CAB Insider: Are Carcass Premiums Supply Or Demand Driven?

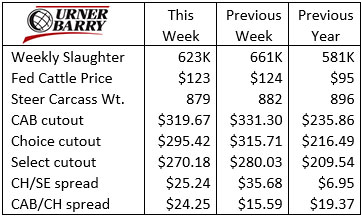

The estimated weekly slaughter total last week was 623,000 head, a significant reduction from the prior week, thanks, in part, to the three-day weekend. Recent weekday daily steer/heifer slaughter totals have been in the range of 93,000 to 95,000. Looking back at the last two years, we could make a case that current fed cattle slaughter is about 1,000 to 2,000 head per day shy of recent history for this time of year.

Turning the calendar to the month of July, one of the characteristics that continues to be seasonally abnormal in the market is the historically wide Choice/Select cutout price spread. Last week’s wide range in fed cattle cash prices featured the lower values in Texas at $118/cwt. and the top of the range of $127/cwt. in Iowa. It’s fairly intuitive to see that cattle with the highest quality grade potential in the northern tier of the feeding region were worth the premium paid, while the poorest grade-potential cattle in the south were discounted. The cash price trading range is as wide as we’ve seen in a long time and is unseasonably driven on quality.

The wholesale boxed beef market continues to adjust lower, as would be perfectly seasonal at this time. Granted, the price retreat is relative to the spring highs, which are second only to 2020.

Middle meat prices are dropping significantly, with wholesale CAB ribeye rolls dropping a massive $1.20/lb. in the past week. Last week’s average $11.46/lb. price is still 23% higher than a year ago and 30% higher than two years ago. Strip loins were down just $0.20/lb. last week and remain 16% higher than a year ago and 30% higher than two years ago. Much to the chagrin of meat buyers, CAB tenderloins and top butts are pricing 50% higher and 40% higher than a year ago, respectively.

As summer progresses with typical hot July temperatures and lighter meal options favored among consumers we anticipate further reductions in middle meat prices. The end meats are also adjusting slightly lower at this point, in keeping with the entire beef complex, noting the welcome softening of overall prices.

Ground beef and hot dogs tend to get a lot of press in protein circles as July consumer favorites. Ground beef, in particular, is at a price point that will generate some sticker shock for many. CAB wholesale ground round, chuck and sirloin values are between 30% and 40% higher than a year ago, although also slightly softer last week.

In summary, boxed beef prices are weakening, but could stand to decline more in order to stimulate tonnage movement in July.

ARE CARCASS PREMIUMS SUPPLY OR DEMAND DRIVEN?

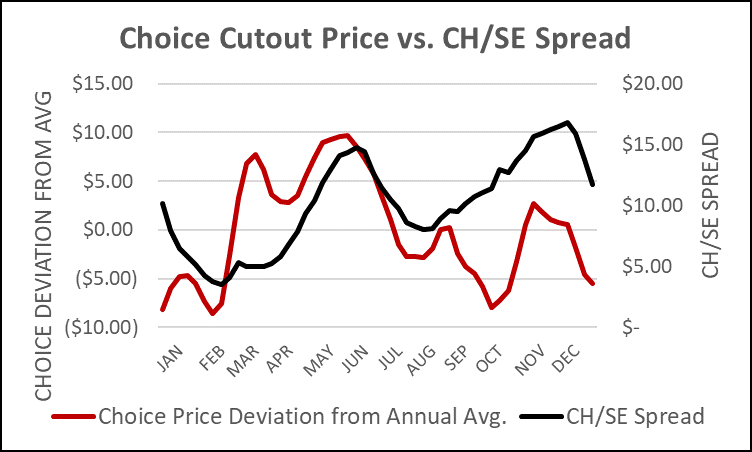

A recent seminar speaker was recently quoted as saying “when beef prices are high the Choice/Select spread is high”. The comment was not entirely incorrect, because this is often the case, depending on the moment in time being described.

A 10-year examination of supply and price trends provides fairly clear relationships between supply and demand factors impacting quality carcass premiums. I’ve included just the Choice data in the charts, since it is the highest volume quality grade category in the fed cattle supply chain for which a premium is available.

The first chart depicts 10-year-average weekly trend lines for the Choice cutout value and the Choice/Select spread. Carcass values exceed the annual average (the zero dollars line) in March through early June. Only briefly in late October and early November does the cutout value again spike above the average. At first glance, the Choice/Select price spread line appears to generally follow the Choice cutout price line throughout the year. But closer inspection shows that the Choice premium remains weak, near the $5.00/cwt. level well into April, long after beef prices jump higher in March. As well, in October beef prices, on average, neared their annual lows in the 10-year period. Yet, the Choice/Select spread was in the $11.00/cwt. range and moving swiftly higher to the early December fall peak. This is an imperfect relationship but not a total disconnect.

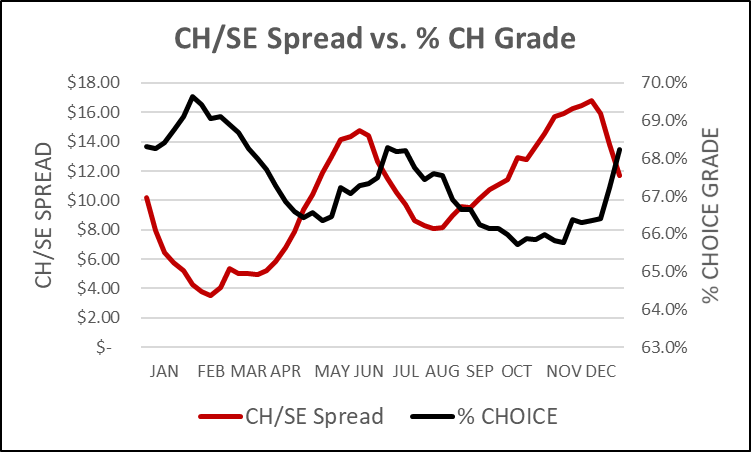

The second chart depicts the relationship between the weekly share of carcasses grading Choice and the Choice/Select spread. With no prior knowledge that demand for Choice and higher grading beef changes throughout the year, a person could conclude through this chart that supply is the singular driving force behind the premiums paid for Choice beef over Select. Without statistical analysis, it’s fair to say that supply is certainly impactful to price. Two important factors to note in that discussion are that first, we’re looking at supply change within a total range of four percentage points. Second, the chart is not depicting volume of Choice beef produced, but simply the proportion of carcasses graded Choice.

The assumption that beef prices above the annual average cause a wide Choice/Select price spread is incorrect as a singular cause-and-effect relationship. More appropriately, we can say that the Choice/Select spread is wide during the times of the year when demand is highest for high quality middle meats. These times can be defined by spring grilling demand, centered on a large handful of holidays, plus the run-up to winter holidays such as Christmas. The supply side is equally important, with periods of smaller supplies of high quality grade carcasses aligned with increasing prices for those same carcasses, while the Select price falls behind. These phenomenon logically align with aggregate beef prices above the annual average price.

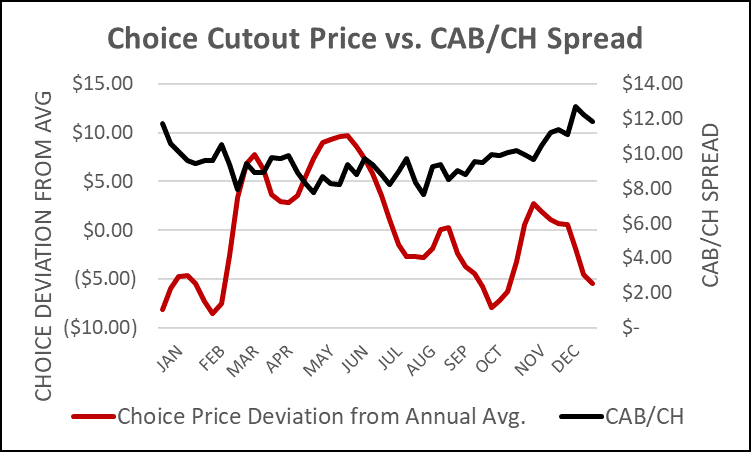

Certified Angus Beef ® brand and Prime prices are, of course, additive above the underlying Choice price. The CAB wholesale cutout premium reached record highs in 2020-2021, touching $24/cwt. in last week’s data. Yet, the 10-year data through 2019 reflects a more moderate premium range for CAB above Choice, ranging from roughly $8/cwt. to $13/cwt. premiums, with more muted seasonal effects, given the smaller range. Much of the market signal for quality is driven on the Choice premium, when the price spreads seasonally widen. Adding a modest $10/cwt. CAB premium on top of a $15/cwt. Choice premium, for instance, is an attention-grabbing price signal. The extreme pricing data for 2020 through today, while quite convincing in favor of heightened quality demand under restricted supply, has been excluded from the charts due to the extenuating circumstances caused by COVID.

At last, the perfect storm occurs, on average, at the same times annually: when demand for highly marbled middle meats is at its peak and the supply of carcasses to fulfill that demand is also near annual lows.