Crop and Cattle Market Foresight

Trade uncertainty, tepid prices, excessive supplies and crop rotations are stacking up to cause another year of grain market volatility. Dive into the headwinds and tailwinds for the four major crops so you can smartly plan your 2020 production and marketing decisions.

Fourth-Largest Soybean Crop Projected For 2020

Look for U.S. farmers to plant a large soybean crop this spring. USDA pegs the 2020 crop at 84 million acres, which would make it the fourth-largest soybean crop on record.

“Guys planted a lot of corn in 2019, so the rotation itself is set up to come back into soybeans,” says Todd Hubbs, University of Illinois agricultural economist.

Based on late fall and early winter prices, Hubbs says, he sees no incentive for farmers to choose corn over soybeans in 2020.

Market Wild Cards

Mother Nature is always a wild card and could contribute to a boost or reduction in soybean acres.

Likewise, the ongoing U.S.-China trade dispute and African swine fever (ASF) are two additional factors that could impact soybean acres and prices, explains Arlan Suderman, chief commodities economist for INTL FCStone.

“The soybean market keeps trying to rally on a China trade deal, improve soybean demand and strengthen the U.S. soybean balance sheet, but I don’t see that happening,” Suderman notes.

A phase one trade deal with China could move prices higher, he says. But with ASF’s impact in Asia, it might not be enough business.

What About Prices?

The continuing trade war and ASF put considerable downward pressure on soybean prices in 2019, notes Stephen Nicholson, senior grains and oilseeds analyst at Rabo AgriFinance.

“The trade war alone has reduced the average national price paid to soybean farmers by $1 to $1.50 per bushel,” Nicholson explains. “The ASF outbreaks add another 50¢ to $1 to the reduction.”

Even if the U.S. trade dispute with China is resolved, Nicholson’s current analysis indicates a 75% probability that soybean prices at the farmgate will stay under $9.60 per bushel cash in the decade ahead. ~Rhonda Brooks

Low Optimism for Corn

More corn, fewer soybeans. More soybeans, fewer corn acres … or no change at all. The annual crop mix decision isn’t getting any easier.

“The general expectation is unplanted acres from 2019 will get planted in 2020 and 5 million will go to corn and the other 10 million to soybeans,” says Arlan Suderman, chief commodities economist for INTL FCStone. “That puts corn at around 95 million acres — a range I think is far more likely than the 100 million we’ve heard.”

Corn’s stocks-to-use ratio makes the crop seem more favorable than soybeans, but that doesn’t mean the market is incentivizing farmers to grow the golden grain. Bill Biedermann, partner at AgMarket.Net, sets up this profit comparison between corn and soybeans:

- 200-bu.-per-acre corn sold for $3.93 with a negative 15¢ basis equals $756 per acre. With costs at $700 per acre that puts profit at $56 per acre.

- 70-bu.-per-acre soybeans sold for $9.49 at a negative 30¢ basis equals $643 per acre. With costs at $530 per acre that equals $113 per acre in profit.

Financial Pressure Mounts

Adding insult to injury, corn is the more expensive crop to grow, and securing financing could be a struggle.

“We’re seeing a notable increase in farmers feeling pressure from lenders for 2020,” Suderman says. “We’re not at 1980s crisis levels, but it does appear finance options will influence and possibly discourage farmers from expanding corn acres.”

Uncertainty is nothing new for farmers, but the trade situation makes crop mix much harder to predict, says Pat Westhoff, director of University of Missouri’s FAPRI. Whether it’s at the national level or an individual operation, the trade situation is weighing heavy on the corn versus soybeans crop mix decision. ~Sonja Begemann

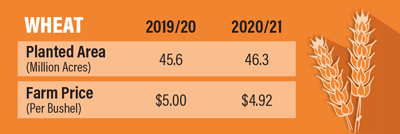

Could Wheat Acres Hit a 110-Year Low?

For the past two years, wheat acres have dipped to a 100-year low. For 2020, planted wheat acres could challenge the 110-year low. The reason for the decline is easy to understand.

“Prices are poor, and profit is non-existent for some farmers,” says Kim Anderson, Oklahoma State University Extension economist.

Going forward, wheat acres are expected to stay close to the current level of around 45 million acres, according to the 2019 U.S. Baseline Outlook compiled by Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri. Prices are also expected to level out around $5.

Wheat supply and quality are influencing price, Anderson says. From a quality standpoint, U.S. wheat is facing stiff competition.

“In the U.S., our 2019 hard red winter wheat crop averaged 11.3% in protein; the Black Sea region, continually ships 12.5% protein,” he says. “So, you have a quality issue.”

Global Glut of Wheat

On the supply side, the world has a glut of wheat:

- Global wheat production is at a record 28.1 billion bushels.

- World ending stocks are at a record 10.6 billion bushels.

- Wheat’s global stocks-to-use ratio is at 38.2%, which is another record level.

The good news, Anderson says, is the Black Sea region (Russia, Ukraine and Kazakhstan) will have a stocks-to-use ratio of 9.6%.

“That tells you if they have problems with 2020 production, they don’t have any room to spare,” Anderson says. “If they have a poor crop, we could see wheat prices get profitable again, but we won’t really know the state of their crop until June, July or August.”

Positive Demand Signs

The upside of lower prices is they are incentivizing higher purchases, says Ken Zuckerberg, lead economist, grain and farm supply, CoBank.

In the past decade, global human wheat consumption has increased 90 million metric tons, while feed usage has increased 16 million metric tons. This trend could be a positive market signal in the year ahead, Zuckerberg says.

As wheat farmers plan their future crops, Zuckerberg encourages them to think about how to capture niche or supplier-driven contracts and markets.

“Wheat is in so much of our value-added food,” he says. “Farmers can be more consumer centric, and we could see a reinvention of the wheat business.” ~Sara Schafer

Cotton Acreage Plunge in 2020?

The big picture for cotton in 2020 is centered on dual pillars — China and acreage cuts.

Despite cotton reaching almost 14 million planted acres in 2019 (2.7% less than 2018 acreage), the white blanket might not even cover 11 million acres in 2020.

“More than anything, reduced acreage has potential to raise prices in 2020, and right now, I believe acreage may drop 2 million to 3 million acres,” says John Robinson, Texas A&M University Extension cotton economist.

China’s One-Two Punch

The tariff clash with China has hit U.S. producers with a one-two punch, Robinson says.

“Will there be resolution in the U.S.-China dispute in 2020? It’s had direct effects where Brazil has picked up market share, but that doesn’t necessarily hurt the fundamentals of the market,“ Robinson says. “Still, the indirect effects are a drag on demand that raises prices on consumers, and places cotton shippers and merchants in a very uncertain business climate.”

For over a decade, China has been a crucial market for U.S. cotton fiber exports. With cotton prices down 30% since the beginning of the U.S.-China trade dispute, Jody Campiche, vice president of economics and policy analysis for the National Cotton Council, provides a detailed look at the clash and its implications.

“The current trade dispute with China and the resulting retaliatory tariffs on U.S. cotton and cotton yarn are increasingly harming the U.S. cotton industry and long-term market share in China,” she says.

The immediate impact, Campiche adds, has been a decline in market share of China’s cotton imports from 45% for the 2016 and 2017 crops, down to 18% for the 2018 crop. Meanwhile, Brazil’s market share increased from 7% in 2017 to 23% in 2018.

This lost market share has depressed U.S. cotton prices. The retaliatory tariffs and uncertainty facing the textile supply chain reduced global cotton demand for both the 2018 and 2019 crop years, Campiche notes.

Three Trends to Watch

Campiche offers three possibilities as wild-card factors:

- A resolution to the U.S.-China trade dispute, and potential purchases of U.S. cotton.

- An increase in cotton demand if a trade resolution is achieved.

- Significant production issues in foreign cotton-producing countries.

~Chris Bennett

Optimistic Cattle Price Outlook

Even the most hardened ranchers were discouraged by Mother Nature in 2019. They responded by sending more cattle to slaughter than expected, which provides optimism in 2020.

“Broadly speaking, 2020 is shaping up to be better than 2019 for cattle prices,” says Glynn Tonsor, Kansas State University livestock economist. “The main drivers would be we are slowing down the volume of production of animals in the system.”

Bullish attitudes hinge on tight supplies and strong demand. The 800-lb. gorilla is African swine fever.

“Even though it’s a pork disease, it impacts all proteins,” Tonsor says.

Global demand for protein is growing as is the population. Both are positive for beef demand. ~Greg Henderson

To read the full 2020 crop and livestock market outlooks, visit AgWeb.com/markets/outlook