Meat Institute Disputes White House Analysis of Packer Concentration

Rising retail meat prices coupled with historic packer margins and softer cash prices for cattle and hogs created what the Biden administration has called “exploitation” of consumers and farmers.

That view is disputed by the North American Meat Institute (Meat Institute) which says “consumers saw increased meat prices in 2021 because of labor shortages, greater consumer demand, supply chain problems and other factors experienced by most sectors of the economy.”

In early January, President Joe Biden unveiled an action plan to boost competition for beef, pork and poultry processing that includes $1 billion for grants and loans for new independent processing plants, $100 million for worker training, new labeling rules and ways for farmers to report anticompetitive practices.

In December the White House published an analysis that the Big Four meatpackers – Tyson Foods, Inc., JBS SA, Marfrig Global Foods and Seaboard Corp – had tripled their net profit margins during the pandemic. Additionally, the administration and some producer groups have targeted meat industry concentration for livestock farmers receiving a smaller share of consumer dollars than a decade ago.

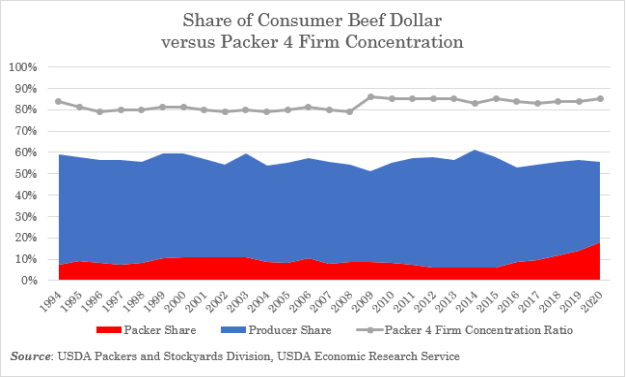

A Jan. 3, 2022, White House Fact Sheet claimed ranchers received 60 cents of every dollar a consumer spent on beef 50 year ago, compared to about 39 cents today. Similarly, hog farmers received 40 to 60 cents on each dollar spent 50 years ago, down to about 19 cents today.

In a statement released Wednesday, the Meat Institute says the administration’s numbers are wrong, arguing that beef packers’ share of consumer dollars are actually lower than the producer share.

“Unfortunately for the White House, the USDA database referenced by the White House Fact Sheet, updated with December 2021 data released by USDA, shows in 2021 beef packers’ share of the consumer dollar was 22.2 percent – lower than the producer share,” the Meat Institute’s statement said. “For pork, the packers’ average share of the consumer dollar was 18.9 percent in 2021, also lower than the producers’ share, which was 25.8 percent in 2021.”

“Inflation is hurting consumers by erasing the wage gains workers received due to the tight labor market and the pandemic,” said Julie Anna Potts, President and CEO of the North American Meat Institute. “It is no wonder the Biden Administration and some members of Congress would rather hold press conferences and hearings instead of addressing the labor shortage and supply chain bottlenecks.”

The Meat Institute submitted additional testimony for a hearing of the House Judiciary Subcommittee on Antitrust, Commercial, and Administrative Law called, Reviving Competition, Part 5: Addressing the Effects of Economic Concentration on Americas Food Supply.

The Meat Institute provided important context to antitrust allegations in submitted testimony.

“The meat packing industry has been, and continues to be, one of the most highly scrutinized industries when it comes to antitrust review,” said Potts in the testimony submitted. “The USDA Agricultural Marketing Service’s (AMS) Packers and Stockyards Division (P&S) is uniquely charged, by statute, to provide on-going oversight for fair business practices and to ensure competitive markets in the livestock, meat, and poultry industries. Additionally, any potential merger or acquisition regulators believe threatens ‘too much market power’ is subject to review by the Justice Department or the Federal Trade Commission. The last proposed merger of two of the ‘big four’ fed cattle slaughterers occurred in 2008 – and it was blocked by the Department of Justice.”

Potts said much of the “rhetoric about concentration in the beef packing sector wrongly implies that consolidation is on-going and that packers’ market power is becoming more and more concentrated. That is not the case. The four-firm packer concentration ratio for fed cattle slaughter has not changed appreciably in more than 25 years.”