Speer: Cattle Prices 101?

We’ve all had one of those classes where the professor repeatedly goes off on tangents. The classroom turns theater for ranting and/or obfuscating about some topic; the students are a captive audience. That’s precisely where I found myself listening to recent commentary entitled, “How to Manage Cattle Prices 101.”

The observations were a primer on the conspirator connection among packers, beef imports and the fed cattle market: “…globalist beef packers increase their importation of foreign beef when domestic cattle prices are rising, then those imports will effectively suppress those rising domestic cattle prices.” Some of the key components of that premise included the following:

- “…after reaching their peak in 2005, monthly beef imports began trending downward for several years, until the fall of 2013, which was soon after mandatory country of origin labeling was fully implemented.”

- “So applying the hypothesis, it appears there was a strong correlation between increasing monthly beef imports and downward pressure on domestic cattle prices for the 16-year period from 2000 through 2016. But this strong correlation became even more pronounced after 2016. From 2016 through today, there have been six obvious peaks in domestic cattle prices, and each of those six peaks was associated with monthly import surges. By mid-2020, monthly imports surged to almost the same volume as when they peaked in 2005. You ask why increasing domestic cattle prices cannot be sustained? Well, you may want to take a close look at the timing of monthly import surges.

Four graphs are included below to address this “hypothesis.” The data will facilitate some working knowledge and ultimately make us better students of the business.

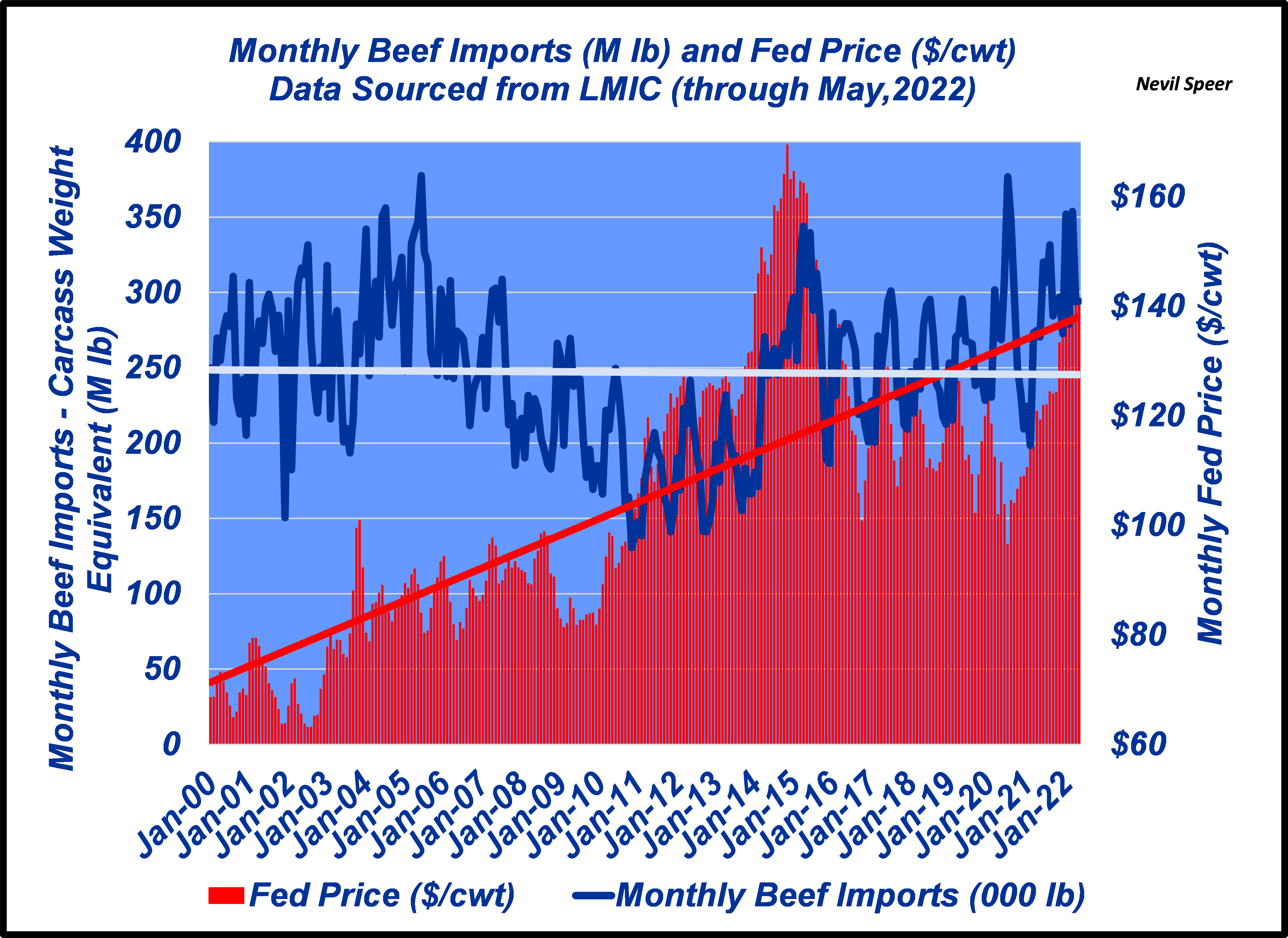

First, a graph of the long-run view; it provides monthly beef import tonnage and fed price data. Note the long-run import trendline is flat, the fed price trendline slopes positively upwards over time (there’s no “downward pressure on domestic cattle prices”).

But what about beef imports “trending downward for several years, until the fall of 2013…”?

Two distinct factors were at work. One, the Financial Crisis resulted in sharp devaluation of the dollar (bottoming in mid-2011). Therefore, ground beef suppliers increasingly procured lean trimmings from domestic sources. The dollar’s recovery began in late-2012 thus making foreign sourced product more economical. And two, recall BPI Products ceased operations in 2012 thereby further underpinning the need to source lean trimmings from abroad.

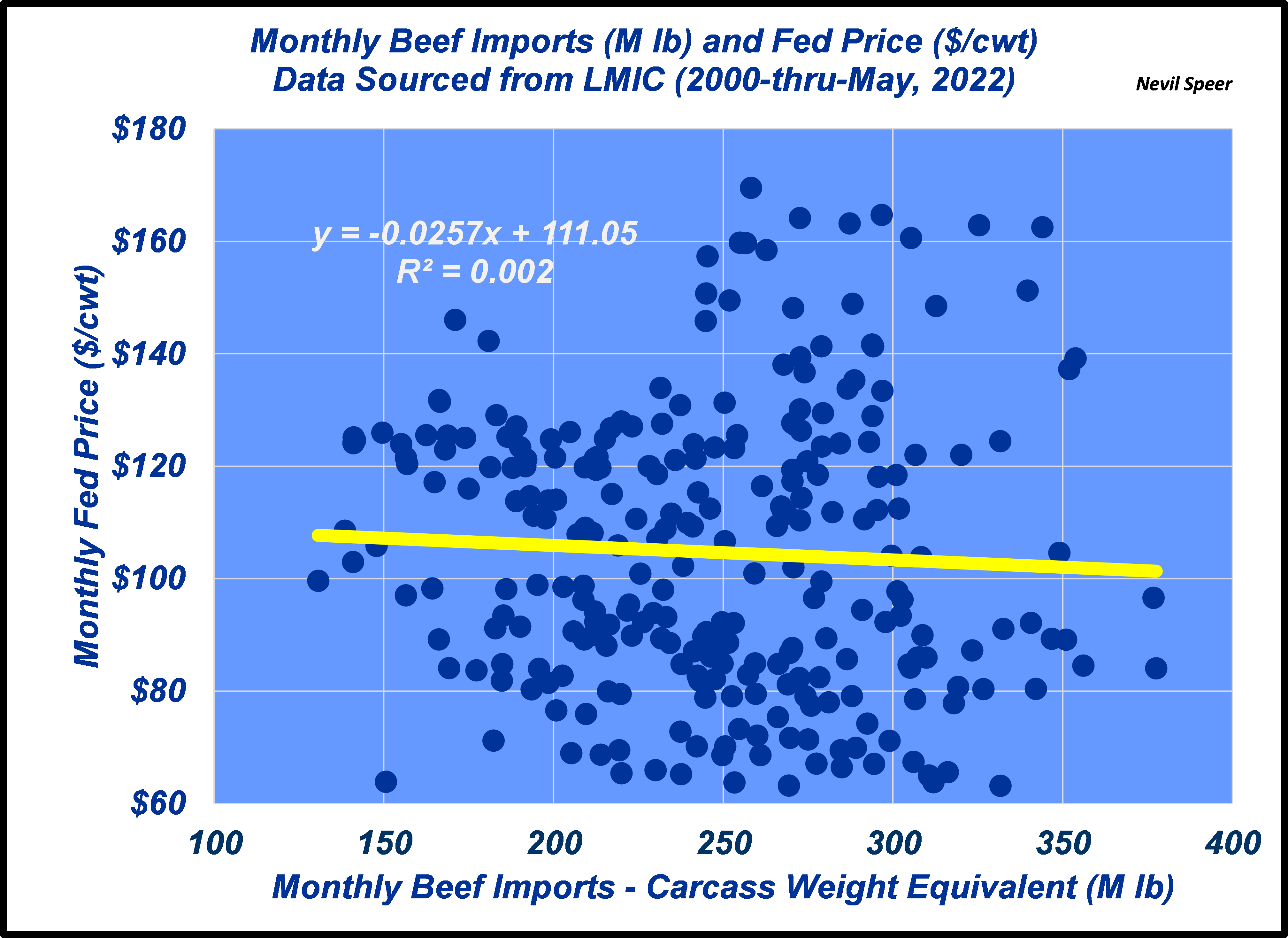

Second, have beef imports been a driver of the fed market? No: the regression line is essentially flat. More importantly, the r-squared value is effectively zero: monthly differences in fed prices are NOT explained, in any part, by differences in monthly imports.

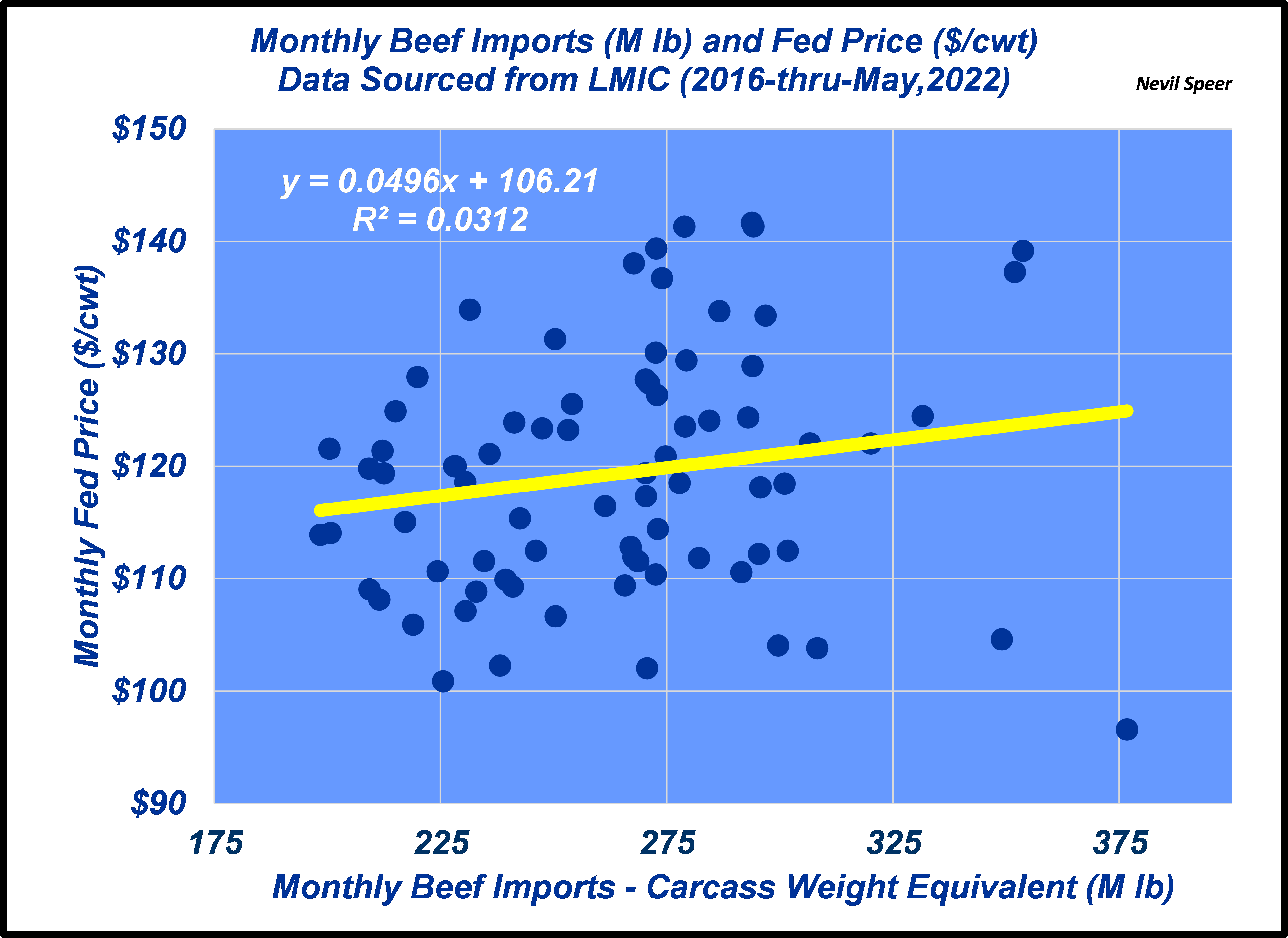

Third, what of the claim “this strong [negative] correlation became even more pronounced after 2016”? Wrong again: the covariance is actually positive and the r-squared value is only .03. Repeat: imports don’t influence fed prices.

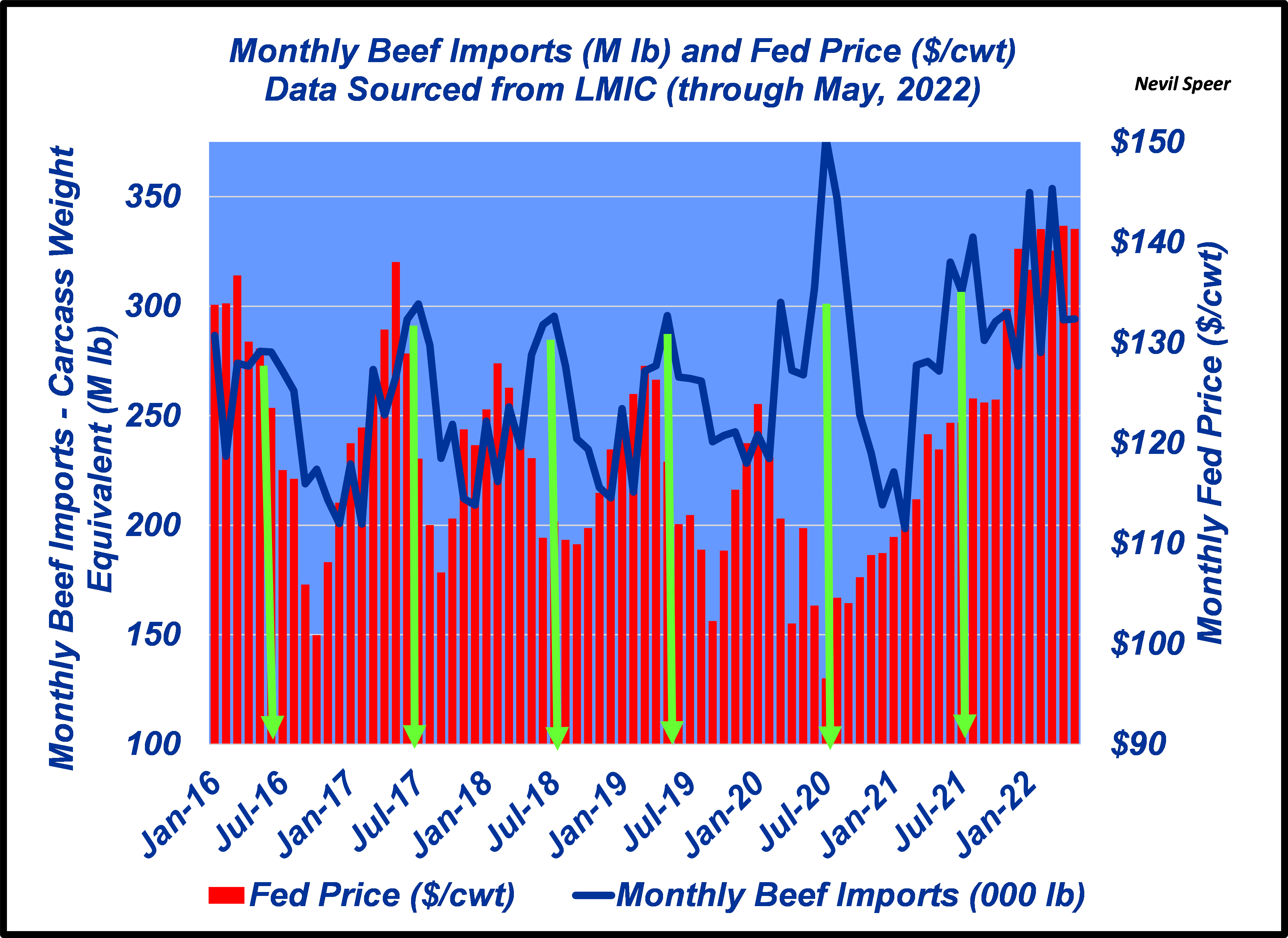

Last, our professor notes “six peaks” of import surges and subsequent fed price declines. But what about the claim around some sinister “timing of monthly import surges” and “why domestic cattle prices cannot be sustained”? The “peaks” all occurred during the summer: beef imports increase because cow slaughter seasonally wanes and fed prices inherently trade lower due to normal supply / demand fundamentals.

The professor then tries to bolster his claim: “…we’re not the only ones who have identified this strong correlation between rising monthly beef imports and falling monthly domestic cattle prices. In fact, last year a bipartisan group of 28 U.S. Senators and House members wrote the U.S. Attorney General asking him to determine the impacts of imports on the domestic beef supply chain.” That’s perhaps the weakest argument of all. Politicians often do things that don’t make sense (for more on that see: Settling the Score with Big Cattle).

If the professor is looking for specific answers, I won’t do well on the exams. Based on the data, it’s impossible to establish any meaningful link between beef imports and the packer and fed prices. I’ll probably just drop the class and wait to take it with a different instructor.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.