Market Thoughts: Free Markets For Free Men?

Markets have been extremely volatile, with most commodities at all-time record highs. It's easy to cast blame, but there are a lot of considerations to explore before we start trying to exclude anybody from using his money to help finance commodity price risk.

Acceleration in food and fuel has caught the eye of many, including the U.S. Congress. In the past few months, Congress and regulatory oversight agencies have held hearings to examine the role of speculation in commodity markets.

Rules of the game. One central theme emerging from these hearings is the explosive growth of index funds in commodity trading. Corporate pension funds, retirement funds from federal and state governments, university endowments and other large investors are pouring billions of dollars into commodity futures markets.

Index funds account for a larger share of outstanding contracts than any other classification of market participants—including commercial accounts.

Index funds in the first quarter of 2008 are estimated at $206 billion. Some sources say in 2008, nearly $1 billion of new index fund money is coming into commodity markets every day.

In early June, the Commodity Futures Trading Commission (CFTC) announced several initiatives meant to evaluate the role of speculators in futures markets and to preserve use of the futures market for producers and other commercial interests as a risk management tool. The initiatives aim to improve trader reporting and classification and make trader information more public.

The CFTC stopped short of direct intervention that would limit market access by index funds or other groups of traders. However, there are requests for the CFTC to do just that. Still, it's doubtful the CFTC will do anything to restrict market access to commodity futures markets without strong evidence of intentional manipulation.

And why should they? Index funds are not inherently a bad thing for markets. Increased trading volumes and more open contract commitments can make more liquid markets, thus providing more and better opportunities for commercial users to manage risk.

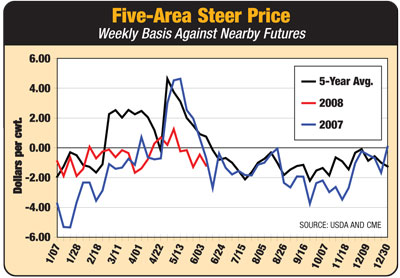

The concern for using futures markets for effective risk management comes in two areas. First, basis must converge to a fairly reliable and predictable level. If speculative long fund positions are an obstacle to convergence, then we should seek ways to make delivery of the physical commodity less restrictive.

Options might include continuous delivery, cash settlement, or a host of creative solutions that have not even been explored. Price levels should be of little concern to a true hedger but basis reliability is paramount. And basis will converge if it is painful enough for the holder of a long futures contract to hold at a viable risk of taking delivery on the physical product.

Second, financing margin requirements for hedges should not limit the hedger in obtaining credit needs for normal business activities. Hedges might be placed at profitable levels when harvest takes place in the future, but income doesn't come until harvest. Conversely, cash flow to maintain margin requirements for futures hedges has to come from immediate sources.

The same is true for cattle feeders who hedged cattle that will not be marketed for several months. Feeders have to finance margin calls on those cattle all the way through the feeding period. If margin financing is part of the operating line of credit, feeders will be pinched in using their credit to buy replacement cattle or other inputs.

What can a cattle feeder do in this environment? Contracting with a packer may look good, but packers will be in the same situation. Basis levels may widen, and/or contracts may only be offered for a limited amount of time in the future. Put options, though expensive, may be worth a look at to maintain price insurance but leave a opening for higher prices and less stress on cash flow.

Bob Price is president of North American Risk Management Services Inc. (NARMS) of Chicago, and has 27 years' experience in developing and executing risk management programs. He can be reached by e-mail at bprice@narmsinc.com.