What is Livestock Risk Protection (LRP)?

While many tools for managing risk exist for livestock producers today, livestock risk protection (LRP) may be a valuable option for producers no matter how large or small the operation.

What is LRP?

Livestock risk protection insurance serves as a price insurance policy developed as a price risk management tool for feeder cattle, fed cattle and swine, and is administered by the USDA Risk Management Agency (RMA), according to a University of Tennessee publication, written by Andrew Griffith, assistant professor and livestock extension economist.

LRP is used to establish a floor selling price and protects producers against catastrophic price declines, such as those at may occur due to a disease outbreak, drought, pandemics or other industry disruptions. However, LRP allows producers to benefit from price increases.

This program does not protect against any type of production risk, such as mortality, condemnation, physical damage, disease, individual marketing decisions, local price aberrations or any other cause of loss, Griffith notes.

“LRP is not designed to enhance livestock producers’ profits, nor does it guarantee a cash price for the cattle,” notes Griffith. “LRP strictly protects against declines in a regional/national cash price index.”

Additionally, LRP provides flexibility for producers in the timing of purchase, length of coverage, number of head covered, target weight of livestock at the end of coverage and the coverage price level, Griffiths adds. Compared to using futures and options as a risk management tool, producers are not subject to margin calls or quantity minimums.

How Do I Sign Up for LRP?

Signing up for LRP requires two forms: the policy/application and a specific coverage endorsement (SCE).

The policy/application is first completed with the provider prior to purchasing LRP. Local agents can be found using USDA’s RMA agent locator site.

When deciding on a specific coverage environment, there are several options to consider.

LRP policies begin on the effective date of insurance purchase and run for the selected number of weeks (13, 17, 21, 26, 30, 34, 39, 43, 47 and 52), completing on the end date. The insurance period for a producer should be the number of weeks closest to when the livestock will be marketed.

Additionally, LRP coverage levels can range from 70% to 100% of the expected ending price (approximately the futures price for the given time period), and is calculated based on the chosen coverage price relative to the expected ending value, Griffith explains.

However, he adds, “It is important to note not all coverage levels or all weeks of insurance periods are offered each day. Therefore, a policy meeting the goals of the operation may not be available today, but such a policy may be offered at a future date.”

Requirements of LRP

To insure livestock using LRP, the livestock must be owned by the producer or family member, and ownership must be maintained until 60 days prior to the SCE end date for the insurance to maintain its value. Livestock do not have to be sold to receive an indemnity payment, as there is no restriction on livestock being marketed after the end date of the SCE.

“Any portion of insured livestock disposed of prior to the last 60 days of coverage results in that portion of the coverage terminating with no indemnity being paid for neither that portion nor any of the premium being refunded,” Griffith explains.

How are LRP Insurance Premiums Figured?

Premiums are figured using the expected ending value of the livestock (near the futures price for the particular end date, derived from the futures market) and a coverage price level (percentages of the expected ending value, chosen by the producer).

Then, the expected ending value is compared to the actual ending value (cash price for the commodity on the end date) to determine if an indemnity payment is to be received by the producer. Specifically, the actual ending value is based on the weighted average price as defined in each SCE.

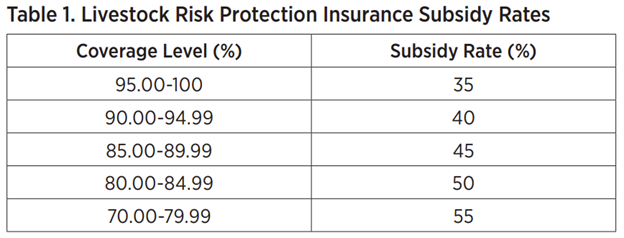

LRP insurance is offered under the Federal crop insurance programs and premiums are subsidized by the federal government. RMA subsidizes 35% to 55% of the premium cost of a SCE based on the coverage level chosen. Additionally, premiums of LRP insurance are not collected until the end date.

When Does LRP Pay?

"If, on the end date of the policy, the regional/national cash price average (not the producer’s cash price) is below the insured coverage price, the LRP insurance pays an indemnity to make up the difference," explains Farm Credit Services of America.

While LRP is a price risk management tool available to livestock producers to protect against major financial losses due to catastrophic price declines, it is not meant to increase producer profits. It's to reduce losses when prices decline and save the producer from losing the farm, Griffith says.

If considering implementing LRP as a risk management tool, find a local agent to discuss more details and determine which SCE is best for your operation.

For more information, visit these USDA RMA provided Fact Sheets:

Livestock Risk Protection Feeder Cattle

Livestock Risk Protection Fed Cattle

Livestock Risk Protection Swine