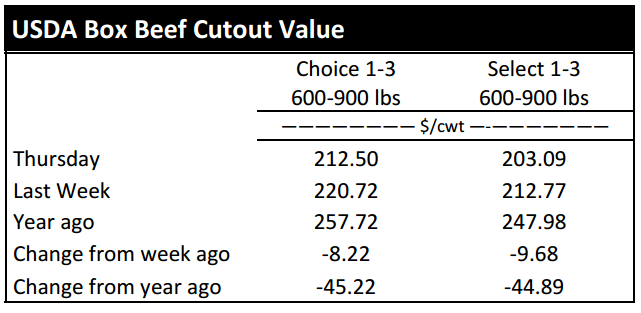

BEEF CUTOUT: At midday Friday, the Choice cutout was $212.05 down $0.45 from Thursday and down $8.45 from last Friday. The Select cutout was $203.17 up $0.08 from Thursday and down $8.39 from last Friday. The Choice Select spread was $8.88 compared to $8.94 a week ago.

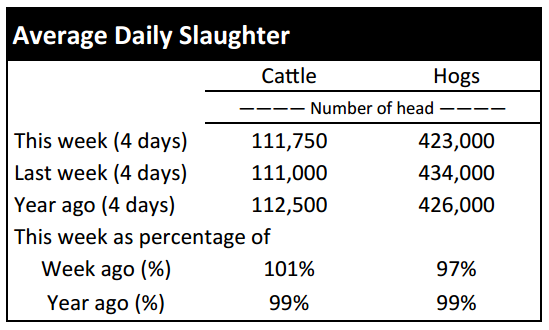

Packers are struggling to keep support for beef cutout prices, but maybe this is to be expected given the expected meat production and supply as released in the World Agricultural Supply and Demand Estimates (WASDE). Projected United States beef production for 2016 is 4.8 percent (1.14 billion pounds) higher than one year ago while pork production is projected to be 1.9 percent higher (471 million pounds) than 2015.

Similarly, poultry production is projected to increase 3.1 percent (1.45 billion pounds) in 2016. The increased production means the product has to be absorbed either domestically or abroad. The increased production will certainly soften domestic retail meat prices which will result in an increased per capita consumption. However, the key to price strength and packer profitability will likely lie in the hands of the international market. The ability of processors to move beef through international channels will be key to supporting beef prices and thus cattle prices. The trade market can sometimes be fickle.

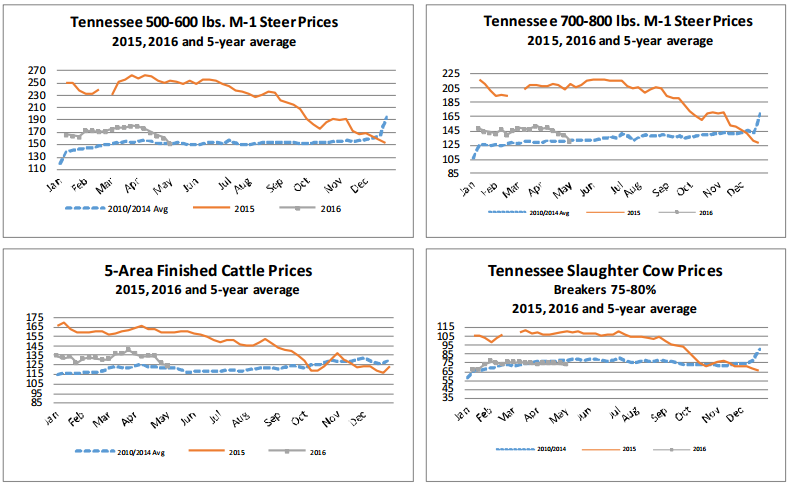

OUTLOOK: The complete collapse of feeder cattle futures has led to complete doom and gloom in the sale ring at local auction markets. Auctioneers have been forced to pull out distant memories to even begin figuring out how to start bids this low. Steers on Tennessee auctions were down $8 to $11 compared to one week ago while heifers were down $4 to $6. Considering Tennessee weekly auction data, 500 to 600 pound steers averaged $150.20 per hundredweight which is the lowest price for this class of cattle since September of 2013.

The lower prices are good for those purchasing cattle because the total investment is declining which reduces financial risk tremendously. However, the declining prices are a complete drag for margin operators ready to market cattle.

For seasonal buyers and sellers, the market volatility could have very well resulted in large losses the past month or so. However, for those who are continuously buying and selling, the action of being continuously in the market is somewhat of a natural hedge as cattle are sold and bought on either a high or low market. The one aspect of the natural hedge that could work against producers is the seasonal price slide for different weight cattle.

Since the spring price peak in the middle of March, 500 to 600 pound steer prices have declined $30 per hundredweight. Similarly, 700 to 800 pound steer prices have declined $22 per hundredweight during the same time period. It is hard to imagine a continuation of this downward price movement in the near term, but there has been little indication of the price deterioration slowing down.

Is it possible in 2016 to fall below the lows experienced in 2013? It is certainly possible considering 500 to 600 pound steers are only $16 per hundredweight higher than the weekly low experienced in 2013 and 700 to 800 pound steers are only $10 per hundredweight higher than the 2013 price trough. This is not to say prices are at unprofitable levels, but poor managers may find themselves losing money this year if managing costs does not become a top priority in the near future. Cost management will be the key to profitability for most producers if cattle prices do not become reinvigorated.

ASK ANDREW, TN THINK TANK: This week a question came in from Midland, South Dakota. This particular producer was searching for information related to forward pricing cattle. He was looking for a way to analyze different forward pricing mechanisms which in turn was in relation to price risk management. There are several decision aid tools available through land grant universities such as the one from Texas A&M University. These decision aids are built to help producers evaluate decisions and improve profitability. If you have a question and do not know where to start, trying to find a decision aid tool is a good starting point. Tools and calculators available on our software page.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle –June $114.93 0.13; August $112.43 0.68; October $112.33 0.75; Feeder cattle - May $140.43 -0.15; August $140.38 0.58; September $140.50 0.58; October $139.90 0.53; May corn closed at $3.90 up $0.03 from Thursday.