CAB Insider: Premiums High in a Lower Market

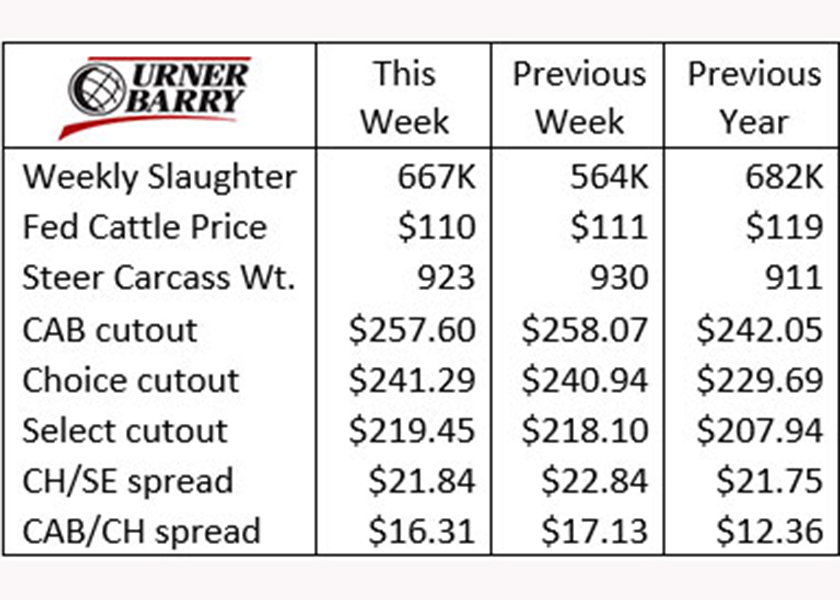

We’ve seen a couple weeks of sideways trade in the fed cattle market, which has underperformed as we moved from November to December. The latest weekly price of $110/cwt. was 7.5% lower than a year ago, settling $1/cwt. below the prior week.

The December fed cattle market for the past two years has followed a strong pattern with increasing values through the end of the month. Today, however, it’s very unlikely we’ll see that kind of a rally in the face of lower Live Cattle futures and ample fed cattle supplies in the near term. In fact, some mid-week reports indicate a much softer trade at $108/cwt.

On the boxed beef side, weekly cutout values were mixed with the CAB cutout down a mere $0.47/cwt. while Choice and Select were marginally higher. The trend over the past seven days, however, shows a rapid retreat in cutout prices seeing the Choice carcasses lower by $6.42/cwt.

December is historically the odd month when live cattle prices trend higher while boxed beef values simultaneously trend lower. Now it seems no strong upward trend will develop this month, but it’s just as clear that the normal price decline in boxed beef values will remain intact.

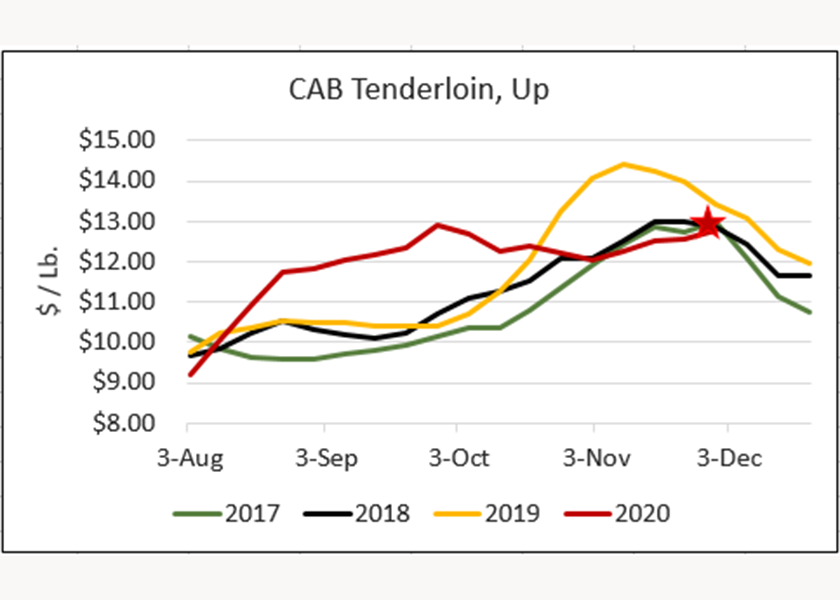

Beef demand this season remains very good and last week CAB ribeyes set a spot wholesale market record at $13.58/lb. Early fall ribeye purchasing by end-users has limited current spot market supplies to the extent that hand-to-mouth buying today reflects this in the price.

Much smaller restaurant traffic has limited holiday price advances on tenderloins, keeping them near 2017 and 2018 pricing. Ribeyes leapt to 30% higher prices than a year ago, but tenderloins are 9% lower.

Premiums High in a Lower Market

We can’t count all the reasons why 2020 needs to find a hasty exit, but at least we can hope that a new year will bring on new dynamics for the cattle industry. No, it won’t be overnight. We know we’re facing a first quarter in 2021 that will test our resolve because there are lots of fed cattle slated for harvest.

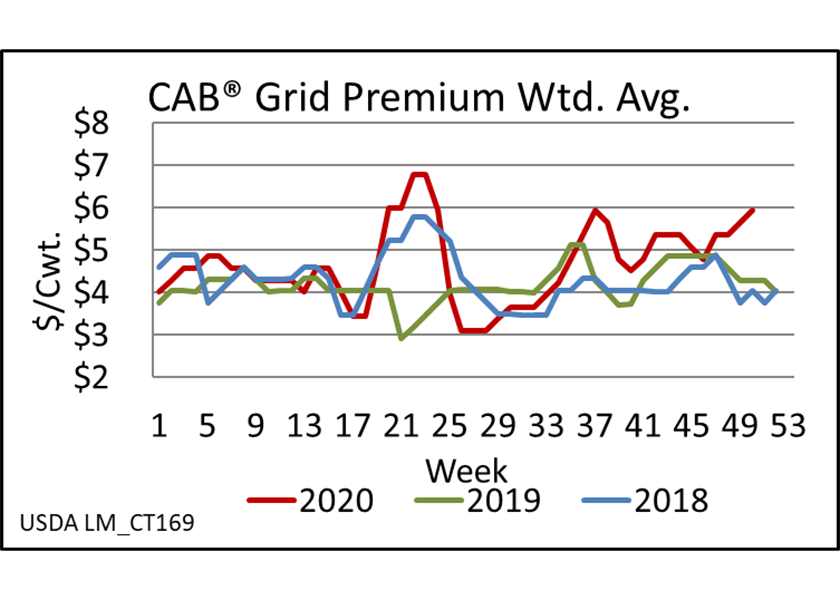

Even with these challenges, it’s important to stay aware of the market forces in action and how they will change seasonally. The November/December marketing period has been good for the high-carcass-quality cattle sold on grid arrangements.

While the Choice/Select spread has not been as wildly high as the 4th quarter of 2019, it did widen to meet the anticipated trend with the season’s high of $21.74/cwt. a week ago. CAB carcasses brought an average of $5.93/cwt. over Choice, the highest since May, with the top of the range premiums at $12/cwt. over Choice.

If we’re gambling on predictions, it’s a cinch that rewards for carcass marbling will see their annual lows in the 1st quarter of 2021. With larger numbers of finished cattle in the offering we’ll see quality grades better than a year ago in the season where consumer demand for richly marbled middle meats falls off into February.

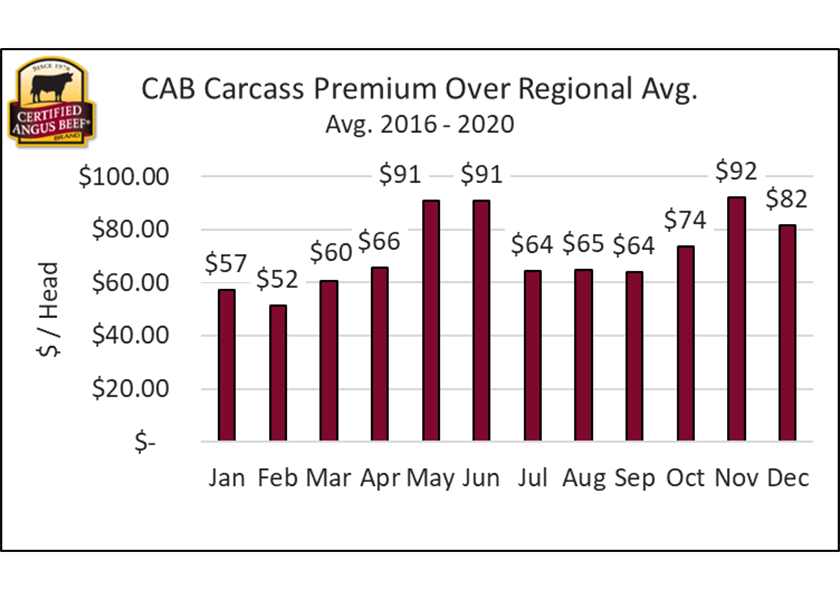

The bar chart shows a five- year average, with February bringing the lowest CAB carcass premiums and January a close second. Carcass grading tends to peak in February and the outlook points that direction again.

Feedyards will be cognizant of the shift from heavy supplies in February to market-ready supplies in June that could be potentially lower than normal. The historical pattern shows a $39/head improvement in CAB carcass returns from February to May/June. This may be exaggerated in 2021 because of the potential for lower premiums for Choice and higher quality in February on larger market-ready supplies. It could also develop that unusually higher quality premiums are offered in May and especially June, given the projected shift to smaller supplies through that period.

Feedyards wary of grid marketing in the 1st quarter due to smaller premiums will want to sharpen their attention to changes in the 2nd quarter. The shift from smaller to larger quality premiums may be more pronounced in 2021 than what we’ve seen historically due to supply imbalances.

Beef Cow Culling to Reduce Inventory By 2.5% By Year's End

With three weeks until the year’s end we can take a relatively safe guess at what the beef cow herd will look like in the new year. The story is a two-sided one with both losses and benefits.

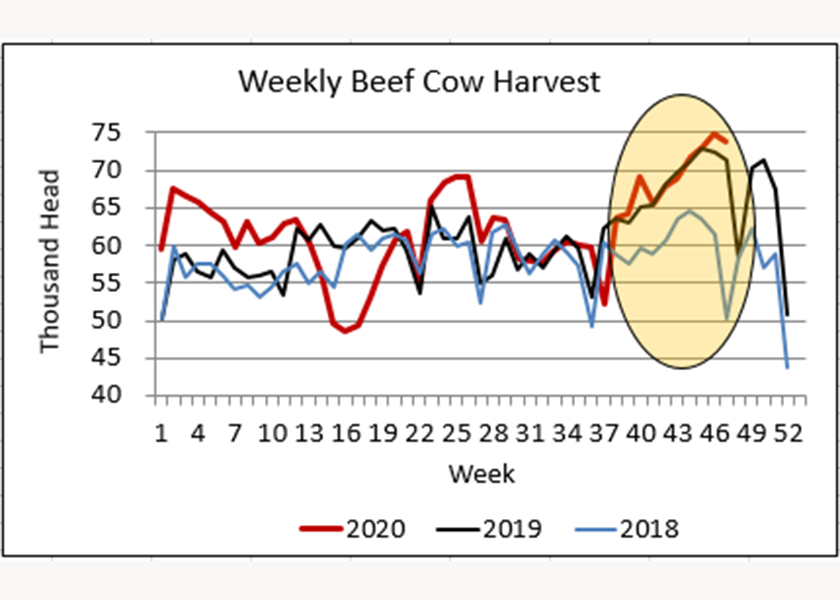

The national drought monitor tells a story of worsening conditions spanning a large portion of the West, with many states badly in need of moisture. The fallout is evident in the beef cow slaughter pace, recently exceeding that of 2019, which featured the most aggressive weekly 4th quarter cow harvest counts the industry had seen in recent history.

The immediate impact to individual producers is significant. Several areas in California, Oregon, Washington, Wyoming and Colorado face long-term resource and property losses from fires. Still scores of others have reduced their stocking rates to preserve pastures and minimize already soaring winter-feed costs due to drought.

CattleFax estimates a 300,000 head reduction in the beef cow herd by January 1, as a result of these events. Finding a silver lining from these circumstances seems insensitive, but there are ancillary impacts to supply shifts.

This second consecutive year of culling sends the industry toward not only a smaller 2021 calf crop but a smaller crop yet by 2022. The macroeconomic outcome means that fed cattle supplies along this timeline will become more aligned with a packing industry that has contracted over the past 15 years. A greater equilibrium between supply and harvest capacity will lift calf prices and the cow/calf share of retail beef dollars.