Speer: Mad About Trade

International trade is an essential part of the U.S. beef industry. It’s also the topic that seemingly generates more interest among producers than any other major issue within the business.

As such, several of my recent columns have addressed some of the fundamentals around trade:

- The first column focused on beef imports and exports on the product side.

- Next there was some discussion around live animal trade.

- And the third topic addressed being the trimmings and ground beef market.

But none of those address the direct impact on U.S. farmers and ranchers. Generally, those concerned about trade believe foreign supply reduces “demand and price of domestic cattle.” So, let’s dig a little deeper to see if the data supports those claims.

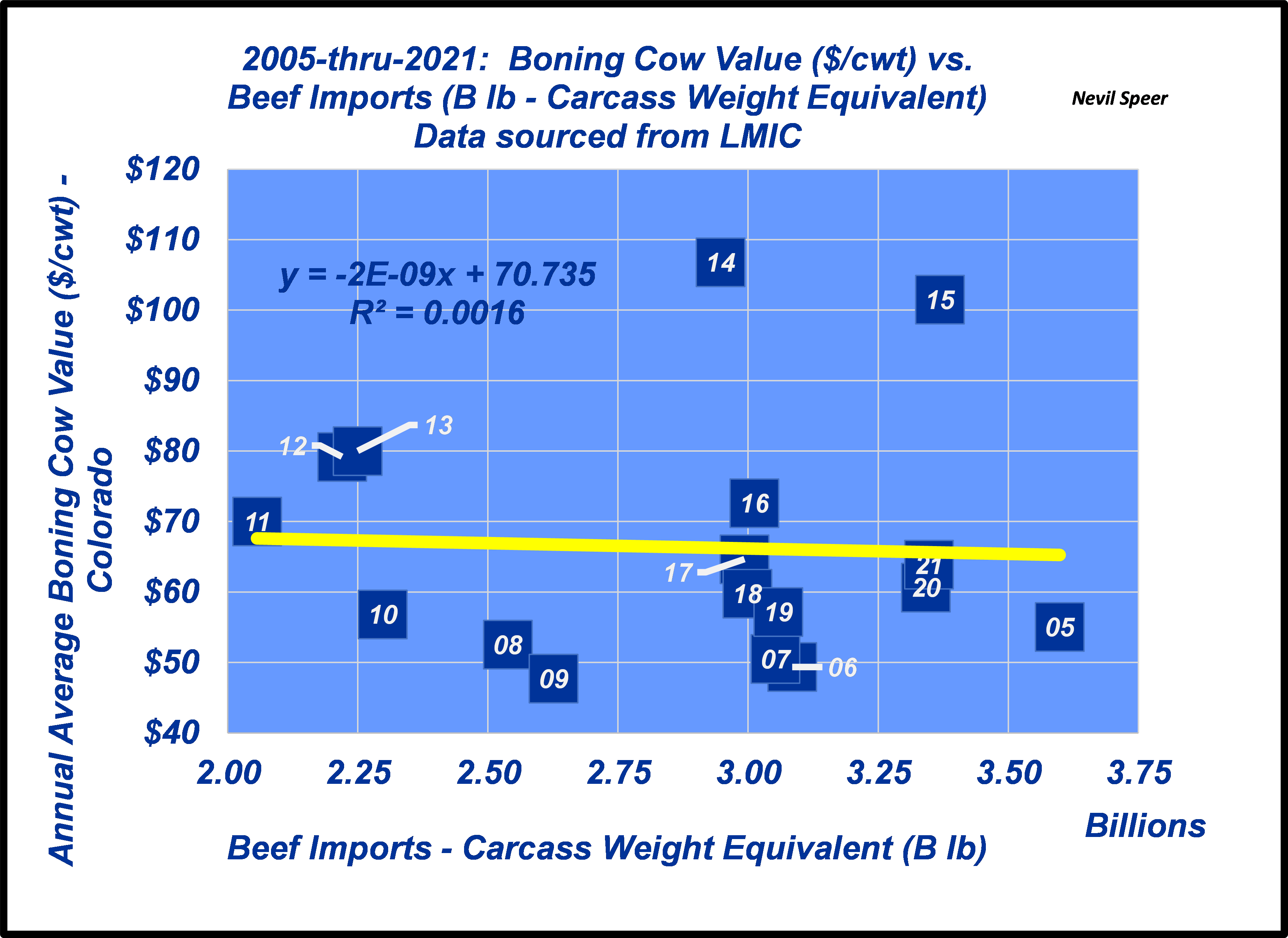

First, there’s the issue of beef imports. The assumption being they replace what could be sourced from the U.S. – namely from slaughter cows and bulls. Therefore, they drive down the price of cull bulls and cows. The data doesn’t support that argument (see first graph). The correlation and regression are zero. In other words, the domestic cull cow market (pick whatever market you like because they all trend together) is NOT influenced by beef imports.

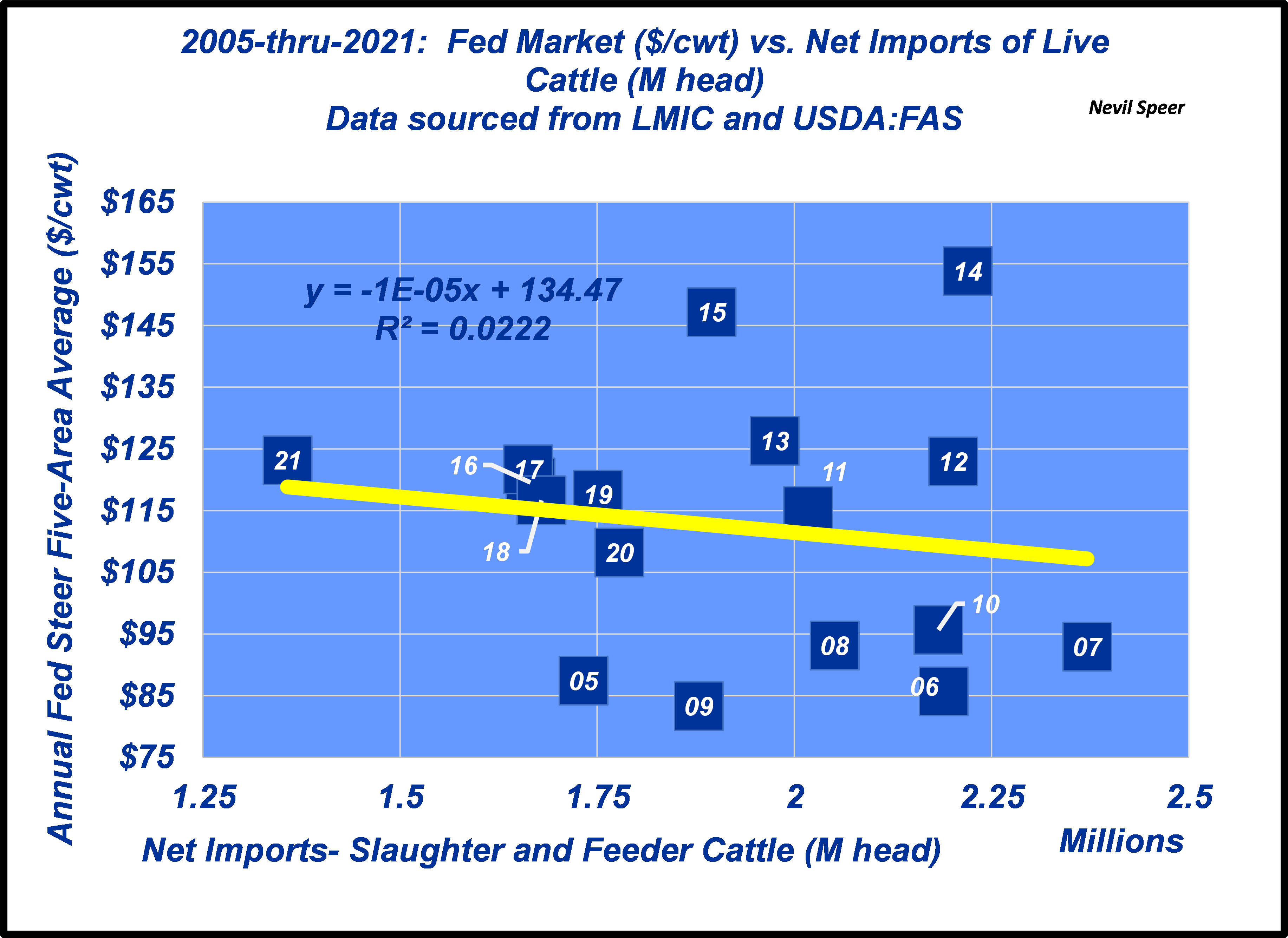

Second, live animal imports impact the value of fed cattle (and subsequently feeder cattle, too). Once again, the correlation is nearly zero (see second graph). The average year-over-year change in number of cattle being imported (plus-or-minus) is only 200,000 head. Per the regression, that equates to about $2/cwt. In other words, with $140 fed cattle, an up-or-down change in imported cattle from one year to another represents a price effect of less-than-1.5%.

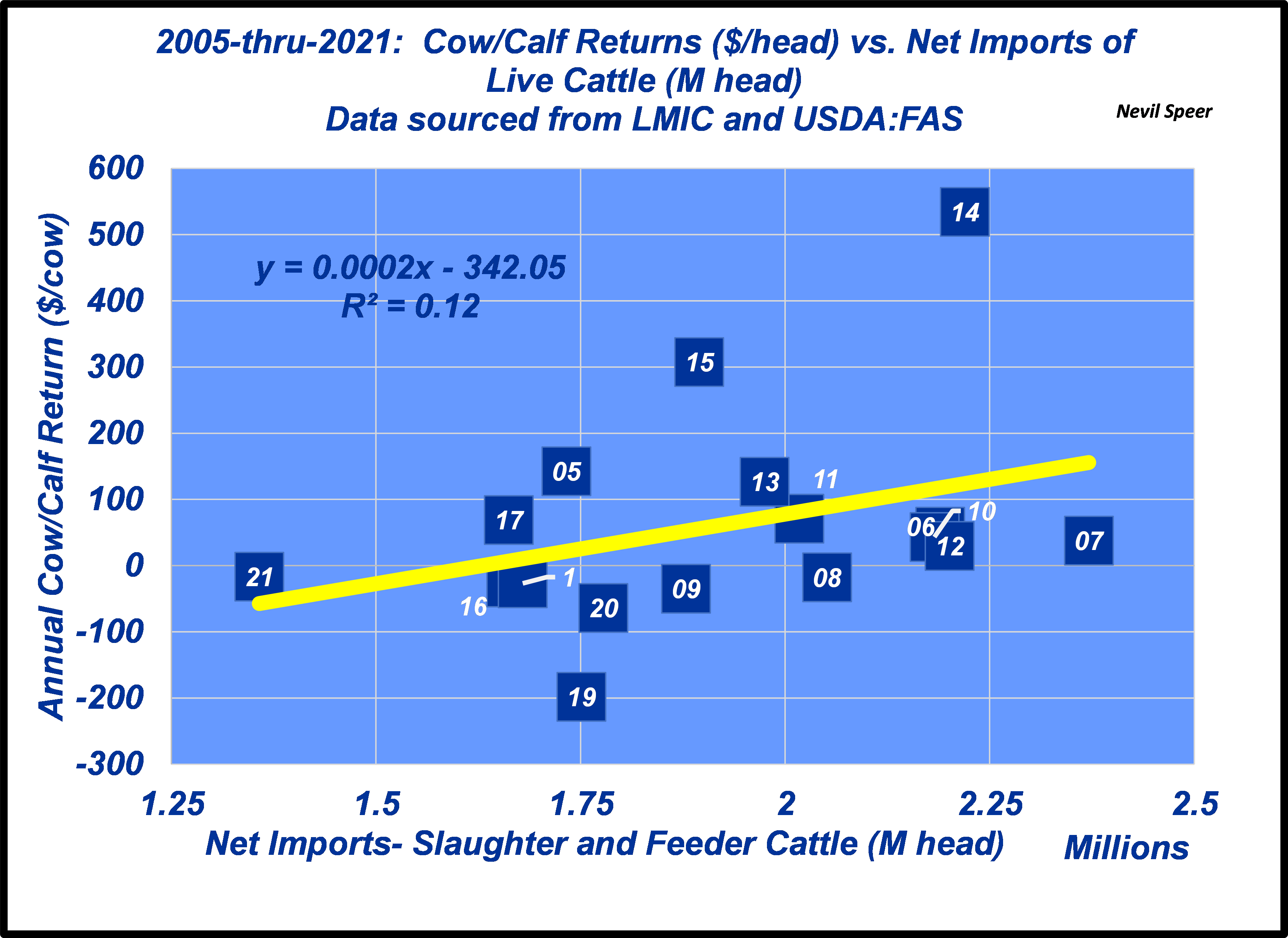

Third, and most importantly, what about the supposition that imports hurt cow/calf producers financially? The evidence doesn’t back that up either. In fact, there’s a positive relationship between live animal imports and producer profitability. Granted, correlation is NOT causation; but the trend reinforces the reality that imports are NOT hampering overall returns (see third graph).

All that aside, what about the underlying economic tenets surrounding international trade? The protectionists want to limit free trade, claiming it holds no apparent advantages (most notably, to the producer). But trade is never about producers, it’s about consumers. And measures to impede or hamper that process penalizes the consumer sector more than it benefits the producer sector. With that in mind several principles emerge.

First, that benefit applies to consumers globally. And U.S. beef producers are direct beneficiaries of that principle. For example, beef exports from the United States just established a new record in the first quarter of 2022: $3B!

Second, the producer / consumer designation isn’t mutually exclusive. Producers are also consumers and thus enjoy the benefits of global trade, too. The list of goods is endless: computers, food, tools and even pickup trucks (e.g. the ranch-favorite Power Stroke Diesel engine).

Third, and most important, trade is a two-way street; there’s no having your cake and eating it too (all exports and no imports). What’s more, when it comes to trade, no industry operates independently. The one-way street isn’t a viable option; impeding imports of one product can result in broad, indiscriminate retaliation across other sectors of the economy (thereby turning allies into rivals).

None of this means there aren’t times when trade requires principled action (e.g. Russian oil) – but that’s a different conversation. Given the broad swath of data, and the underlying economic principles, staying mad about trade – for no apparent reason – is wasted energy. The industry is better served by staying focused on innovation and competitiveness and objective decision-making – those are the keys to enduring success.