Speer: Back of The Napkin Cow Math

The fall run is upon us. So, over the next several months most producers will be busy weaning and shipping calves. It also means sorting cows – some of them will need to make their way to town. In aggregate, and over time, those culling decisions possess some important connotations for the industry.

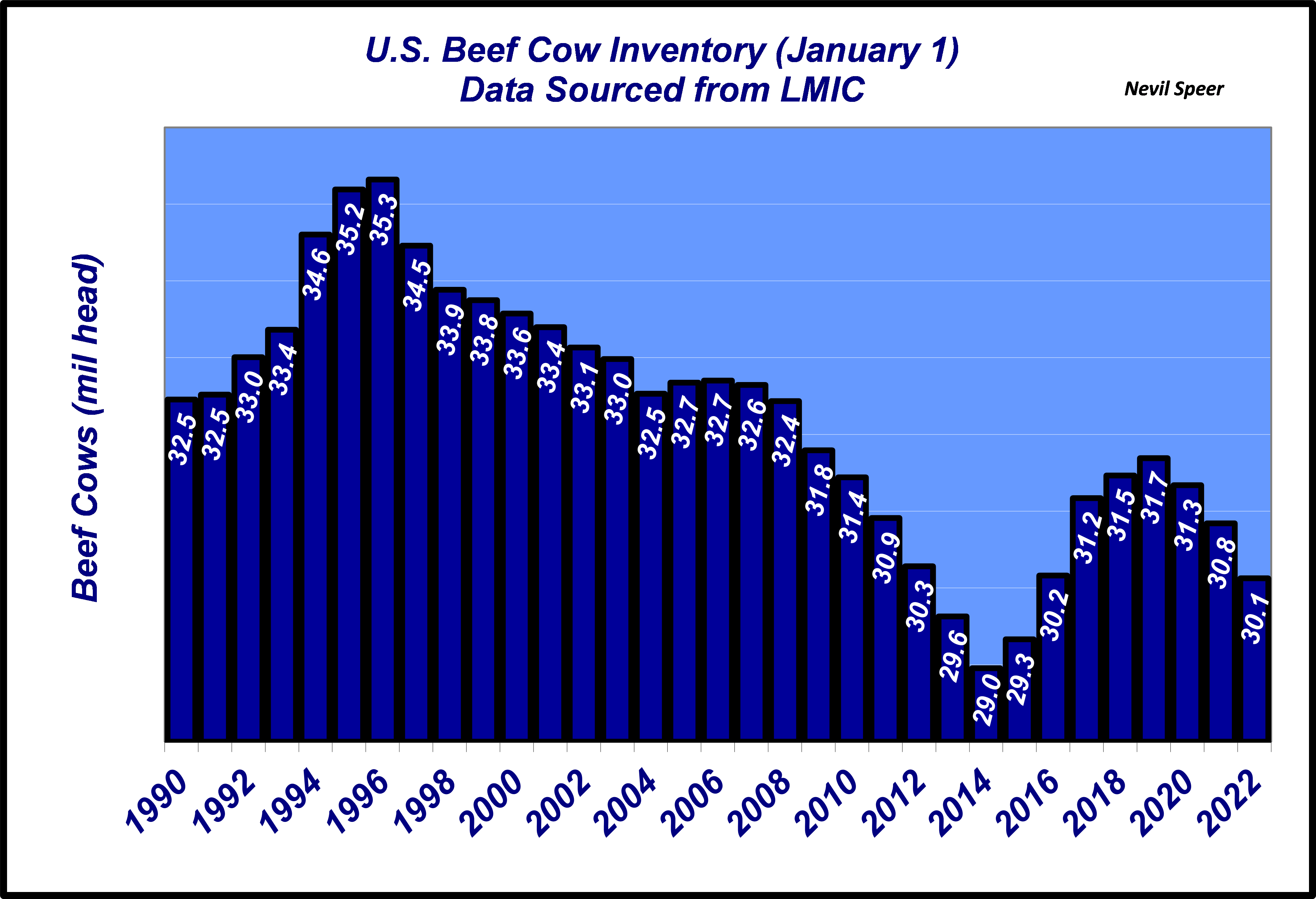

That’s especially true as we go into 2023. But to fully grasp the implications of that collective decision-making process, it’s important to first get some broader perspective of the numbers. As a starting point, the first graph below provides an overview of annual starting cow inventory since 1990.

Note the recent peak inventory occurred in ’19 with 31.7M cows. As a side note, that’s 97.5% of the same mark 30-yers earlier (starting inventory in ’89, ’90 and ’91 was remarkably steady: 32.49, 32.45 and 32.52 M head, respectively). Despite all the rhetoric from some groups about the demise of the industry, the inventory snapshot across three decades is essentially flat. Not to mention, the incredible advancements in quality and productivity that’s occurred within the nation’s cowherd during that time.

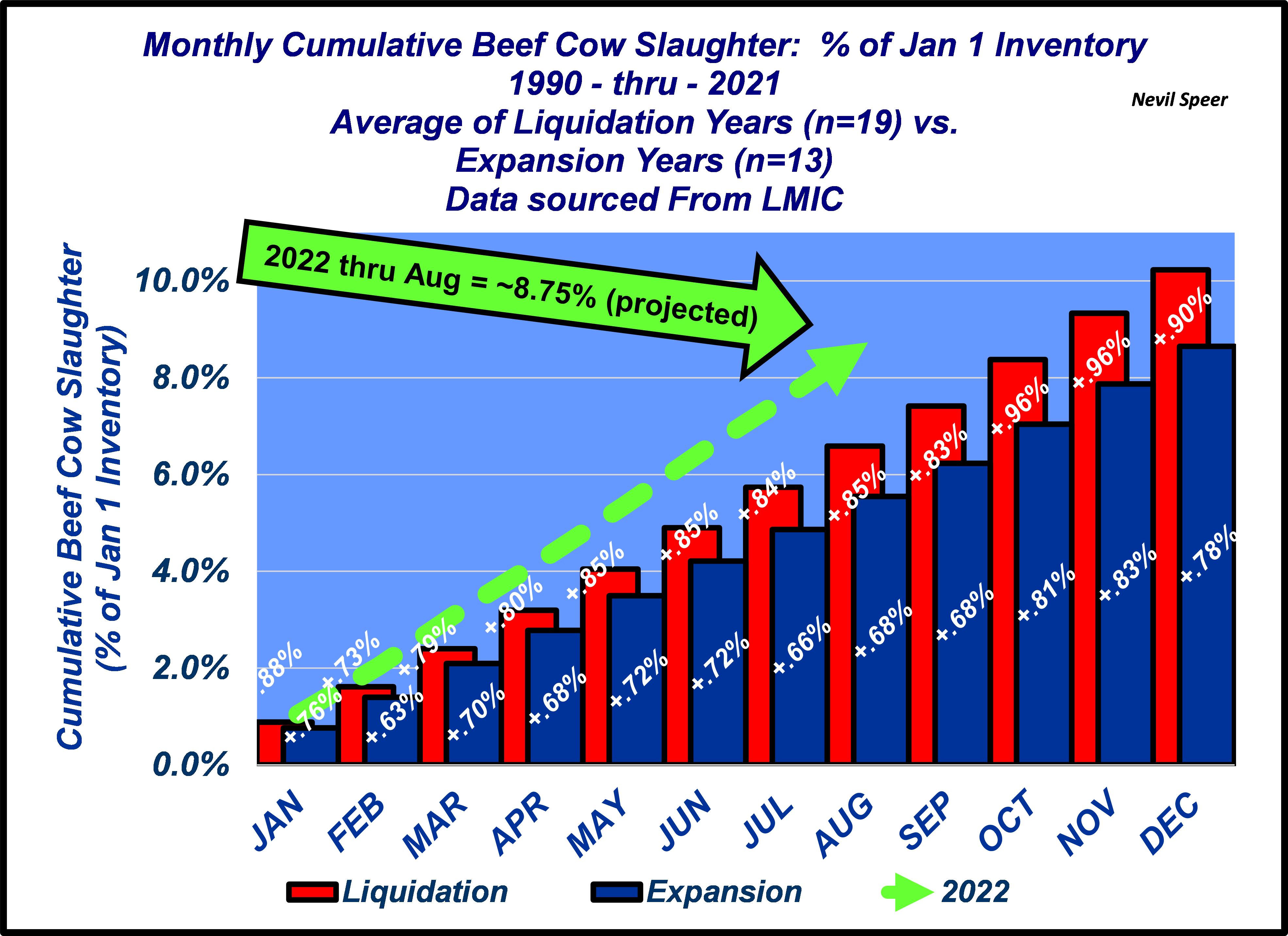

Nevertheless, the cow/calf sector has witnessed a sharp sell-off during the past three years. And clearly, 2022’s drought puts an exclamation point on that process. To that end, the second graph details average slaughter rates (as % of starting inventory) for liquidation and expansion years, respectively. Years in which cow inventory shrank the sell-off rate averages 10.2%.

August’s slaughter numbers haven’t been finalized yet. But based on weekly slaughter counts for the month, year-to-date (through August) beef cow slaughter already encroach 9% of the Jan 1 inventory. Of course, the real unknown is the pace September-thru-December. Given the drought, perhaps culling has been front-end loaded. But whatever happens, it’s clear this year’s sell-off will be significant – easily surpassing the 10.2% average noted above (and could potentially be record-large).

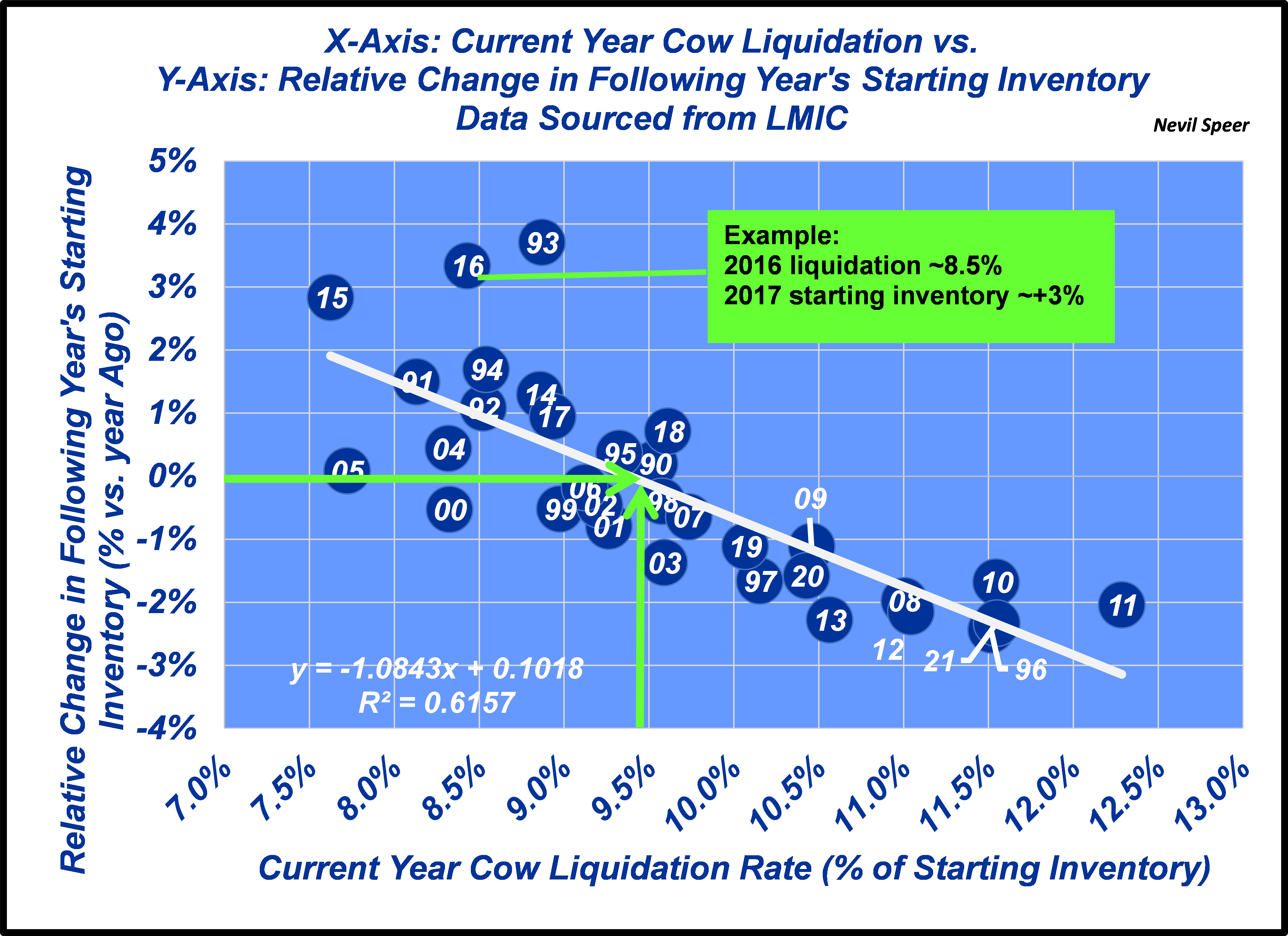

The final graph provides some perspective on culling rates and the resultant year-over-year change in cow inventory (the correlation is nearly .8). Let’s just assume the liquidation rate for 2022 totals ~12% (give or take). Given the historical relationship, that means the cowherd shrinks by 3% - leaving the industry with roughly 29.2M cows to start 2023.

The alternative way to get at a potential starting number for 2023 is through some direct math. If we assume a 12% liquidation rate, that’s equivalent to eliminating 3.62M cows. But then we need to add back in bred heifers that calved in 2022. There’s no direct availability of that measure. However, it’s a solid guess to assume the number generally runs about half of the year’s starting heifer inventory (that method has proven reliable over the past 10 years). Accordingly, that’d mean 2.81 M head of bred heifers calving in 2022. So, the math works like this: 30.13M beef cows less 3.62M culls plus 2.81M first-calf heifers equaling 29.3M head of beef cows going into 2023.

Undoubtedly, some analysts have models providing far more precision. Regardless of the process, though, several items are important: First, the next few months will be critical regarding beef cow slaughter and where we end up for the year. Second, whatever occurs, next year’s starting inventory will be down sharply and likely hug the lower side of 29 M head (similar to 2014/2015).

Most importantly, regardless of the actual number, this back-of-the-napkin cow math draws us into consideration of the implications. That is, while the count may be similar to ‘14/’15, amidst tightening supplies this time is different in a number of ways. But that’s another column for another day.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.