The Cattle Cycle: What You Need to Know Today

How often have you heard the saying, “History repeats itself?” In the cattle industry, “cycle” tends to be a term often used to describe the up and down of the industry, including herd inventories, prices, etc. Good or bad, producers can look to the history, or the cattle cycle, to estimate and often predict what might be on the horizon.

Unfortunately, it’s not quite like knowing the winning lottery numbers before they are drawn, but there are some valuable insights producers can gain from understanding the cattle cycle and what the future might hold.

Cattle Cycle History

“The cattle cycle is perhaps the most iconic characteristic of the U.S. cattle industry,” says Derrell Peel, professor in agricultural economics at Oklahoma State University. “Cattle cycles emerged as the ranching industry developed in the late 1800s.”

The first cyclical peak was in 1890, when cattle inventory numbers had expanded to 60 million head. Six years later, in 1896, herd numbers had liquidated to 49.2 million head, becoming the first of continuous cattle cycles since.

Measured peak to peak or trough to trough, there have been 12 cyclical peaks and 11 cyclical troughs since 1890, and is often described as a “ten-year cycle,” Peel explains. In history, the time between peaks and troughs has averaged 12.8 years.

From 1867 to 1975, cattle inventories trended higher, increasing from 28.6 million head to 132 million, for a total increase of 361% over 108 years. Since the peak in 1975, inventories have trended generally lower, hitting 93.6 million head in 2021, down 29.1%.

Peel explains that the interaction between production and reproduction in the cattle industry is of large importance. “Expanding production when inventories are too low means that tight supplies are made even tighter to retain heifers for increased production, and likewise, too much supply is made even larger in the short run as more cows are culled and fewer heifers are retained for production.”

The most recent cyclical expansion occurred from 2014 to 2019, following the drought of 2012, where inventories in 2014 began at a low of 88.24 million head and increased to 94.8 million head by 2019.

Cattle Cycle: Where Are We Today?

A modest cyclical liquidation took place in 2019 and 2020, while widespread drought since 2021 has encouraged further culling.

Peel notes, “For the year to date, beef cow slaughter is up 12.3% year over year. If beef cow slaughter were to decline to just equal year ago levels for the remaining weeks of the year, total beef cow slaughter for the year would be up 10.5% year over year. This would be a net beef cow herd culling rate of 13.1% for the year, a new record level. The actual culling rate is likely to be a little higher.”

Meanwhile, heifer slaughter does not show any signs of decreasing, Peel says. The October 1 quarterly cattle on feed report showed the number of heifers in feedlots is up 1.7% year over year and weekly heifer slaughter continues to remain up over 4% year over year. However, lower feedlot placements in October presumably means fewer heifers entering feedlots and reduced heifer slaughter eventually.

While herd inventories have likely been adjusted to get through winter, Peel says, if La Niña weather patterns persist into next spring, more liquidation can be expected going into the next growing season.

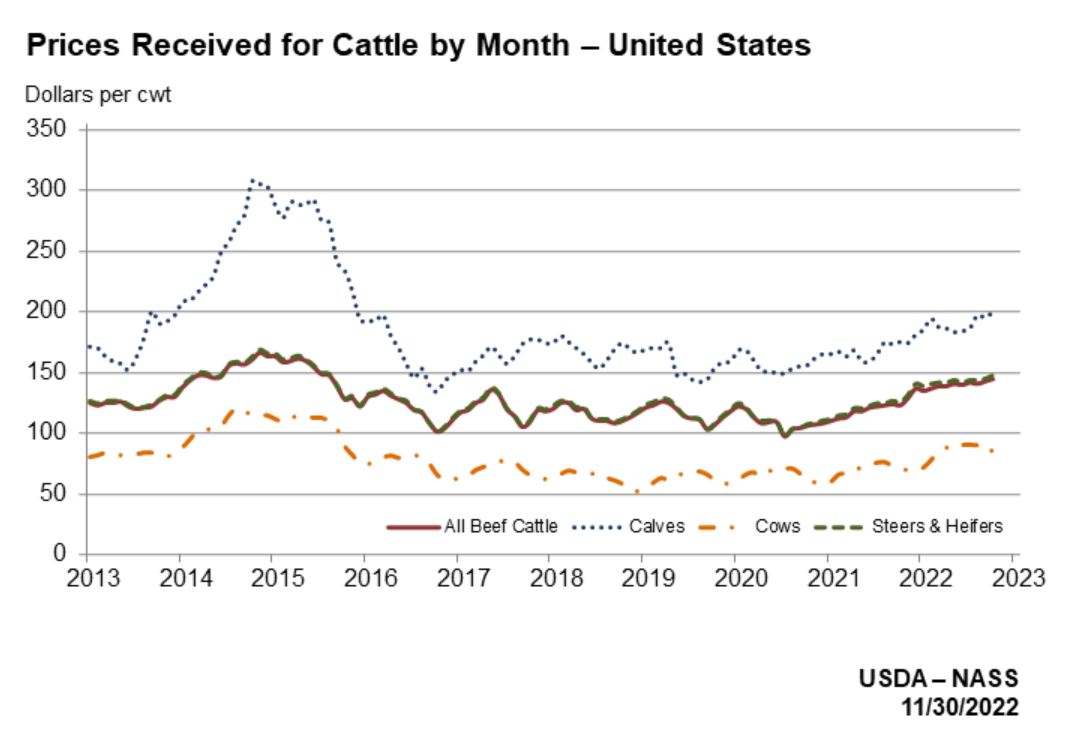

If 2023 allows for herd maintenance or even expansion, producers can expect to see higher cattle prices as the retention of heifers and decreased cow slaughter further tightens supplies. Here’s a look at the price of cattle received since 2013.

With the nature of the cattle industry and the slow process of rebuilding, supplies will likely remain tight for one to two years following the end of liquidation and increased heifer numbers in feedlots, further causing higher cattle prices.

As the cycle continues, from a management standpoint, it may be a good time to consider the next few years of production.

Here’s some questions that might help plan your operation’s next steps:

• With cow slaughter prices strong; is now a good time to cull cows in late years of production?

• Heifer calves have been receiving strong prices; should producers sell all heifer calves on the operation to buy replacements with possibly better genetics while bred, replacement heifer prices are reasonable?

• The herd will expand, at some point; could the operation benefit from keeping more heifers to sell as replacements?

While many of these questions will have answers specific to your operation, it’s important to consider management strategies that will put the operation in the best position during the highs and lows of the cattle cycle.